As Washington moved to slap a $100,000 fee on H-1B visas, on 1 Oct, Beijing is rolling out its K-visa, a fast-track for global top STEM (science, technology, engineering and mathematics) graduates with no strings attached. The symbolism is striking. While the US raises barriers, China is opening doors to global talent. For a country determined to lead in AI, robotics and biotech, attracting brains is more than policy – it is strategy.

This symbolism also frames today’s market paradox. Chinese equities are staging one of their strongest rallies in years, even as the macro backdrop remains challenging. Property is still a drag, deflationary pressures persist and consumer confidence is subdued. At first glance, the divergence between strong market performance and weak economic data looks like a disconnect.

At the same time, renewed US-China tensions – from tariff threats to tighter tech restrictions – have added some short-term volatility. Our base case is that these are largely negotiation tactics ahead of the planned Xi–Trump meeting later this month. Investors are distinguishing between noise and substance, recognising that while external risks persist, the rally’s core drivers – innovation, liquidity, and a pro-business policy shift – remain firmly intact.

Rather than a fleeting rebound or policy sugar high, this market strength reflects a deeper structural shift. Innovation, liquidity and a renewed policy focus on growth are reshaping sentiment and capital flows – forces powerful enough to support a more durable repricing of China equities well beyond the current rally.

Rally versus reality

The divergence between equity markets and macro headlines is striking, but not unusual. Markets are forward-looking, and what they are discounting today is not another short-lived rebound or policy sugar high, but a structural shift in where growth and confidence are emerging, in three major ways:

1. Innovation: Everything everywhere all at once

This is not a broad-based surge. The rally is concentrated in innovators, in AI, semiconductors, biotech and robotics. These are the companies transforming China’s economic base, with business momentum that contrasts sharply with the gloom in property and consumption. Consider the following:

- Tencent’s advertising revenues grew 20% year on year in the last quarter, turbo charged by AI-driven targeting

- Alibaba Cloud posted 26% growth, with triple-digit expansion in AI workloads

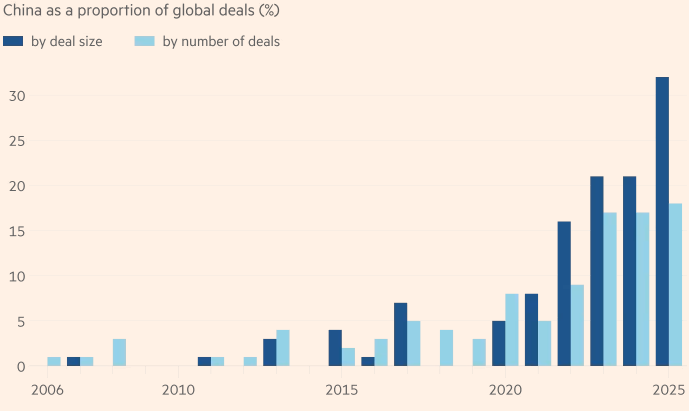

- In biotech, over 30% of global licensing deals now involve Chinese firms, underscoring China’s growing weight in global innovation networks

- Chinese supply chains are accelerating the development and deployment in humanoid robotics, empowered by AI

| Chinese companies' share of global pharma licensing deals has jumped |

|

| Source: FT, Jefferies, PharmCube; published 22 July 2025. https://www.ft.com/content/89285fd5-cd24-4772-a53d-0553cd37032d |

Importantly, China’s AI application layer is becoming one of the most vibrant in the world. With over a billion internet users and deeply entrenched online behaviours, Chinese platforms enjoy a ready-made ‘data flywheel’, a scale of user engagement that enables faster A/B testing and model iteration than anywhere else. Unlike the US, where frontier AI is concentrated in a few monolithic models, Chinese developers are producing diverse, often open-source vertical models across domains like translation, coding, image generation and video. This combination of scale, openness and low token costs has made Chinese models such as DeepSeek and Alibaba’s Qwen global contenders, already gaining meaningful share in international usage.

DeepSeek is emblematic of this wave – everywhere at once, powering applications from consumer platforms to factory floors. Innovation in China today truly feels like everything, everywhere, all at once. The market is rewarding these innovators with higher multiples because they represent the strongest engines of China’s next growth chapter.

2. Liquidity: Fuel for the rally

Liquidity is the second force powering equities higher. With Chinese bond yields anchored near historic lows, insurance companies have already shifted over $100bn into equities this year. Households, too, are beginning to reallocate, sitting on over $20trn in deposits, with property no longer a reliable store of value and bond returns muted, equities are re-emerging as a destination for wealth creation.

Policymakers are also encouraging this reallocation by laying the foundations for a more transparent, efficient and resilient equity market. Beijing’s emphasis on improving corporate governance, raising the quality of listed companies and encouraging stronger shareholder returns is gradually reshaping the landscape. These capital markets reforms are critical for deepening investor confidence, making equities not only a tactical beneficiary of liquidity but also a more durable long-term asset class.

As George Soros observed, markets are reflexive: rising stock prices attract flows, which in turn support further gains. The liquidity base in China is deep enough to sustain this process – and unlike past episodes, the flows are aligning with genuine and accelerating earnings growth in select sectors.

3. Policy: Reigniting animal spirits

Confidence, not credit, has been China’s scarcest resource in recent years. That began to shift in 2024. Subtle signals – Jack Ma re-emerging in public, Tencent’s Pony Ma writing an op-ed in People’s Daily championing entrepreneurism – culminated in February 2025, when President Xi met with leading private sector entrepreneurs and declared: “I have always been a champion of the private sector.”

For investors, the signal was clear. After years of regulatory tightening and uncertainty, the state is pivoting back towards growth and innovation. Policy tone and actions are increasingly pro-business, creating room for capital formation and risk-taking. Animal spirits, long dormant, are reawakening – and markets are responding.

Crucially, this policy pivot is reinforcing the same forces driving the rally in innovation and liquidity, aligning all three pillars behind a more durable rerating of Chinese equities.

A rally with roots

The headlines continue to focus on the disconnect between weak macro data and strong equity performance. However, we believe this is not a disconnect at all but a rerating driven by deeper structural forces.

Innovation is accelerating across AI, biotech, robotics and beyond, giving China a new growth engine. Liquidity is abundant, with institutions and households reallocating into equities, supported by reforms that are improving governance and encouraging shareholder returns. Alongside this, policy has pivoted decisively back to business, restoring confidence and reigniting risk appetite.

Together, these three forces are aligning to power a rally with real roots. While challenges in property and consumption will take time to resolve, the market is already pricing the future not the past. For investors, the opportunity is clear: this is not a short-lived bounce, but the early stages of a more durable rerating of Chinese equities.

Portfolio positioning: Capturing the engines of change

Against this backdrop, our portfolio is positioned to capture the long-term winners of China’s next chapter. We remain highly selective, backing the innovators and market leaders that are delivering real growth and earnings, rather than chasing speculative momentum.

Our focus is anchored on three themes:

Innovation everywhere: We are concentrated in companies driving breakthroughs across AI, semiconductors, biotech, robotics, and automation – the sectors powering China’s structural growth.

Rise of Chinese multinationals: Beyond consumer champions like Byd and TikTok, we see industrial and technology leaders expanding their global footprint, setting the stage for the emergence of the Boschs and Siemens of China.

Consumption recovery: After three years of caution, households are sitting on record savings, while many of the best consumer franchises have been significantly derated. As policy support takes hold and confidence gradually returns, we expect a recovery in spending, with local brands gaining share from global incumbents.

In our view, this combination of innovation, expanding global competitiveness and recovering domestic consumption positions Chinese equities for a more durable rally. Our portfolio is aligned with these structural forces, focused on high-quality growth, secular winners and the engines of China’s next growth chapter.