In this article, we discuss our main takeaways from the US earnings season and why we remain upbeat on US banks.

Earnings estimates increased and we think they can go further

The recent results from US banks exceeded expectations as they announced stronger revenue growth that outpaced increased costs, while asset quality trends remained stable. Top-line growth expectations for banks increased on the back of a steeper yield curve1, helping net interest income and a strong pipeline in investment banking divisions that point to higher capital market2 fees.

CEO Todd Pick highlighted on the Morgan Stanley earnings call that: “Depending on how you measure it, whether volume or unit, you see pipelines in M&A that are the highest in seven years. So that is really encouraging. Now some of this will be dependent on how things roll in the first couple of months of the incoming administration and how things feel on a cross-border basis. But the pent-up activity that we’re seeing is starting to release.”

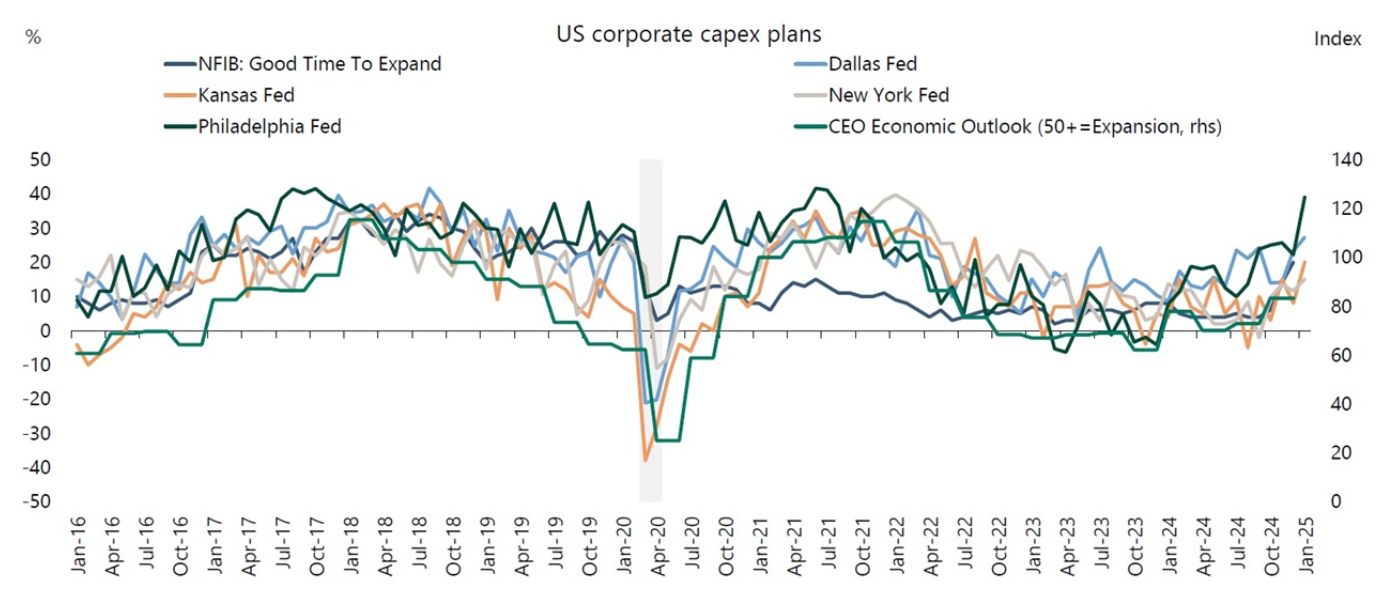

We believe further upside to estimates will be driven by loan growth, which has so far remained anaemic, as leading indicators start to turn positive. Recently released data from SLOOS (the Federal Reserve Senior Loan Officer Opinion Survey), showed an improvement in net demand for the first time in 11 quarters. Changes in demand in SLOOS tend to front-run industry loan growth (see chart below). Additionally, corporate capital expenditure (capex) spending plans are moving higher after the election. Both point to an upside to estimates.

| Increasing loan growth |

|

| Source: Barclays Research, Federal Reserve and FDIC |

| Corporate capex spending plans |

|

| Source: Growth is Accelerating3, Apollo Academy, February 2025 |

Deregulation: A new dawn

On 31 January, President Trump signed an executive order to "unleash prosperity through deregulation", requiring agencies to repeal 10 existing regulations for every new regulation.

Further underpinning the change in tone from the new administration, in a statement on his appointment the new Chairman of the Federal Deposit Insurance Corporation, one of the three main banking regulators in the US, stated that there would be a wholesale review of regulations to ensure its rules and approach would “promote a vibrant, growing economy”. Furthermore, the bank merger approval process would be improved to ensure that transactions satisfying the Bank Merger Act are approved in a “timely way”.

In February, Russell Vought, the acting head of the Consumer Financial Protection Bureau (CFPB), was reported by the Wall Street Journal to have issued a notice to staff demanding they “cease all supervision and examination activities”, not to issue any proposed or final rules or guidance and to suspend the effective dates of rules not yet effective. Trump has effectively shuttered the bureau and, at the time of writing, visitors to its website are greeted with a ‘Page not found’ message.

We see a reduction in regulation as a tailwind for the sector. Indeed, many investors will witness deregulation for the first time in their careers and might not fully appreciate the impact on banks. While most correctly assume deregulation will help capital, we also expect it to lead to lower regulatory costs (Wells Fargo Bank research estimates 20% of banks’ expenses are linked to compliance or other regulatory matters) and reduced concerns on fees (credit card late fees were the CFPB’s latest target) helping sentiment and therefore valuations.

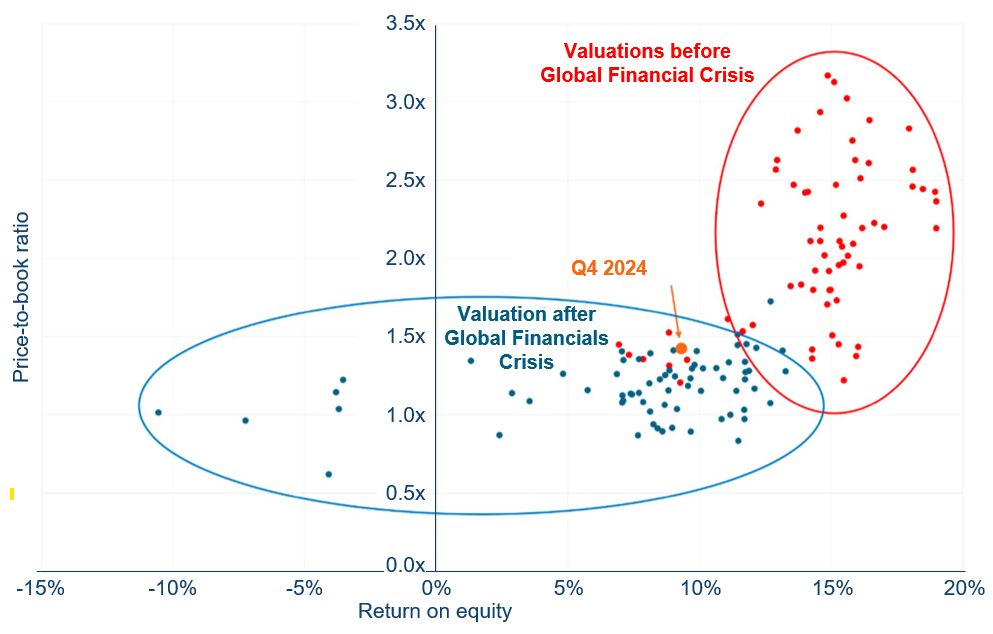

| Bank valuations |

|

| Source: Institutional Money, https://www.institutional-money.com/news/regulierung/headline/us-banken-stehen-dank-kuenftiger-deregulierung-vor-ihrem-comeback-238603, 16 January 2025. Note: This chart shows the valuation of US Financials before and after the Financial Crisis in 2007. Following the Financial Crisis, regulation of US Financials increased significantly and we believe this was one of the key driver of lower valuations across the sector. |

Valuations remain undemanding

It is important to highlight US bank earnings are expected to grow in line with the S&P 500 and MSCI All Country World indices over the next two years yet they trade at a material discount. Given the undemanding valuation and our expectation of continued upside to estimates, we remain positive on US banks.

The Polar Capital Global Financials Trust has just under 20% invested in US banks and offers investors an attractive way to gain exposure to this key component of the US, perhaps global, economy.

| P/E* (2026) | EPS** estimated growth 2025 | EPS** estimated growth 2026 | |

| KBW Banks Index | 11.2 | 13% | 11% |

| S&P 500 Index | 20.0 | 14% | 12% |

| MSCI ACWI World Index | 16.9 | 11% | 12% |

| Source: Bloomberg; 12 February 2025; Notes: P/E* stands for price-to-earnings ratio, which relates a company's share price to its earnings per share (EPS**), a measure of a company’s value | |||

1. Shows the yield on bonds over different terms to maturity

2. Equity and bond markets where individuals and companies go to raise and invest money