Over the past year, the narrative around AI has evolved dramatically along with the growing consensus that its progress was underestimated rather than overhyped.

The latest generation of large language models (OpenAI GPT-5, Grok 4, DeepSeek-V3.1 and so on) is already delivering expert-level performance as well as showing early signs of emotional intelligence, skill transfer and the ability to perform previously unseen tasks. This increase in performance comes with a huge increase in tokens – the amount of text the model needs to process and understand language – which means a far greater compute demand and therefore more energy is used. With the advent of agentic AI (multi-step, autonomous reasoning) and physical AI (robotics, embodied agents), this trend is set to accelerate.

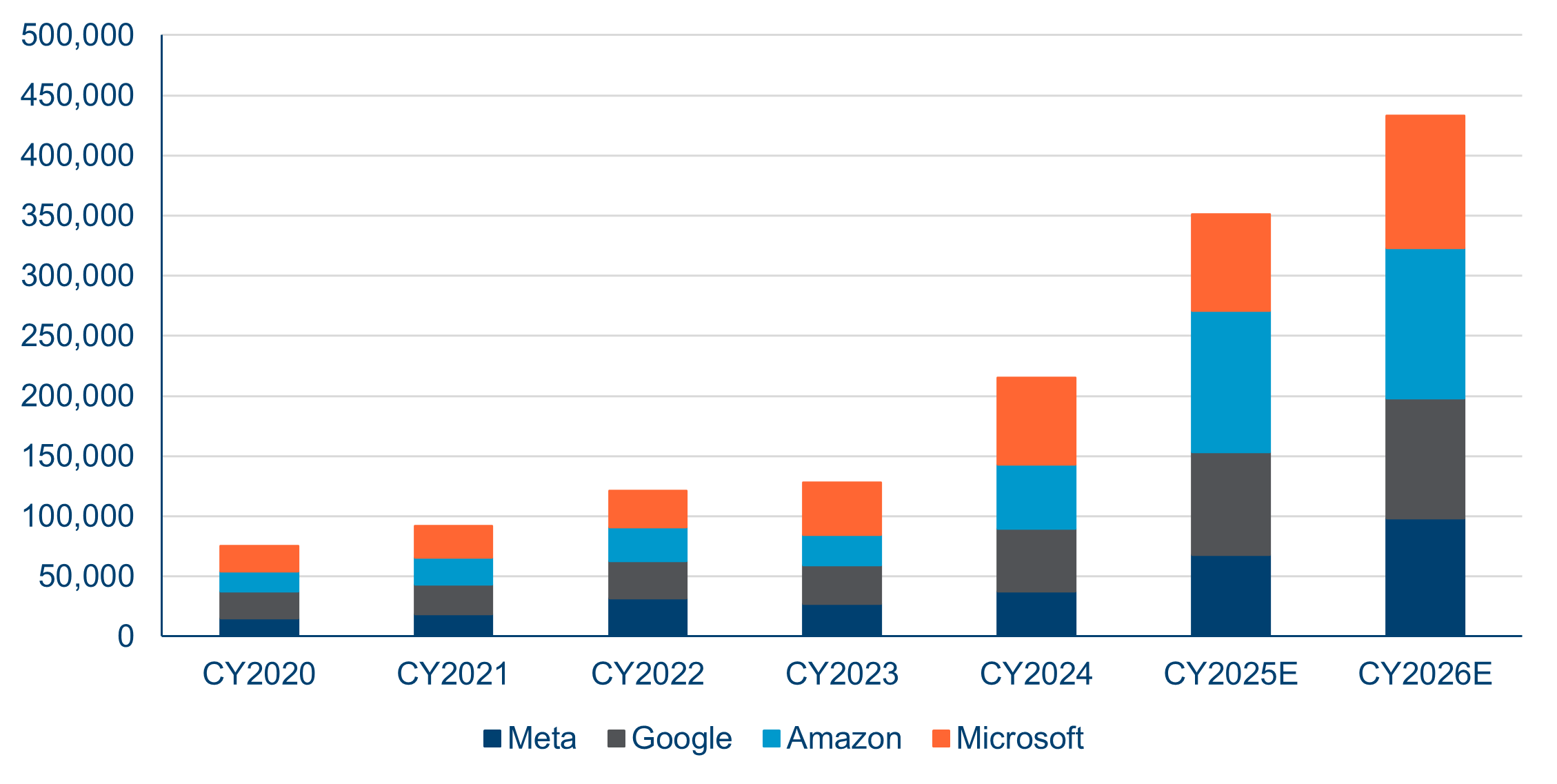

While the hardware and algorithmic efficiency gains are being seen more widely, the scale of demand requires increasingly vast amounts of compute, data, human talent and energy. Hyperscalers are rapidly scaling investment. During their mid-year 2025 earnings announcements, Amazon, Microsoft, Google and Meta collectively revised their 2025 capex upward by 12%, to $351bn from $313bn – this compares to $215bn spent in 20241.

| Hyperscaler capex (2020-26E) |

|

| Source: Polar Capital and Bloomberg, August 2025. Forecasts contained herein are for illustrative purposes only and does not constitute advice or a recommendation. |

Power surge

This increase in data centre-related capex will require significant new power. According to the US Department of Energy (DoE), electricity consumption by US data centres is expected to rise sharply, from 4.4% of national electricity use in 2023 to between 6.7% and 12% by 2028 – this increase is close to the current total electricity consumption of France2. Industry estimates3 suggest that 25-30% of total data centre capex is being allocated to power infrastructure, implying that $88-105bn of the $351bn committed in 2025 will go directly toward power generation, transmission, distribution and backup systems.

The new power needs will be increasingly difficult to source, as utilities struggle to adapt to the rapid rise in demand following years of slow decline in electricity usage. Despite a recent wave of hyperscaler power procurement deals – including contracts involving nuclear plant restarts – short-term power availability is rapidly becoming the defining supply constraint for data centres and their supply chain. This has already reshaped data centre operators’ strategies, including considering moving out of data centre hubs to locations with available excess power as fibre optic buildout is easier, but opportunities are rare. This power scarcity was identified as a potential “US economic and national security” threat by the US DoE in June 20254.

To regain control over their energy supply, data centre operators are increasingly turning to ‘behind-the-meter’ generation – producing power directly on site. This shift is not only strategic but also increasingly encouraged by public utility commissions and regulators, who see it as a way to reduce the strain that large data centre loads place on shared grid infrastructure and other customers5. As of April 2025, 38% of data centres are expected to use on-site power generation by 2030 (up from 13% in April 2024), and 27% are projected to rely on it entirely for primary power (up from just 1% a year earlier)6. According to AFCOM7, 62% of data centres are actively evaluating on-site solutions and 19% had already implemented some form of it by the end of 2024.

Given the stringent requirements in terms of reliability, speed of deployment, scalability, flexibility and emissions, the most favoured solutions currently centre around gas-fired generation and either gas turbines (aeroderivative or industrial sized) or gas reciprocating engines (smaller). These systems can be deployed within months, as natural gas supply is readily available in most locations nationwide. Importantly, they are for the most part hydrogen and renewable natural gas compatible for future decarbonisation.

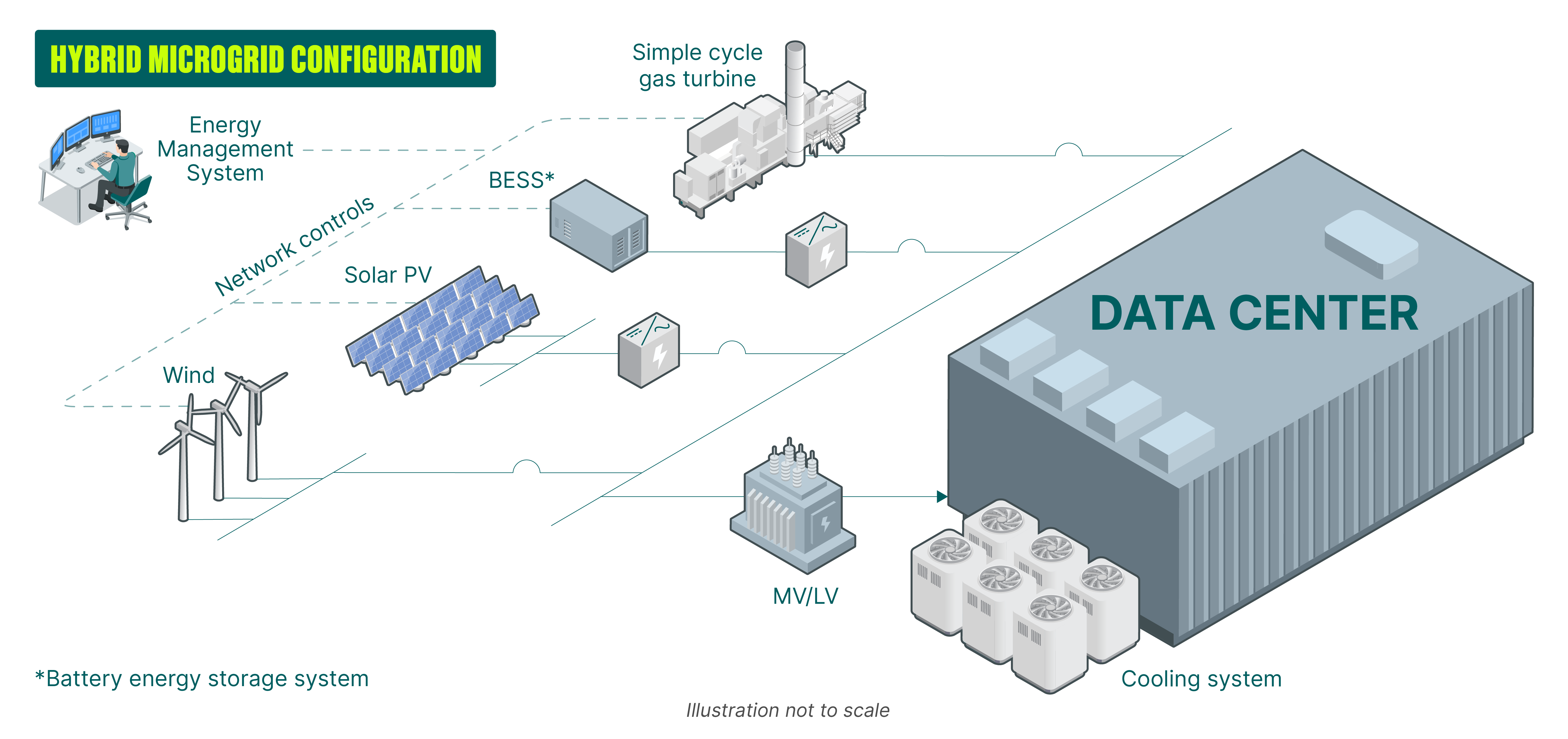

More than one answer

Other solutions include solar plus batteries (more land and capital intensive) and fuel cells (limited by scale). Small modular reactors are also considered a potential future solution and pilots are ongoing, including partnerships with data centre operators. In effect, the adopted power configuration will increasingly be a hybrid architecture combining multiple power sources. Rather than depending on a single type of generation, operators are likely to integrate gas-fired generators for primary or baseload power, battery storage systems for load balancing and instantaneous backup, and, where feasible, solar or renewable energy inputs to offset carbon intensity. This multi-source setup enhances both reliability and flexibility, allowing data centres to optimise for cost, uptime and emissions across different operating conditions.

On-site generation also requires a robust layer of additional electrical infrastructure beyond what grid-connected facilities typically deploy. Additional equipment is needed to manage ‘islanding’ – where an interconnected power grid is separated into disconnected regions (‘islands’) that can operate independently – switching between sources when they need to. Additional energy storage systems are also commonly used to bridge startup lags or absorb peaks. Microgrid controllers to start/switch generation are needed, as are specialised systems to carry the electricity from its source to the electrical grid.

| Electricity transfer |

|

| Source: GE Vernova, August 2025. |

This switch is already showing up in heavy power equipment companies’ order books. Gas turbine manufacturers have seen a surge in orders driven by data centre demand, including partnerships dedicated to co-located and on-site-powered data centre clusters. Reciprocating engines suppliers are also expanding manufacturing production as their smaller engines are rapidly adopted to bridge gaps. All major electrical equipment firms are seeing far higher demand for data centre equipment.

The enormous electricity demand driven by data centre expansion, paired with the slow, inflexible pace of utility infrastructure development, makes this supply/demand imbalance a structural and long-lasting trend, likely to persist well into the mid-2030s. While the issue is currently most acute in the US, similar challenges are emerging globally where grid limitations and permitting delays are already constraining hyperscaler growth. As a result, we can expect sustained and intensifying demand for both on-site generation solutions and the power equipment ecosystem that supports them.

Compelling investment opportunity

On-site power procurement has become a strong growth area within industrial products, driving renewed investment in manufacturing capacity for natural gas turbines and outsized growth for associated electrical equipment. The Polar Capital Smart Energy Fund has exposure to leading companies addressing this trend, including power generation equipment providers, electrical equipment providers and system integrators.

1. Figures collected from Bloomberg for 2024 capex and the companies’ communications for the 2025 guidance

2. https://escholarship.org/content/qt32d6m0d1/qt32d6m0d1.pdf

3. BNP Paribas analysis, August 2025

4. https://www.energy.gov/sites/default/files/2025-07/DOE%20Final%20EO%20Report%20%28FINAL%20JULY%207%29_0.pdf

5. https://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2025/2025q2-som-pjm.pdf

6. https://www.bloomenergy.com/wp-content/uploads/2025-data-center-power-report.pdf

7. https://www.datacenterknowledge.com/energy-power-supply/data-centers-bypassing-the-grid-to-obtain-the-power-they-need