Just as the PC, smartphone and electric vehicle (EV) revolutions redefined entire industries, humanoid robotics is set to become the next major technological shift, reshaping how we work, care and live.

Rapid advances in AI, combined with falling hardware costs, are accelerating this transition, enabling their deployment beyond traditional industrial uses and into services and households. While adoption is still in its early days, the industry is approaching an inflection point where commercial-scale deployment will soon take hold.

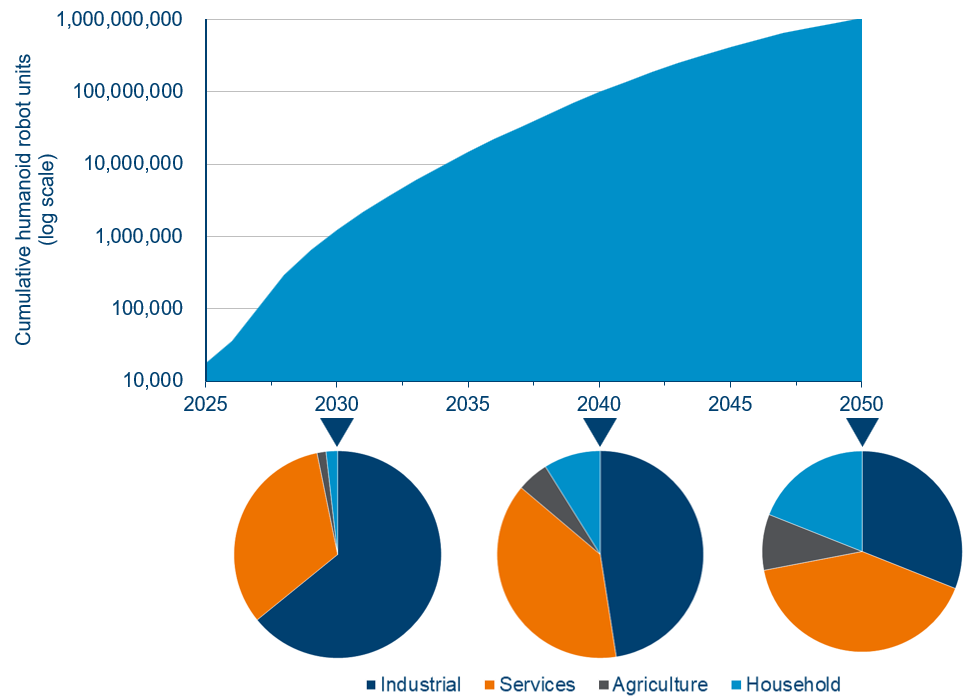

Humanoid robots are advanced robot systems that emulate human actions and reasoning, enabled by the convergence of AI and robotics. As humanoid robots become more sophisticated and widespread, scaling from thousands of units today to billions globally by 2050, their power demands are becoming a wider issue, having a significant impact on their overall economics. Energy-efficient robots will operate longer per charge, require fewer battery replacements and have lower maintenance costs, ultimately improving total cost of ownership.

From industrial robots to humanoids

Traditional robots are already well embedded in industrial environments but humanoid robots offer far more versatility. Unlike fixed-purpose machines, they are adaptable, general-purpose systems designed to operate in unstructured environments, opening new applications across retail, hospitality, home care and eldercare.

Currently, humanoid robots are in pilot trials and limited deployments. Initial adoption is centred in manufacturing, warehousing and logistics where tasks such as packaging, adding to pallets, assembly, inspection and hazardous operations are repetitive and structured, providing an ideal entry point.

The automotive industry is expected to lead the adoption, leveraging decades of automation leadership and scale. Tesla aims to produce 5,000 Optimus robots in 2025, with ambitions to scale up to 500,000 annually by 20261. Mercedes-Benz is partnering with Apptronik, while BMW is collaborating with Figure AI to pilot humanoid integration. In China, BYD is collaborating with UBTech Robotics, to deploy humanoids for inspections and logistics in its factories. Miyi Automotive has announced commercial orders to UBTech, signalling early market readiness. Beyond automotive, adoption is beginning to extend to other industries, for example China Mobile has announced orders to Agibot and Unitree.

Looking further ahead, humanoid robots could transform industrial labour dynamics. By 2050, we estimate humanoids could represent close to 40%of the manufacturing workforce, augmenting productivity, addressing labour shortages and extending automation into tasks previously unsuited for traditional robots2.

Beyond industry: Services and society

As AI capabilities advance, improving perception, dexterity, decision-making and autonomy, humanoids will extend into service sectors such as healthcare, retail and home care. Success in these domains will require not only mechanical precision but also contextual awareness and emotional intelligence.

Public trust will be critical to adoption. For humanoids to operate in social and caregiving environments, they must enable safe, intuitive collaboration with humans executing tasks reliably while adapting communication styles, respecting personal space and learning individual preferences over time.

Improving economics driving adoption

The economics of humanoid robotics are rapidly improving. Industrial humanoids currently have a payback period of six years, but this is expected to shorten to two years by 2030 as hardware costs decline and efficiency improves3. The average price of a humanoid robot has fallen from more than $250,000 in 2022 to $100,000-150,000 today4, equivalent to an effective manufacturing wage of $14 per hour3, below U.S. entry-level labour rates ($15-20/hour5). As scale increases and efficiency improves, costs could fall to $2/hour by 2050, making humanoids economically indispensable3. Like solar energy and EV batteries, humanoid robotics will be entering a phase of cost deflation and performance improvement, driving exponential scaling.

A massive market opportunity

Annual units are projected to grow at a CAGR of 80% (2025-35) and 30% (2035-50)6. By 2050, cumulative deployment could reach one billion units6, or 0.1 humanoids per capita, comparable to today’s global passenger cars ratio7. This implies a total addressable market (TAM) reaching $5trn by 2050, positioning humanoid robotics among the largest technology markets of the century6.

Humanoid robot market to reach $5trn by 20506 |

|

| Source: Polar Capital estimates; World Bank. July 2025. All opinions and estimates constitute the best judgment of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. |

The energy challenge

The scale of energy needs of humanoid robots will be significant, adding a new layer of electricity consumption on top of the surge already driven by AI data centres. A current industrial humanoid consumes 2kW at operation, depending on design and task complexity, and can operate 2-3 hours per charge at maximum3. This might not be enough for the robot to complete a task, adding complexity and costs to the operations. While a humanoid robot’s peak power draw is lower than an EV, its average daily energy use is expected to be higher due to continuous operation.

| Power use of Humanoid versus EVs and household devices8 | ||

| Wattage in operation kW | Daily energy use kWh | |

| Industrial humanoid | 2 (avg.) | 16 |

| Compact EV (e.g. VW ID3) | 8 (avg.) | 6 |

| Refrigerator | 0.6 | 4.8 |

| Air conditioner | 2 | 10 |

New battery technologies with higher energy density such as solid-state batteries will allow for extended hours of operations. At the same time, improvements in algorithms, hardware innovations including high-performance actuators and regenerative power systems, combined with smart charging and fleet-level power management will enable humanoids to operate with higher energy efficiency.

Together, these advances are projected to reduce per-robot energy use by half, reaching 1kW by 20503, similar to the energy an elite athlete generates in short, intense bursts. As adoption accelerates, global humanoid electricity demand will be staggering, reaching 5,200TWh annually by 2050, exceeding current US electricity consumption, which is at 4,400TWh9. By then, it will represent close to 10% of global electricity consumption and puts humanoids on a par with the massive energy appetite of AI data centres and battery electric vehicles9. The future of the humanoid revolution will depend not only on advances in mechanics and AI but on building an affordable and reliable energy infrastructure to power the machines that will walk beside us.

Compelling investment opportunity

Humanoid robots are no longer science fiction and will be one of the defining industries of the 21st Century. They are becoming a transformative force, boosting efficiency, improving mobility and addressing structural challenges such as labour shortages, wage inflation and ageing populations. The companies building, powering and enabling them will shape the next great wave of technological progress.

The Sustainable Thematic Equity team are well positioned to capture this opportunity, with exposure across the humanoid robotics value chain: from integrators to key component suppliers such as motors and actuators, sensors, power management systems (battery; thermal management; power electronics), AI chips and software.

1. Tesla Announces Ambitious Production Targets for Optimus Humanoid Robot

2. Polar Capital estimates. Assumptions include: 1% growth in manufacturing workforce, humanoid robots in industrial sector at 322 million units in 2050. https://www.numberanalytics.com/blog/global-manufacturing-job-market-analysis.

3. Polar Capital estimates. Assumptions include: A robot’s lifespan of seven years, financing cost of 5%, maintenance cost of 15%/20%/20% of initial robot’s cost in 2026/2030/2050, utilization rate at 30%/40%/70% in 2026/2030/2050, a robot consumes 2kW/1.8kW/1.06kW 2026/2030/2050, power cost at $129/MWh in 2026, 3% increase per year and $800 charging infrastructure.

4. Humanoid Robots in Manufacturing: The Next Frontier in Industrial Automation

5. Average hourly wage varies depending on specific job duties, experiences and data from various job platforms https://www.bls.gov/news.release/empsit.t24.htm?utm_source

6. Polar Capital estimates. Assumptions include: 203 million units annual and average selling price of $25,000 by 2050

7. https://autokunbo.com/number-of-cars-in-the-world-2025-key-stats-figures/, United Nations' World Population Prospects 2024 Revision

8. Polar Capital estimates. Assumptions include: 40km average daily driving distance, 15kWh per 100km. eight operating hours for a humanoid and refrigerator, eight hours for an air conditioner. Compact central residential air conditioner with 12,000-30,000 BTU/hour of cooling capacity.

9. Polar Capital estimates. Assumptions include operating hours efficiency at 53% in 2050, global electricity demand 60’000 TWh 2050. https://rbac.com/rethinking-energy-demand-through-2050-review-of-the-eia-annual-energy-outlook-2025/