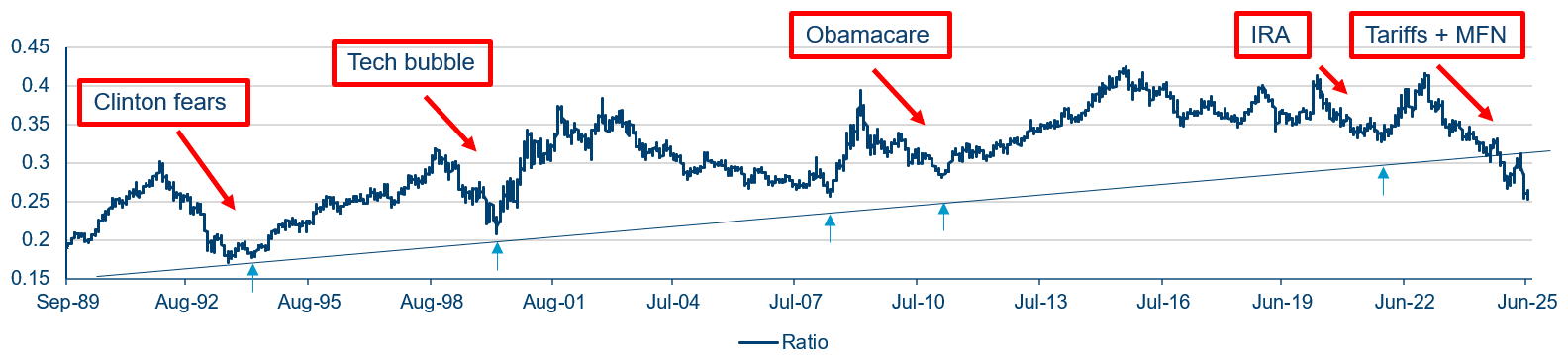

It has been a difficult time for healthcare investors recently as the sector has struggled on a relative basis since the start of 2023. This trend has continued so far this year, to the extent that in Q2 the healthcare sector in the US produced the worst relative return versus the S&P 500 of any previous quarter in history. The closest comparison to this was weakness in healthcare stocks back in 1993 when the Clintons threatened policy change – to provide universal healthcare coverage for all Americans – which generated enormous fear among investors. This time around, it was again the threat of changes in US policy which drove the sector downwards, but in this case the potential changes came on multiple fronts.

Long-term performance of healthcare sector

S&P 500 Healthcare Index vs S&P 500 Index |

|

| Source: Polar Capital, Bloomberg as at 30 June 2025. Note: all Indices are shown in US$ terms. |

Investors grappled with the US administration’s announcement of two plans which impacted sentiment– pharmaceutical, industry-specific tariffs and the threat of a ‘most favoured nation’ (MFN) drug pricing plan for US government-funded healthcare. There was also continuing fallout from the controversial appointment of Robert F Kennedy (RFK) Jr as Secretary of Health and Human Services (HHS). The weakness in healthcare stocks was exacerbated by more general market trends, including investors’ continuing focus on tech stocks – in particular AI-related tech – which directed attention and investment away from more defensive areas such as healthcare.

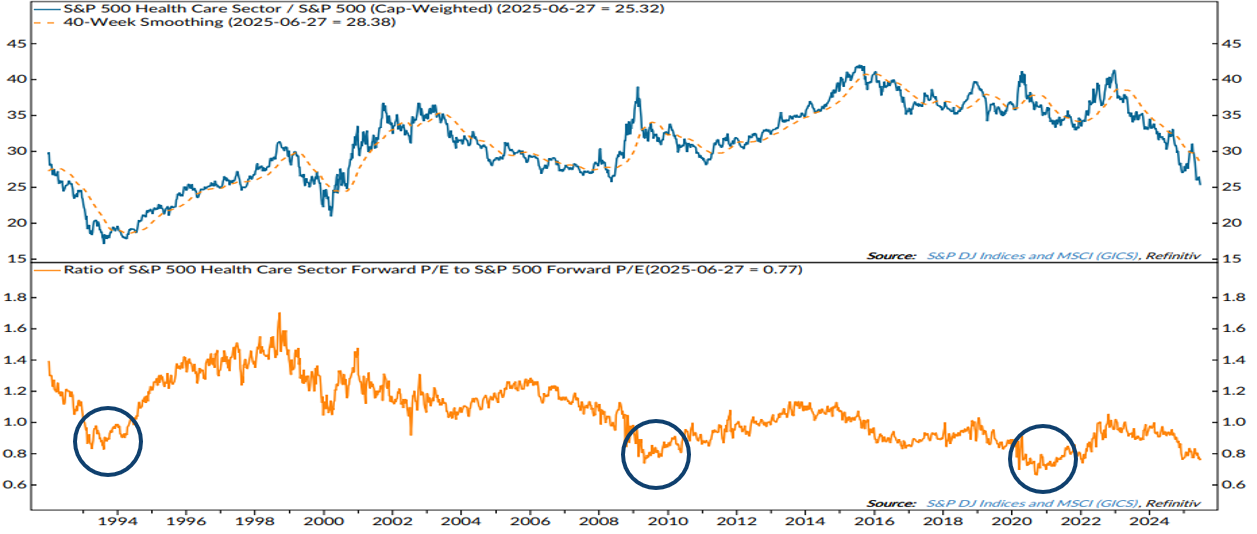

While these issues continue to hang over the sector, we would argue that they are more than priced in – valuation discounts are in line with historic levels, with the sector’s relative valuation compared to the S&P 500 in line with lows seen only three times in the past 35 years.

| Healthcare sector’s relative valuation |

|

| Source: Ned Davis Research Inc., 03 January 1992 to 27 June 2025. Sector earnings estimate calculated by NDR using available mean 1-year forward earnings estimates for sector constituents. Copyright 2024 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. |

What could be the catalyst for recovery?

As we pass President Trump’s extended tariff deadline of 1 August, there is still not much more clarity on the potential imposition of tariffs on the pharmaceutical industry. The industry's products are being assessed under a separate ‘Section 232’ process to evaluate whether the global supply chain for pharmaceuticals represents a national security threat. As we have seen in other sectors, any positive developments on this or the plans for ‘most favoured nation’ pricing would shift sentiment markedly on the sector. We are hopeful that we will get more clarity over the next few months and that this will encourage investors to re-engage.

Elsewhere, there are signs that some fears over the Trump administration are beginning to abate. The Department of Government Efficiency (DOGE)-driven headcount and budget cuts were unsettling but, several months in, we still see no real evidence of delays or setbacks in the approval or commercialisation of new therapeutics with established clinical evidence. Despite concerns surrounding the appointment of RFK Jr, the pace of innovation and activity in healthcare remains steady, with the US Food and Administration (FDA) appearing to function as normal. In addition, RFK’s appointees to the various government bodies under the HHS, including the FDA, all seem relatively sensible.

Despite all the negativity, the sector is fundamentally in a great place with higher utilisation and new product launches being key drivers for growth. With one or two exceptions, the Q2 results season has underlined this and provides some reassurance.

Near-term drivers are still intact…

The healthcare industry remains highly innovative and is focused on addressing high unmet medical needs. Breakthroughs have recently been made in areas including obesity, atrial fibrillation, Alzheimer's and respiratory diseases such as smoker’s cough. As well as meeting patients’ needs, these new product cycles drive revenue and earnings momentum. This innovation is increasingly being enabled by artificial intelligence and machine learning that are helping to drive efficiencies and reduce complexity. AI can also lead to more accurate diagnosis and better outcomes.

Another important near-term trend is accelerating investment in emerging markets, where increasing wealth is leading to demand for higher-quality and better healthcare provision. At the same time, government expenditure on healthcare is set to increase from current low levels, contributing to strong growth prospects.

…but are not reflected in valuations

Valuations have now been pulled down to such an extent that the potential returns from here for healthcare stocks look extremely compelling. As evidence of this, despite the concerns over US government policy, M&A activity is starting to pick up again.

Meanwhile, the demand for products and services is not dissipating and the sector continues to innovate and find solutions for complex medical problems. Key long-term growth drivers such as emerging markets, prevention, consolidation, and access and affordability are mostly intact.

In addition, the healthcare sector is extremely diverse, not just in terms of business models and technologies, but in terms of market capitalisation and geography.

We believe this current period of volatility allows us to take advantage of investment opportunities that offer long-term growth. We see plenty of really exciting medium and long-term investment opportunities and remain optimistic for our investors and our outlook.