Investing in a stagflationary world

Introduction

Recent market commentary has focused increasingly on the risks that, for the first time since 1983, western economies may experience a prolonged bout of stagflation. This concern stems from the fact that the world is contending with a multitude of input price shocks against a material slowing in economic activity and an elimination of the macroeconomic policy tailwinds that have supported economic activity since the end of the global financial crisis.

In particular, there is a real risk that historically tight labour markets and the inflation already in place may be creating a wage-price spiral. However, at the same time, consumer discretionary income has not kept pace as real wages have been declining for some time – for 11 consecutive quarters in the US. Finally, all this may be exacerbated by the first simultaneous tightening of fiscal and monetary policy in nearly four decades as western central banks are forced to focus on price stability at the expense of economic growth while policymakers eliminate the emergency support measures necessitated by the onset of the COVID-19 pandemic. Recent geopolitical tensions, notably events in Russia and Ukraine, have complicated matters by further disrupting supply chains, hiking input prices and directly affecting consumer budgets through food and energy price inflation.

Stagflation is often thought of as the ‘worst case’ for financial markets. Simultaneously rising prices and deteriorating economic conditions imply falling real bond values, declining profit margins, higher equity risk premia and thus lower multiples. This makes them particularly challenging periods for investors to navigate.

While it may seem like there is no place to hide, the reality is that there are areas which have historically outperformed during stagflationary periods. In the commentary which follows, we highlight four Polar Capital investment strategies which offer potential solutions that investors may wish to consider going forward – we believe they provide material diversification and performance benefits.

We hope this helps readers better understand the causes and nature of the emerging risks as well as the options available to help address and respond to them. Naturally, we are willing to answer any questions you may have and provide further information so, if required, please contact your usual Polar Capital sales representative.

Begin

Global Convertibles

A stagflation hedge

While convertibles are a natural hedge for both equity and fixed income investors at all times, they are particularly well suited to the current environment. Due to their unique, hybrid nature, convertibles provide more consistent capital protection than either equities or fixed income; in short, they typically outperform fixed income during periods of rising rates, equities during periods of share price declines, and both during periods of economic stress and/or stagflation.

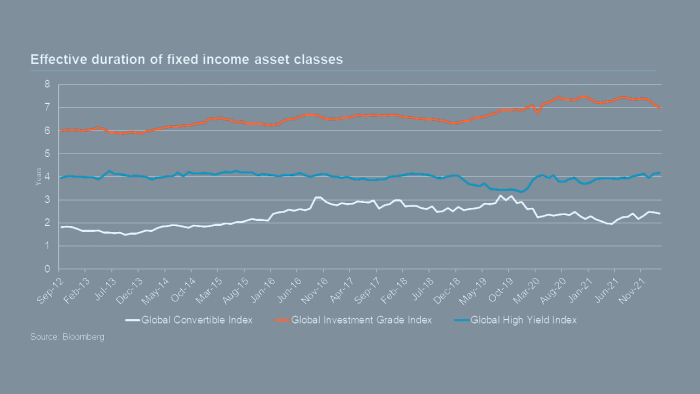

This outperformance stems from the fact that convertibles grant holders a right but not an obligation to convert. Consequently, convertibles enable investors to enjoy the capital protection of fixed income while retaining the upside potential of equities, suggesting they should outperform equities during periods of risk-asset declines. Thanks to a lower interest rate sensitivity (duration) than fixed income, they should also outperform fixed income during periods of interest rate rises.

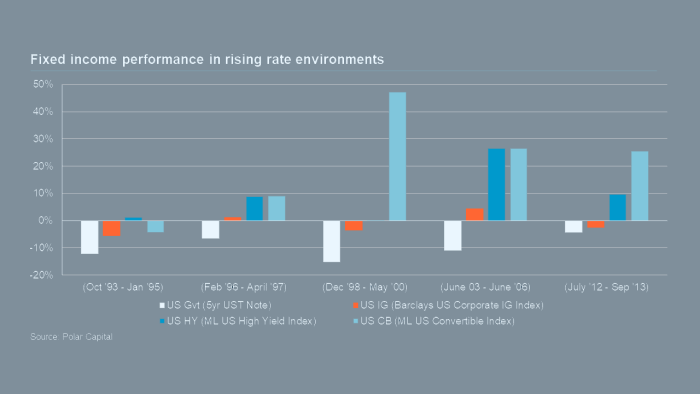

Back in 2017, we examined the fixed income aspect of this in some depth in Fixed Income Investing in a Rising Rate Environment, demonstrating that convertibles had materially outperformed all other fixed income markets during periods of rising interest rates. In fact, across the periods we identified, convertibles delivered a combined positive 20.8% return thanks in part to their low duration and ability to protect capital regardless of economic conditions, as shown below.

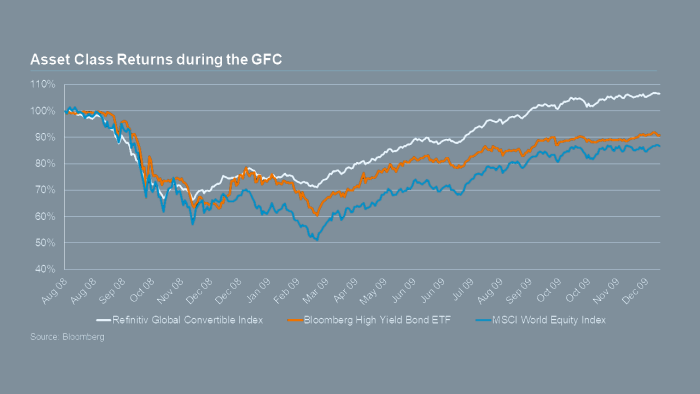

This ability to protect capital is a key determinant of convertibles’ ability to also generate superior risk-adjusted returns relative to equities. The most recent period of simultaneous negative GDP growth and CPI increases was in 2009 – during the midst of the global financial crisis. As shown below, during the months of negative GDP growth (August 2008 to December 2009), convertibles delivered a positive return of 8.4% despite equities suffering a decline of over 13% and high yield bonds declining 9.1%.

In summary, thanks to their unique characteristics, one would expect convertibles to outperform fixed income during periods of rising rates, equities during periods of share price declines, and both asset classes during periods of economic stress and/or stagflation. As the graphs above demonstrate, this is precisely what we have seen during the past 30 years. Consequently, we believe convertibles are well placed to help investors navigate the challenges that stagflation may provide, enabling them to both protect capital and generate positive returns that are attractive both nominally and when risk-adjusted.

Polar Capital Global Convertible Team

Important information: All opinions and estimates in this document constitute the best judgement of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. Polar Capital is not rendering legal or accounting advice through this material; viewers should contact their legal and accounting professionals for such information. This document does not constitute a prospectus, offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instruments, which may be discussed in it. This is not a financial promotion. Past performance is not indicative of future results. A list of all recommendations made within the immediately preceding 12 months is available upon request. This document is not a personal recommendation and you should consider whether you can rely upon any opinion or statement contained in this document without seeking further advice tailored for your own circumstances. This document is only made available to professional clients and eligible counterparties. Shares in the fund should only be purchased by professional investors. The law restricts distribution of this presentation in certain jurisdictions; therefore, persons into whose possession this presentation comes should inform themselves about and to observe, all applicable laws and regulations of any relevant jurisdiction.

Next

European Ex-UK Income

Defensive dividends favourable in the current backdrop

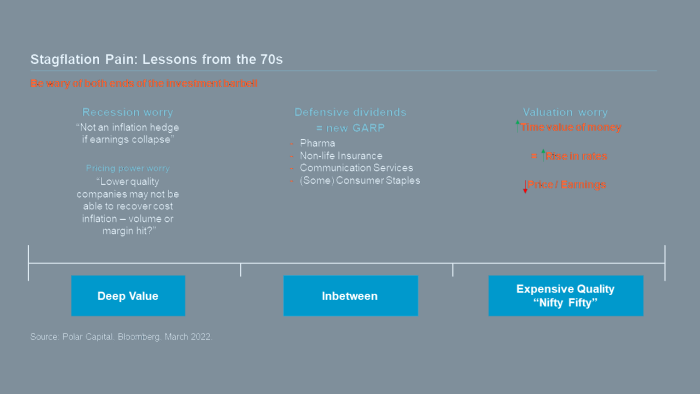

Although equities are a good inflation hedge, there are important nuances to this thesis and two key considerations to getting the maximum inflation hedge effect from an asset allocation to equities. Both argue for caution in regard to both very deep value and very expensive growth:

- Avoid overpaying for stocks when you move from a low to high inflation environment. The original nifty fifty stocks were great companies but, unfortunately, their valuations were too elevated when the world moved from the disinflationary 1960s to the inflationary 1970s. Overly high multiples of current earnings can typically only be justified by fully valuing long-term profits (ie discounting by an extremely low discount rate). Higher inflation means higher discount rates and, therefore, valuation multiple compression.

- Minimise the recession risk impact on earnings. Inflationary periods are frequently followed by recessions. The corporate profit gains from higher nominal growth can be easily swamped by the painful collapse in profits that typically come with recessions. This argues the case to be selective within deep value parts of the market. Even if a recession is avoided, companies with low pricing power, a lack of ability to innovate and sustain a leadership position are unlikely to behave well during stagflation.

How we see the investment style spectrum

Stagflation would favour different parts of the investment style spectrum than the post-global financial crisis (GFC) disinflation.

Dividends versus capital gains within equities

In a more uncertain environment, we would expect a rebalancing in investor appetite for dividends relative to capital gains. Post-GFC, central bank asset inflation saw a long period of especially strong capital gains, driven by easy monetary policy and a perception of a central bank put. The abundance of capital gains reduced investment appetite for dividends. This post-GFC trend was then amplified by the pandemic, a time when many dividend stocks were briefly unable to pay dividends and therefore behaved in a much less defensive way than previous drawdowns. Dividends are now bouncing back strongly, while some capital gains in the most speculative pockets are faltering.

An unusual starting point for European dividends

We are seeing an unusual starting point for defensive dividend stocks, with many European blue chips having dividend yields several hundred basis points higher than their corporate bonds. The central bank policy of buying corporate bonds created a perfect storm for corporate bond valuations in an investment environment that suddenly focused on the twin stagflation threats of inflation and economic slowdown. This starting valuation makes us very optimistic for the prospects of companies able to offer real positive dividend yields with real dividend growth.

Polar Capital European ex-UK Income Team

Important information: All opinions and estimates in this document constitute the best judgement of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. Polar Capital is not rendering legal or accounting advice through this material; viewers should contact their legal and accounting professionals for such information. This document does not constitute a prospectus, offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instruments, which may be discussed in it. This is not a financial promotion. Past performance is not indicative of future results. A list of all recommendations made within the immediately preceding 12 months is available upon request. This document is not a personal recommendation and you should consider whether you can rely upon any opinion or statement contained in this document without seeking further advice tailored for your own circumstances. This document is only made available to professional clients and eligible counterparties. Shares in the fund should only be purchased by professional investors. The law restricts distribution of this presentation in certain jurisdictions; therefore, persons into whose possession this presentation comes should inform themselves about and to observe, all applicable laws and regulations of any relevant jurisdiction.

Next

Financials

The value of value in a stagflationary environment

Banks

Banks should perform relatively well in a stagflationary environment. For example, in the UK, banks outperformed by close to 100% at the beginning of the 1970s before giving up a significant portion of that outperformance as inflation rose even higher and the UK economy was hit hard. Bank of America has also shown that US banks should outperform, using data going back to 1972.

We would expect banks to benefit from higher loan growth, as companies need to borrow more as the cost of new machinery, inventory etc increases, fee income to grow more slowly and see cost pressures increase. However, the two key variables would be the impact on net interest margins, from higher interest rates, and loan losses.

Banks are very sensitive to rising interest rates, and to the extent that higher inflation leads to higher interest rates this would result in a sharp rise in net interest income as net interest margins expand. This would be partly offset by an increase in loan losses as economies slow, due to the mechanistic way in which they are calculated under new accounting rules.

Insurers

Rising interest rates and bond yields are good for insurance companies but less so than for banks. Non-life insurance companies for the most part hold short-dated fixed income securities and cash to meet claims which can be reinvested into higher yielding securities as bond yields rise. Life assurance companies are more geared as their solvency would go up with rising government bond yields.

However, their performance would be subject to the degree to which inflation rose and the severity of any slowdown. While life assurance companies would in theory benefit more from a stagflationary environment, due to their inherent complexity and sensitivity to a widening in corporate bond spreads and any fall in equity markets they may not perform as well as expected.

Conversely, non-life insurance companies are inherently more defensive as claims are largely driven by accidents or weather-related losses and not economic activity. To the extent that they can continue to raise insurance rates faster than claims inflation they would benefit. Those underwriting shorter-tail risks, such as motor and property, would be at less risk of needing to raise reserves.

Asset managers, stock exchanges, consumer finance etc

On the basis that stagflation would probably be a headwind for financial markets then asset managers would likely underperform. Stock exchanges should prove more resilient along with payment and information service companies, but valuations which are much higher than for banks and insurers would be at risk of compressing as equity markets are likely to derate. We would expect consumer finance companies to underperform as disposable income is squeezed.

Summary

Financials are inescapably a value sector, and we would expect it to outperform in a stagflationary environment as it did in 2000-01 when there was a shallow downturn but underperform if any downturn is deeper. We would see any selloff as an opportunity, due to the underlying fundamentals and strength of balance sheets. A return to the 1970s becomes more complicated but in 1981 the incoming Conservative government saw an opportunity to levy a windfall tax on the banking sector arguing it had generated excessive profits.

Polar Capital Global Financials Team

Next

Global Healthcare

A cure to your stagflation maladies

The healthcare industry is composed of a broad and diversified universe of businesses that range from pharmaceuticals and biotechnology to medical equipment, medical insurance, healthcare facilities and life sciences tools and services.

This diversity, with many different business models across the market-capitalisation spectrum, is one of the reasons the sector can offer investors protection against the prospect of global stagflation. In fact, the correlation of both earnings and the share prices of healthcare stocks to various economic indicators (global GDP; the Current Activity Indicator; PMI) is one of the lowest in the market.

There are also three more fundamental reasons why the healthcare sector should be relatively attractive in a stagflationary environment.

First, with high inflation and low economic growth, consumers’ purchasing power and confidence are greatly reduced, adversely effecting consumer demand. However, given the essential nature of many products and services provided by healthcare companies, demand for these tends to be consistent. That consistency should offer investors greater confidence in healthcare companies’ ability to generate steady revenues, earnings and cash flow.

Second, some pockets of healthcare offer reasonable levels of protection from inflationary pressures given they can pass on costs to their customers or are vertically integrated (thus offering greater control of their supply chains) or have high gross and operating margins that can absorb the additional costs. On the pricing side we would highlight healthcare supplies and contract manufacturers and on the margin side we would point to pharmaceuticals and large capitalisation biotechnology companies.

Finally, during periods of prolonged stagflation, quality companies with high cash flow generation, solid balance sheets and high returns on equity and investments should perform better than higher growth but less cash-generative businesses. This is because future earnings and cash flows have a lower present value when nominal interest rates are high, with investors tending to prefer businesses that can generate earnings and cash flows in the near term. We are therefore particularly constructive on large-cap healthcare stocks, many of which display these characteristics.

In conclusion, near-term macroeconomic uncertainty and the rising spectre of stagflation lead us to believe the healthcare sector is an attractive investment proposition, especially on a relative basis.

Polar Capital Global Healthcare Team