The dawn of a new technology

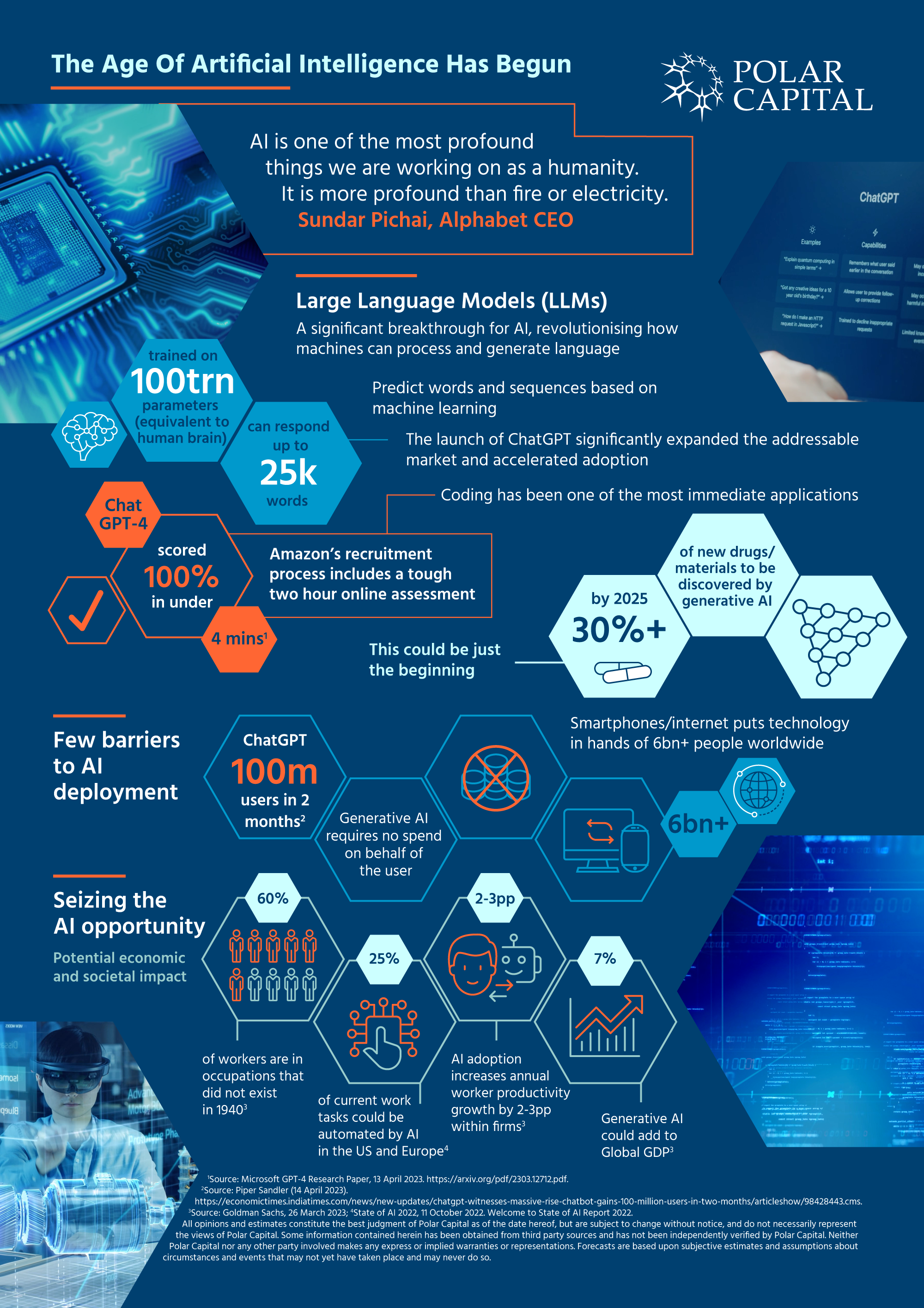

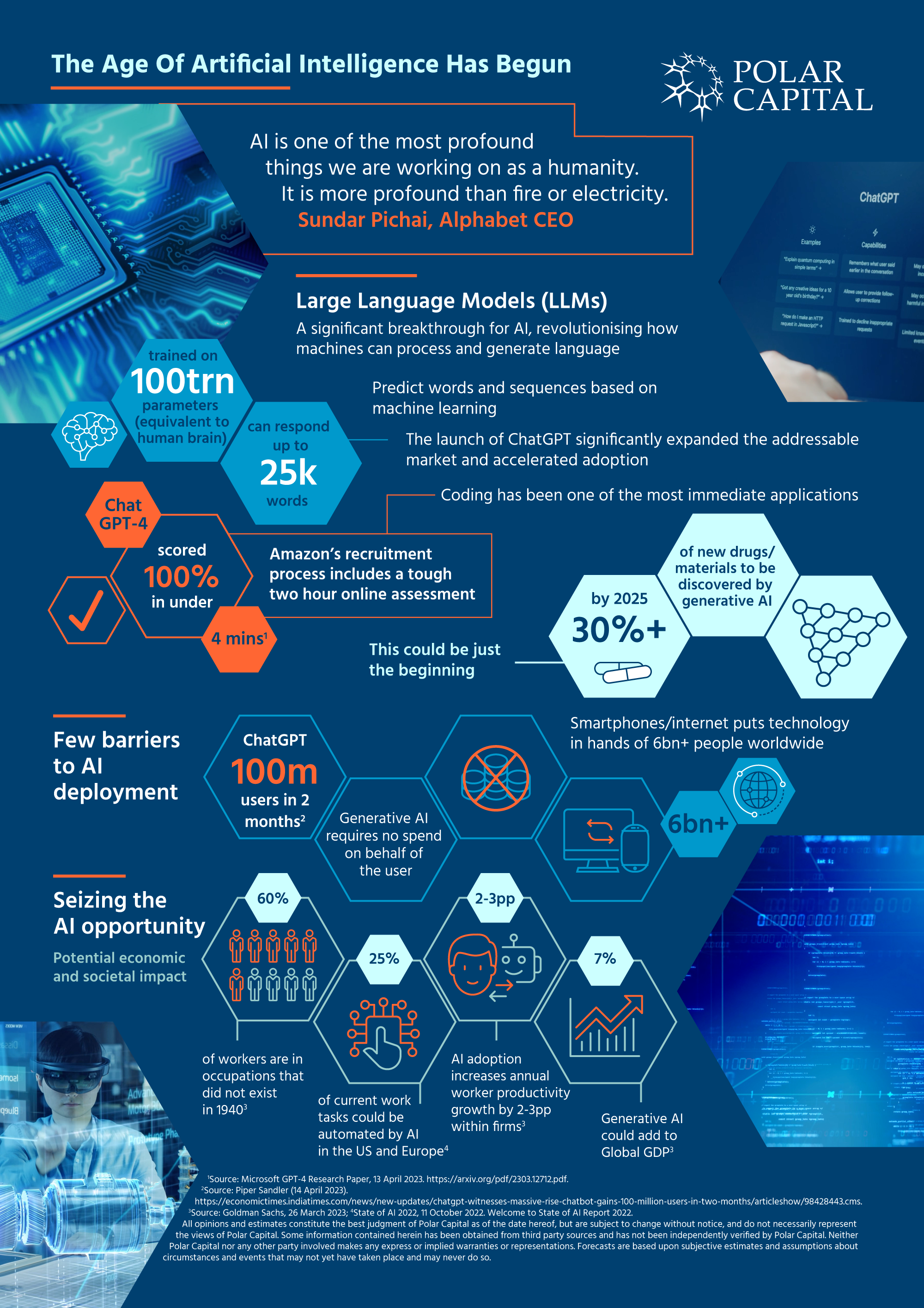

With the launch of ChatGPT in November 2022, artificial intelligence (AI) exploded into the public conscience. The excitement around AI has been palpable and has driven much of the rebound in technology stocks this year, but what does AI actually mean for investors?

Here, the Polar Capital Global Technology Team explore how significant a breakthrough AI has achieved this year, as well as the true extent of the impact it could have on global economies and society.

Artificial Intelligence: Investing in era-defining technology

Artificial intelligence is not all hype – it’s a theme the Polar Capital Global Technology Team have been excited about for a long time. The Polar Capital Artificial Intelligence Fund was launched in 2017, anticipating its potential to become the next general-purpose technology, like the internet or the smart phone. They believed AI would go mainstream; they just didn’t know when.

The team believe that ChatGPT and generative AI represents that mainstream moment. Hear more from them on how they expect AI to prove very disruptive, very quickly across a range of industries, and the opportunities that could create.

Risks:

- Capital is at risk and there is no guarantee the Fund will achieve its objective. Investors should make sure their attitude towards risk is aligned with the risk profile of the Fund before investing.

- Past performance is not a reliable guide to future performance. The value of investments may go down as well as up and you might get back less than you originally invested as there is no guarantee in place.

- The value of a fund’s assets may be affected by uncertainties such as international political developments, market sentiment, economic conditions, changes in government policies, restrictions on foreign investment and currency repatriation, currency fluctuations and other developments in the laws and regulations of countries in which investment may be made. Please see the Fund’s Prospectus for details of all risks.

- The Fund invests in the shares of companies, and share prices can rise or fall due to several factors affecting global stock markets.

- The Fund uses derivatives which carry the risk of reduced liquidity, substantial loss, and increased volatility in adverse market conditions, such as failure amongst market participants.

- The Fund invests in assets denominated in currencies other than the Fund's base currency. Changes in exchange rates may have a negative impact on the Fund's investments. If the share class currency is different from the currency of the country in which you reside, exchange rate fluctuations may affect your returns when converted into your local currency.

- The Fund invests in emerging markets where there is a greater risk of volatility due to political and economic uncertainties, restrictions on foreign investment, currency repatriation and currency fluctuations. Developing markets are typically less liquid which may result in large price movements to the Fund.

Important Information: This is a marketing communication and does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments. Any opinions expressed may change. This website does not contain information material to the investment objectives or financial needs of the recipient. This website is not advice on legal, taxation or investment matters. Tax treatment depends on personal circumstances. Investors must rely on their own examination of the fund or seek advice. Investment may be restricted in other countries and as such, any individual who receives this website must make themselves aware of their respective jurisdiction and observe any restrictions.

A decision may be taken at any time to terminate the marketing of the Fund in any EEA Member State in which it is currently marketed. Shareholders in the affected EEA Member State will be given notification of any decision and provided the opportunity to redeem their interests in the Fund, free of any charges or deductions, for at least 30 working days from the date of the notification.

Investment in the Fund is an investment in the shares of the Fund and not in the underlying investments of the Fund. Further information about fund characteristics and any associated risks can be found in the Fund’s Key Investor Document or Key Investor Information Document (“KID” or “KIID”), the Prospectus (and relevant Fund Supplement), the Articles of Association and the Annual and Semi-Annual Reports. Please refer to these documents before making any final investment decisions. These documents are available free of charge at Polar Capital Funds plc, Georges Court, 54-62 Townsend Street, Dublin 2, Ireland, via email by contacting Investor-Relations@polarcapitalfunds.com or at www.polarcapital.co.uk. The KID is available in the languages of all EEA member states in which the Fund is registered for sale; the Prospectus, Annual and Semi-Annual Reports and KIID are available in English.

The Fund promotes, among other characteristics, environmental or social characteristics and is classified as an Article 8 fund under the EU's Sustainable Finance Disclosure Regulation (SFDR). For more information, please see the Prospectus and relevant Fund Supplement.

ESG and sustainability characteristics are further detailed on the investment manager’s website: (https://www.polarcapital.co.uk/ESG-and-Sustainability/Responsible-Investing/).

A summary of investor rights associated with investment in the Fund is available online at the above website, or by contacting the above email address. This document is provided and approved by both Polar Capital LLP and Polar Capital (Europe) SAS.

Polar Capital LLP is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom, and the Securities and Exchange Commission (“SEC”) in the United States. Polar Capital LLP’s registered address is 16 Palace Street, London, SW1E 5JD, United Kingdom.

Polar Capital (Europe) SAS is authorised and regulated by the Autorité des marchés financiers (AMF) in France. Polar Capital (Europe) SAS’s registered address is 18 Rue de Londres, Paris 75009, France.

Polar Capital LLP is a registered Investment Advisor with the SEC. Polar Capital LLP is the investment manager and promoter of Polar Capital Funds plc – an open-ended investment company with variable capital and with segregated liability between its sub-funds – incorporated in Ireland, authorised by the Central Bank of Ireland and recognised by the FCA. Bridge Fund Management Limited acts as management company and is regulated by the Central Bank of Ireland. Registered Address: Percy Exchange, 8/34 Percy Place, Dublin 4, Ireland.

Third-party Data: Some information contained herein has been obtained from third party sources and has not been independently verified by Polar Capital. Neither Polar Capital nor any other party involved in or related to compiling, computing or creating the data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any data contained herein.

Information Subject to Change: The information contained herein is subject to change, without notice, at the discretion of Polar Capital and Polar Capital does not undertake to revise or update this information in any way.

Forecasts: References to future returns are not promises or estimates of actual returns Polar Capital may achieve, and should not be relied upon. The forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. Forecasts are based upon subjective estimates and assumptions about circumstances and events that may not yet have taken place and may never do so.

Statements/Opinions/Views: All opinions and estimates constitute the best judgment of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. This material does not constitute legal or accounting advice; readers should contact their legal and accounting professionals for such information. All sources are Polar Capital unless otherwise stated.

Benchmark: The Fund is actively managed and uses the MSCI ACWI Net TR Index as a performance target and to calculate the performance fee. The benchmark has been chosen as it is generally considered to be representative of the investment universe in which the Fund invests. The performance of the Fund is likely to differ from the performance of the benchmark as the holdings, weightings and asset allocation will be different. Investors should carefully consider these differences when making comparisons. Further information about the benchmark can be found https://www.msci.com/acwi. The benchmark is provided by an administrator on the European Securities and Markets Authority (ESMA) register of benchmarks which includes details of all authorised, registered, recognised and endorsed EU and third country benchmark administrators together with their national competent authorities.

Country Specific Disclaimers When considering an investment into the Fund, you should make yourself aware of the relevant financial, legal and tax implications. Neither Polar Capital LLP nor Polar Capital Funds plc shall be liable for, and accept no liability for, the use or misuse of this document.

The Fund is registered for sale to all investors in the countries listed above. Investors should make themselves aware of the relevant financial, legal and tax implications if they choose to invest.