The healthcare sector is at the forefront of some of the world’s leading innovation. A growing understanding of human biology and the drivers of diseases are allowing the biotech, pharmaceutical, and medical device industries to produce novel, targeted strategies to address significant unmet medical needs. At the same time, advancements in technology, particularly in AI, telehealth and personalised medicine, are transforming patient care and improving outcomes. All the above underpins the long-term growth of the sector.

2025 has seen some remarkable scientific breakthroughs in areas such as cardiovascular disease, oncology and rare muscular diseases.

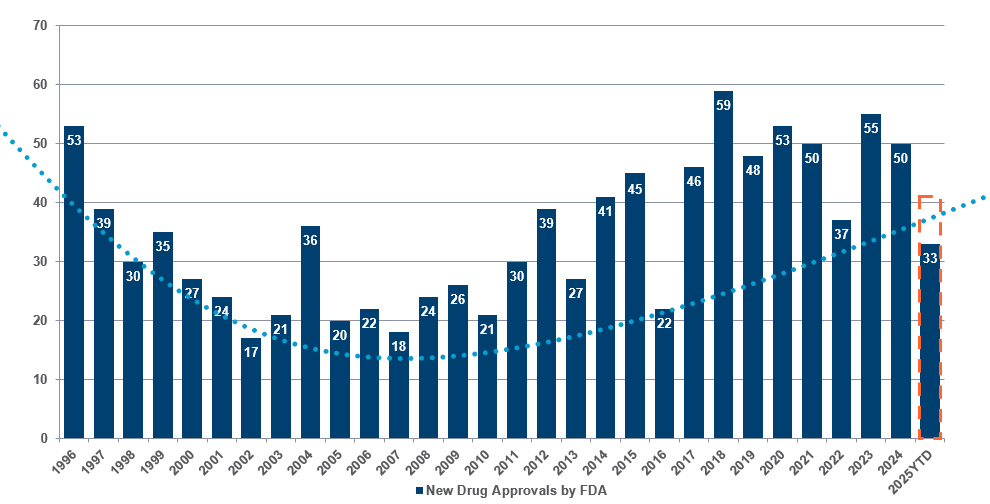

So far this year, the FDA has approved more than 30 novel1 therapeutic treatments:

| Innovation driving new drug approvals |

|

| Source: Novel Drug Approvals at FDA | FDA 7 October 2025. Dashed line – Polar Capital estimates for 2025. |

Cancer remains the main area for innovation, with nearly a dozen approvals so far this year, including four for lung cancer. Other novel drugs approved include treatments for various conditions such as idiopathic pulmonary fibrosis, chronic heart failure and urinary tract infections.

While it is important to recognise and applaud the tremendous pace of innovation, it is also essential to focus on the commercial landscape. While not an exhaustive list, the images below highlight recent breakthroughs in areas where there is not only a high unmet need but also large, addressable markets.

Exciting new product cycles drive revenue and earnings momentum

One of the standout areas of innovation – as well as the most publicised – has been the obesity and GLP-1 drug market, which continues to deliver exceptional growth and investor returns, driven by strong demand, expanding indications and robust clinical pipelines.

While some of the earlier generations of GLP-1s (Wegovy, Ozempic etc.) will be facing patent expiry within a few years, innovation in the area continues with a race to develop both injections that can be administered less frequently and also pills as an alternative to injections. Both Eli Lilly and Novo Nordisk have recently reported promising results in clinical trials for their weight-loss pills. The winners in this area are expected to be blockbuster drugs, with estimates ranging from them taking a fifth to a third of the more than $100bn forecast to be spent on obesity medicines each year from 2030.2

Atrial fibrillation (AF) is an irregular, often abnormally high heart rate. It can lead to blood clots in the heart and increases the risk of stroke, heart failure and other heart-related complications. AF is estimated to affect 1.5 million people in the UK alone. Over recent years, a number of sophisticated devices have been developed to help manage the condition. One example is Boston Scientific’s FaraPulse Pulse Field Ablation (PFA) System, which uses high-energy electrical pulses to create scars in the cardiac tissue to eliminate the abnormal heart rhythm. In less than 24 months, PFA has become the leading technology to treat AF, surpassing the long-established cryoablation and radio-frequencies modalities.

Patients with Alzheimer’s disease represent another huge addressable market. In the UK, there are currently around one million people living with the disease, with this forecast to increase to 1.4 million by 20403 due to the ageing population. There have recently been developments in the treatment of young onset dementia, which refers to people aged under 65. These include disease-modifying drugs such as Eli Lilly’s donanemab.

The medical breakthroughs in respiratory diseases are also significant. This is not just for diseases like Chronic Obstructive Pulmonary Disease (COPD, or smoker’s cough) but also for Respiratory Syncytial Virus (RSV) which can impact both the elderly and new-born babies.

Outside therapeutics and as exemplified by the discussion around atrial fibrillation, the medical devices industry also continues to make progress, with innovation in robotic surgery and equipment designed to remove blood clots, treat hypertension and monitor diseases such as diabetes and irregular heart rhythm. In addition, virtual or augmented reality is transforming medical training, surgical precision and patient rehabilitation, while the rise in wearable tech is helping expand remote monitoring and management of chronic diseases.

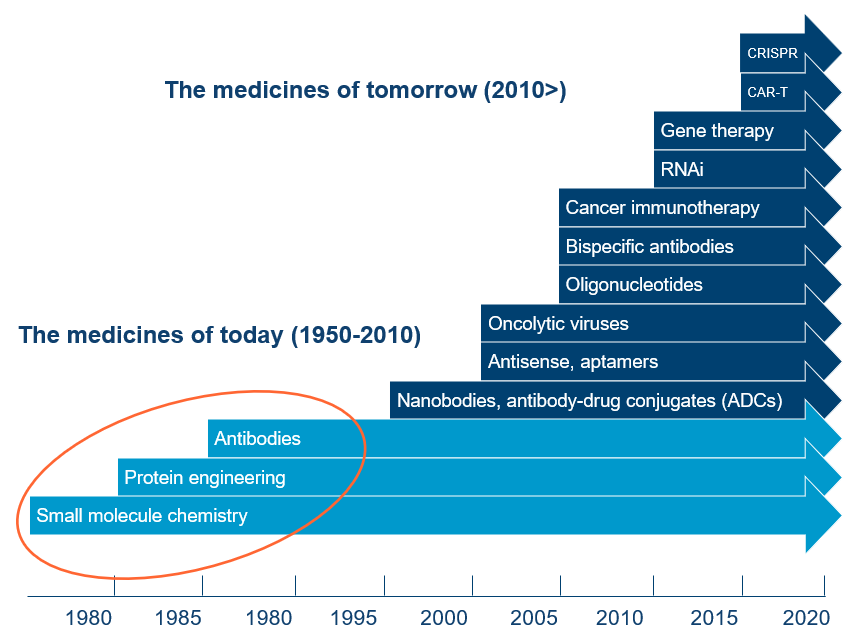

What is coming next?

Some of the particularly exciting breakthrough technologies happening right now are 3D and bioprinting for custom prosthetics, implants and even human tissue. Gene and cell therapies – the transfer of living cells into a patient – are moving from the experimental to the mainstream and have produced impressive results in treating certain cancers.

Additionally, advanced translational models, such as organoids4 and organ-on-a-chip technologies, are improving preclinical testing and validation (to identify any safety concerns) and accelerating the path to clinical trials. We are also seeing machine learning and cloud-based analytics enhancing data collaboration and predictive modelling.

|

| Source: Polar Capital. |

Supporting innovation – leveraging AI to improve efficiency

Major pharma companies are using AI to assist in drug design and clinical trial optimisation. AI-powered diagnostic tools are enhancing accuracy and speed, especially in radiology, pathology and cardiology, while personalised medicine, enabled by machine learning, is tailoring treatments to individual genetic and clinical profiles, particularly in oncology.

How the Fund captures these opportunities

Against this background, the Fund has a broad-based exposure to healthcare. We can invest across the market cap-spectrum and see real value in many different subsectors, which means we can take a very diversified approach across sectors and regions. The Fund is very focused on the new product cycle theme, with a large overweight in biotech and a small underweight in pharma. Putting the two together, the Fund has about a 10% overweight in the product cycle stories within those two subsectors. It is also diversified across healthcare equipment, medical technology, healthcare providers and managed care.

1. "Novel" drugs are new drugs never before approved or marketed in the US

2. Source: FT The race to launch a pill for weight loss

3. How many people have dementia in the UK? | Alzheimer's Society

4. An organoid is a miniaturised and simplified version of an organ produced in vitro in three dimensions and derived from a few cells