- Europe’s quality stocks have seen a significant valuation correction after reaching what were, in our view, clearly excessive valuations during Covid.

- The inflation spike was bad for quality stocks because their excessive valuation vulnerability outweighed any positive benefit from their underlying pricing power

- After a valuation reset, the current environment of interest rate cuts, tariffs and moderating inflation should reward selective quality stocks

Covid policy responses have produced big style gyrations in markets

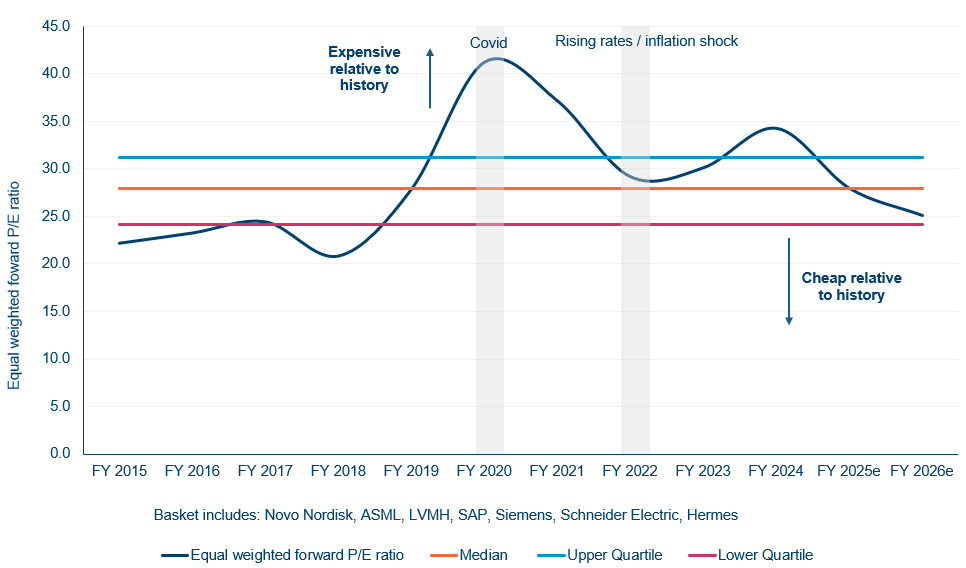

Quality stocks saw a dramatic valuation rerating between 2019 and their 2021 peak (see chart below). The ‘Seven wonders of Europe’ basket was coined by strategists at SocGen and this group of stocks demonstrates the phenomenon well. In many cases, these companies’ valuations reached levels where the risk/reward was extremely poor and their elevated price/earnings valuations were particularly vulnerable to the inflation spike that followed Covid policy responses.

Quality stocks had performed well in the decade after the global financial crisis, up to 2019, but this was primarily driven by earnings compounding against an index with anaemic profit growth. It was only after the Fed guided to lower rates for longer in early 2019 that their dramatic rerating really started.

Any investment outcome is a function of a starting valuation and compounding power. The higher the valuation today, the more that future compounding power has been priced into today’s valuation. Quality stocks typically compound their earnings steadily so the main risk is overpaying for those attributes.

| Europe’s most popular stocks dramatically rerated 2019-21 – and have steadily derated since Valuation re/de-rating of basket of 7 wonders of Europe |

|

| Source:Polar Capital; August 2025. Forecasts contained herein are for illustrative purposes only and does not constitute advice or a recommendation. |

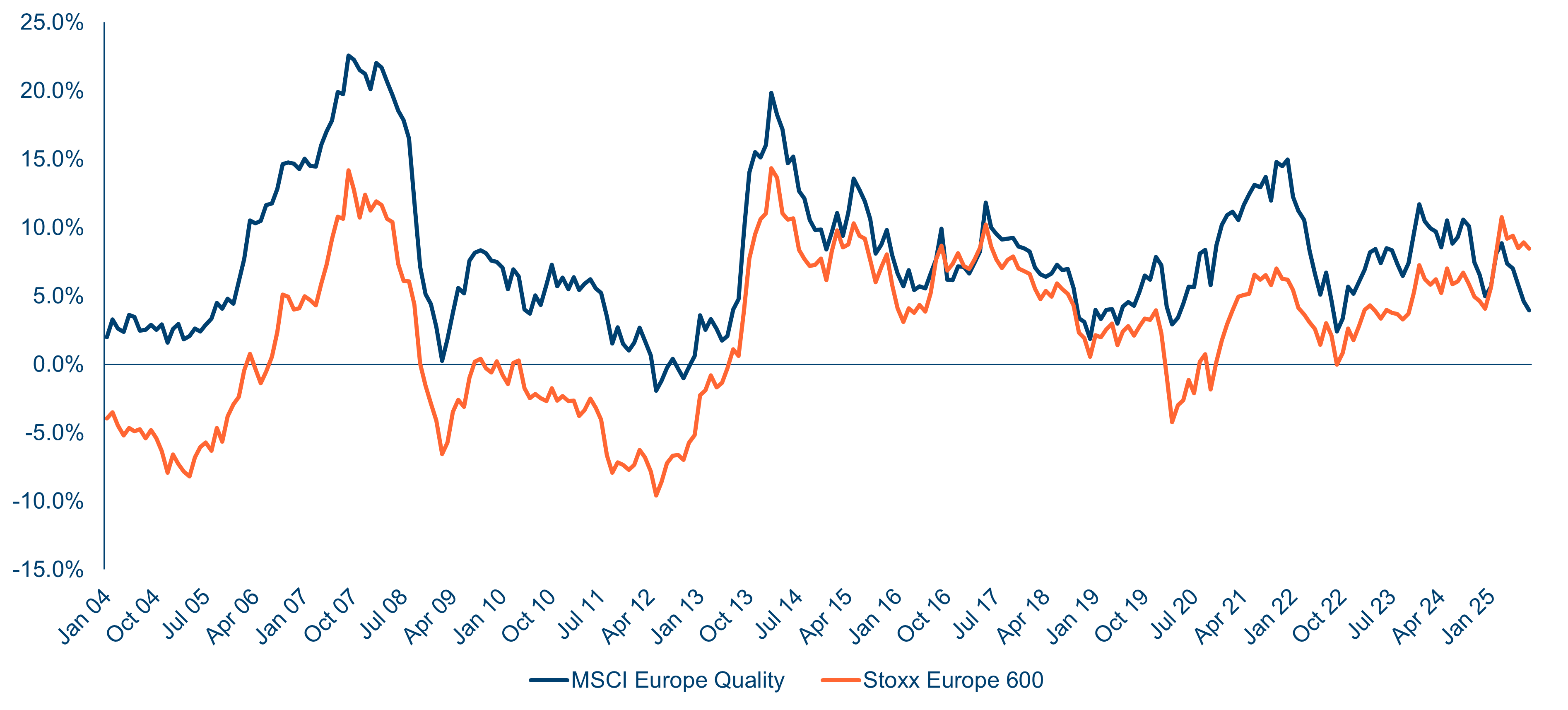

The derating of quality stocks has seen their rolling five-year returns fall to the lowest levels outside the global financial crisis (see chart below). Quality stocks typically make high returns on equity and generate double-digit total shareholder returns, so a rolling five-year return of 5% reflects a significant valuation derating, offsetting the strong underlying fundamental compounding power. This is why quality stocks have historically bounced from these levels, their underlying compounding eventually outweighs any derating headwinds. It is also striking how much worse the rolling returns have been for quality than the overall index – by far the worst they have performed in the past 20 years.

| Rolling 5-year total return for MSCI Europe Quality Index and Stoxx Europe 600 |

|

| Source: Polar Capital; 29 August 2025. |

What we are doing in our portfolio

Our investment approach is driven by our watchlist. We constantly compare the stocks in the portfolio to the stocks on our watchlist – competition for capital drives our investment process. Most of the stocks on our watchlist meet our minimum quality criteria (10% return on equity through the cycle), but not our valuation criteria (we look to buy stocks on more than a 4% free cashflow yield).

It felt uncomfortable when our valuation discipline prompted us to sell some of these high- quality stocks on valuation grounds as they rerated in 2018 and 2019. However, this was ultimately the right approach as many of these stocks went on to materially underperform. We see the opposite situation today – it is uncomfortable buying quality stocks with poor price momentum, but many of these stocks are compelling compounding assets (with strong returns on capital employed; excellent moats; track records of double-digit total shareholder returns). There is a relatively high risk that we might be buying too early and a low risk, in our view, that these stocks do not perform handsomely on a three to five-year view given their underlying returns on equity and compounding earnings.

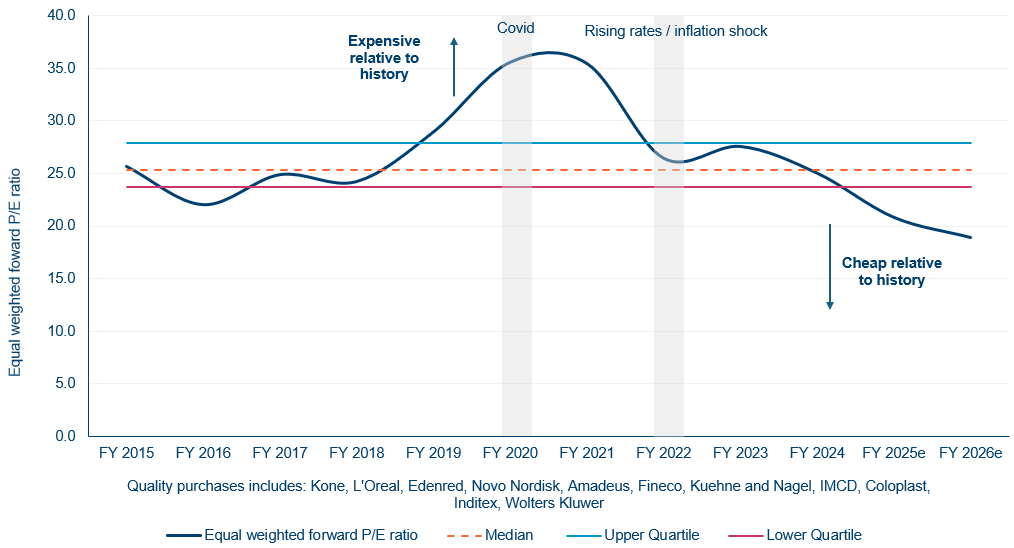

We strongly argue for a selective approach to picking quality laggards. The quality stocks we have been buying over the past year (see chart below) have seen an even more dramatic derating than the high-profile basket of stocks in our first chart. These stocks are now materially cheaper than they were even in 2015, a point from which their compounding characteristics generated excellent outcomes.

| Our preferred quality stocks look very cheap compared to their histories Valuation re/de-rating of our recent quality purchases made in the last year |

|

| Source: Polar Capital; August 2025. Forecasts contained herein are for illustrative purposes only and does not constitute advice or a recommendation. |

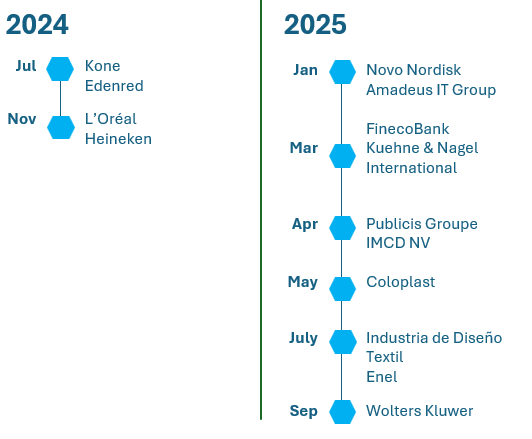

The volatility of markets since last summer has presented plenty of opportunities to buy good companies that are temporarily out of favour (see table below). We are looking for companies that can deliver total shareholder returns (dividend yield plus earnings growth) of at least 10%. Many of these stocks are likely to be able to deliver low teens levels of total shareholder returns.

| We have been steadily finding quality stocks that meet our valuation criteria |

|

| Source: Polar Capital; August 2025. |

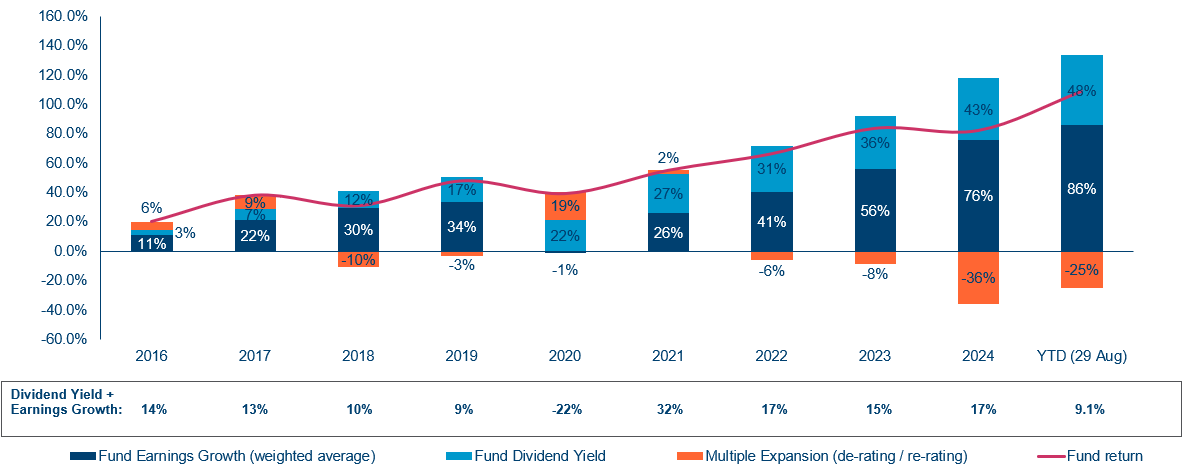

We think our Fund offers a differentiated approach for investors. Our investment process of looking for good companies when they are out of favour keeps us out of the weakest and most overvalued stocks. The core of our investment process is to seek out the right combination of quality and value. The combination of steady earnings and reliable dividend income helps the Fund act as a defensive anchor. When multiple expansion is not lifting prices, the quality and growth of underlying earnings and cashflows become the primary driver of returns. We own businesses that generate real, compounding value, not ones that benefited from expanding investor enthusiasm.

| The Fund’s cumulative return composition |

|

| Source: Polar Capital; August 2025. |

Conclusion

The current market backdrop is presenting unusual opportunities to buy Europe’s quality stocks at a discount to their long-term valuations. In a world of tariffs, central bank interest rate cuts and macroeconomic risks, we think many of these oversold quality stocks offer extremely compelling valuation opportunities.