Polar Capital Income Opportunities becomes Polar Capital Financial Credit

The Polar Capital Income Opportunities Fund was launched in 2009 against a backdrop of central banks and governments having to backstop the financial system. At the time, we saw an incredibly attractive opportunity to provide a lower risk way for investors to gain exposure to the recovery in the financial sector by investing in a combination of equity and debt securities of financial companies globally. The long-term aim was to outperform financial equity indices but with significantly less risk.

The strategy delivered, posting a return of 217.6% from launch until the change of strategy at the end of December 2023. This compares to the STOXX 600 Financials Index return of 71.5%, the MSCI All Country World Financials Index return of 184%, the ICE BofA Global Financials Index return of 63%, the ICE BofA Euro Subordinated Financials Index return of 100.4% and the Lipper Mixed Asset Sector return of 99.6%. Dividends grew from 5.75p per share in the first full year of launch to 8.19p.

Nick Brind, Lead Fund Manager of the Polar Capital Financial Credit Fund, and fellow Fund Manager Jack Deegan discuss the strategy change, where they are currently finding compelling opportunities in financial credit and their outlook for the rest of 2024.

Q: Why has the Fund’s strategy changed?

Nick Brind (NB): First, we found that if an investor was bullish on the financial sector they would, for understandable reasons, want a fund focused on equites not on credit and vice versa, with one focused on credit not equities if they were more cautious so we fell between those two stools. Therefore, we felt it made more sense for the Fund to lean in one direction to give a clearer vision of what it is investing in and its risk profile. With its clearer investment strategy, we believe the Fund will be a more attractive investment proposition to new shareholders.

Second, the focus on credit will reduce risk and has led to a further increase in the dividend yield, which stands at around 6% today if the latest quarterly dividend is annualised. Also, with the rise in interest rates over the past two years, returns on offer are very attractive relative to recent history, especially if inflation continues to moderate and interest rates are cut as expected. Finally, financial credit has emerged as a dedicated asset class due to the increasing complexity of the sector which requires a depth of knowledge and experience which the team has demonstrated aptly over the past 14+ years.

Q: What are the relative attractions of credit over equities in the financial sector?

Jack Deegan (JD): Ultimately, in credit we see the potential for an attractive risk/reward of high single-digit returns for limited risk but, if we are in another equity bull market, credit will lag (and vice versa). That should not be a surprise to anyone and, while there has been talk of the great reallocation to fixed income, for example, by BlackRock co-founder Robert Kapito, we are not so sure. However, the attractions for the asset class are back given their previous absence in a world of negative or zero interest rates.

On a more granular level, we believe there will always be better opportunities in owning the bonds of a company rather than its shares, regardless of the backdrop. As an extreme example, one of the largest holdings in the Fund in 2009 was a Barclays 14% Tier 1 bond which offered a yield of 9%. The bond in question, issued in 2008 as part of Barclays’ plan to raise capital from Middle Eastern investors and thereby stay private, was redeemed in 2019. Over the period it was held, it returned about 9% per annum, 121% over the 10 years, while Barclays shares fell by close to 50% as the headwinds of increased capital requirements, litigation, PPI redress and weak profitability, in part from low interest rates, weighed on returns.

Q: Why is now a good time to change tack?

NB: Looking back over the past 50 years, financial companies have, on average, defaulted less than half as much as non-financial companies, which can probably be explained by being highly regulated, especially with the changes over the past 15 years. Furthermore, higher interest rates have led to the sector being more profitable. All of this would lead one to conclude that default risk is even lower but yields on offer today would suggest otherwise. Do investors believe financial companies are likely to see a significant increase in defaults? I doubt it and suspect it has more to do with the complexity of the sector and recency bias.

The likely repercussions of the recent bank failures will be a further step-change in regulation, especially in the US. US banks will likely have to carry more capital, while liquidity requirements will be tightened and supervisors will be made to up their game, notwithstanding the pushback on the latest so-called ‘Basel III endgame’ proposals. The introduction of deposit insurance and the creation of the Federal Deposit Insurance Corporation in 1933 led to a dramatic fall in bank failures in the US. We believe the changes this time will be much less seismic but could make the risk/reward for debt investors even more attractive.

Q: What does the Fund look like now?

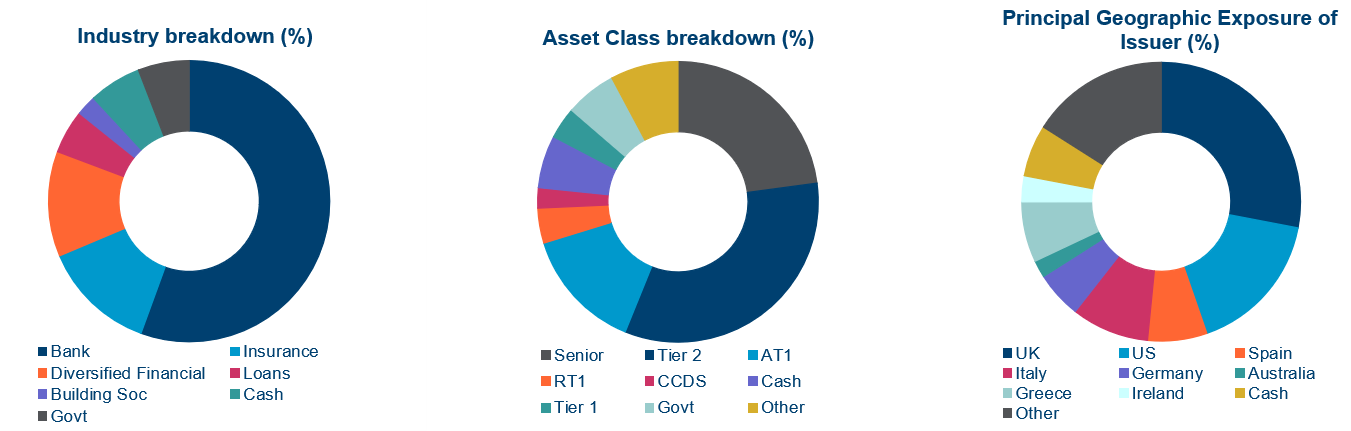

JD: The Fund is diversified across companies, geographies and where bonds being issued sit in the capital structure with the largest exposure being to senior and Tier 2 bonds:

Q: What role could the Fund now play in broader portfolios?

NB: The aim of the Fund is to provide an attractive level of income with a relatively low level of risk. Many have pointed out that fixed income is no longer negatively correlated with equities, but we believe it should still provide that ballast to portfolios, especially in the event of market shocks. I forget who said “equity is that thin sliver of hope that stands been assets and liabilities” but for an asset class that should provide high single-digit returns against an equity market hitting historic highs, it does not seem a bad place to invest, in our view.

The portfolio is split fairly evenly between investment grade and high yield bonds. We would argue it should be more defensive than other financial credit funds with our Fund having much higher exposure to senior bonds and Tier 2 bonds while significantly lower exposure to AT1 bonds. It also has lower exposure to Europe as well. Our aim is to find, where possible, idiosyncratic bonds issued by less well-known but well-managed and well-capitalised businesses that, due to their size, offer a higher yield to complement exposure to the more well-known large banks and insurance companies.

Q: What is your outlook for 2024?

NB: We believe the setup for 2024 is looking increasingly positive for the financials sector. After the “everything rally” at the end of 2023, we believe equity and bond markets have run ahead of themselves in the short term and are due a pause. However, 2023 was only the 26th best year since 1976 for credit markets and below the average annual total return over this period. With indicators we look at pointing to inflation continuing to moderate over the remainder of the year we think that will be good for credit markets and would suggest another year of solid returns.

Underpinning this optimism is the outlook for economic growth, which looks more promising. Job markets remain tight and real incomes, having risen in part thanks to lower energy prices, should support growth. Finally, we had been of the view that central banks would be slow to cut interest rates as inflation dropped, having been caught behind the curve in 2021. However, the recent pivot by the Federal Reserve has brought the “Powell put” out of hibernation, and has changed that calculus and reduced tail risk in markets.