Donald Trump’s recent phone call with Vladimir Putin has sparked an increased focus on the potential for a Ukraine peace deal, with bookmakers’ odds now moving to a 70+% chance of a ceasefire1, while Ukrainian bonds have rallied 90% since September 2024.

Much has been written about the deeply negative long-term implications of a weak peace deal for Ukraine. From an economic perspective, what is likely to matter for markets is whether Russian oil and gas exports form part of a deal, which we believe to be highly likely. Were that to be the case, the gas price should fall substantially.

Europe is currently receiving 32 billion cubic meters (bcm) per year from Russian gas pipelines (c20% imports), compared to 155bcm before the war. Two of the pipelines that supplied Europe (Nord Stream 1 and 2) are damaged but were they to turn on the other three (Brotherhood, Soyuz and Yamal), then Barclays estimates that an additional 87bcm/year could come back on stream which should drive prices down.

In addition, Russian liquefied natural gas (LNG) exports could return to the market. This is particularly important for the UK because the UK sets its electricity prices from the marginal price of gas. This was in many ways the root cause of UK inflation soaring higher than all other countries following Russia’s invasion of Ukraine. Continued sensitivity of the UK electricity price on the natural gas price can be seen by the Bank of England’s recent forecast changes.

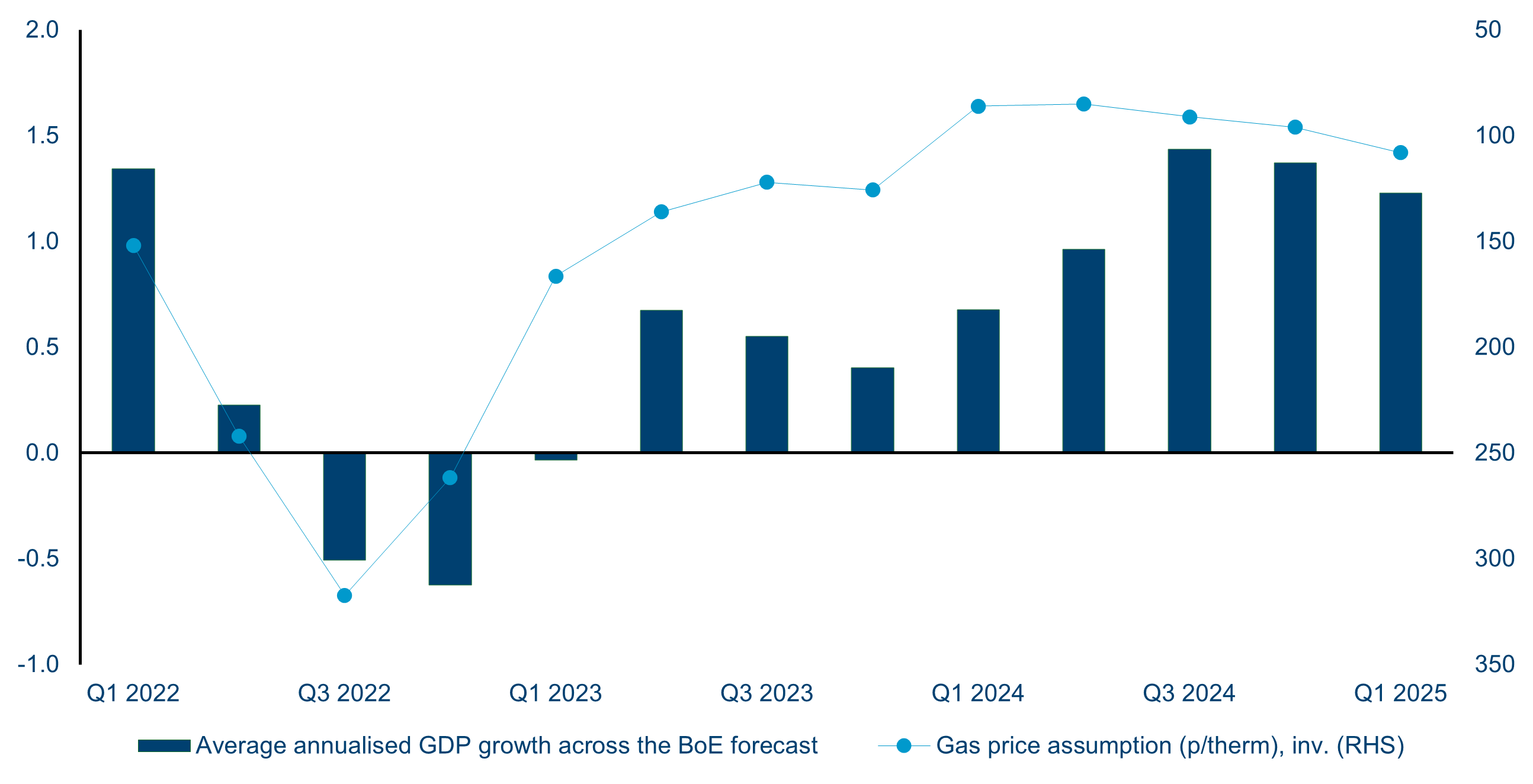

The lion’s share of the inflation upgrade and GDP downgrade was due to the higher natural gas price since previous estimates. The interlink between the natural gas price and UK GDP is striking, as seen in the chart below, which shows the UK’s average annualised GDP growth overlaid with the gas price (inverted).

| Bank of England GDP growth forecasts compared to gas prices |

|

| Source: Bank of England; Panmure Liberum; 12 February 2025 |

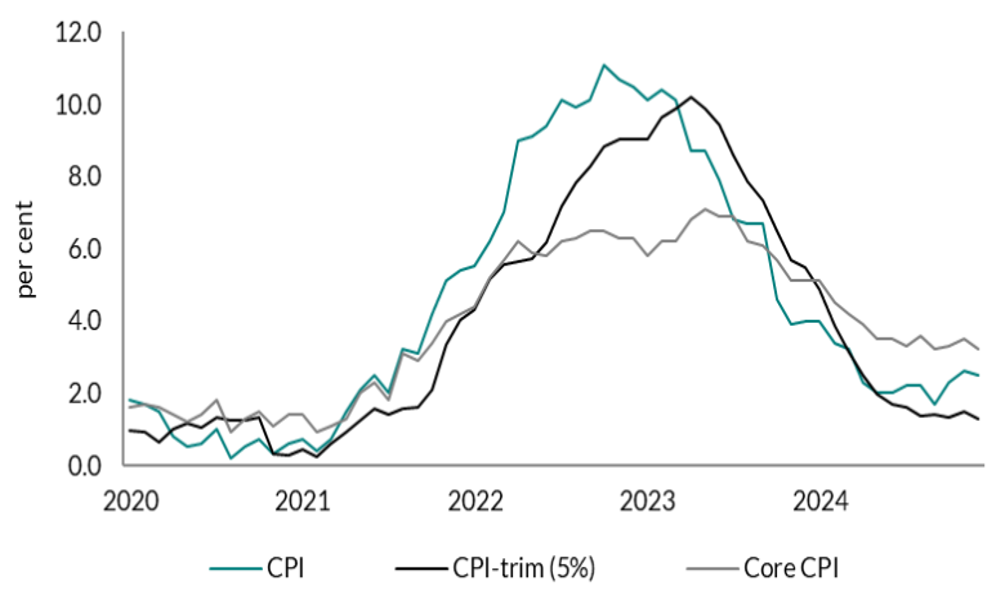

Lower natural gas prices in Europe should bring down corporate and domestic energy prices in the UK and reduce forecast inflation. In the chart below, you can see the ‘trimmed’ inflation rate which excludes the outlying contributors (largely due to energy) is already below 2%.

| UK CPI, Core CPI, and volatility-reduced Inflation |

|

| Source: ONS; National Institute of Economic and Social Research; January 2025 |

The lower inflation rate should kick in a virtuous cycle of lower rates, higher economic growth and better fiscal headroom.

Of course, the pitch is different to several years ago, with the threat of looming tariffs on Europe from the US. That said, the UK should be better insulated given its limited goods exports to the US so is uniquely positioned to benefit from Ukrainian peace without the negatives of additional tariffs.

Implications for the UK Value Opportunities Fund and positioning

The key beneficiary of this would be UK domestic, consumer and rate-sensitive shares. We would highlight significant exposure of the Polar Capital UK Value Opportunities Fund to the UK REITs that are trading at discounts to book value, two housebuilders below book value and UK consumer shares.

Travel names were hit particularly hard in the weeks after the Russia/Ukraine war started and the Fund holding easyJet is one of those we believe should benefit from a lower cost base should the price of oil fall.

Additionally, the Fund has a large holding in Sigmaroc, a Pan-European aggregates and construction materials business that could benefit from a rebound in European construction volumes, and trades on just 7x forward earnings.

The FTSE 250 underperformed the FTSE 100 significantly after the Ukraine invasion and has never recovered this underperformance. If lower power prices and cost base for business can lead to earnings upgrades, the chance of the FTSE 250 rerating increases significantly.

1. https://polymarket.com/event/russia-x-ukraine-ceasefire-in-2025