We live in an age of risk. It is a time-framed by a pace of change that has never been more rapid but, crucially for Fund companies, stands alongside risk insight and underwriting tools that have never been more acute. As a society, the risks we face are broad, everchanging and becoming more complex, ranging from climate change, natural catastrophe risk, geopolitical risk or war, all the way to newer risks such as artificial intelligence, robotics, cyber and even genomics. Specialist risk insight has never been more needed or more in demand.

We believe insurers are fundamental in supporting the broader economy in managing these changing risks. They are crucial, for example, in supporting the climate transition required to reach a net-zero world, which remains top of mind following the focus on climate finance at the recent COP 28 meeting in Dubai. The specialist underwriters the Polar Capital Global Insurance Fund invests in stand at the forefront of these societal changes with their deep expertise and insight into managing and mitigating risk with data that goes back decades. We believe this differentiates our portfolio companies from the many general and regional insurers who are finding it ever more difficult to keep up with the pace of change and gain the specialist knowledge and data insight required to price and accept such risks with an expectation of underwriting profit.

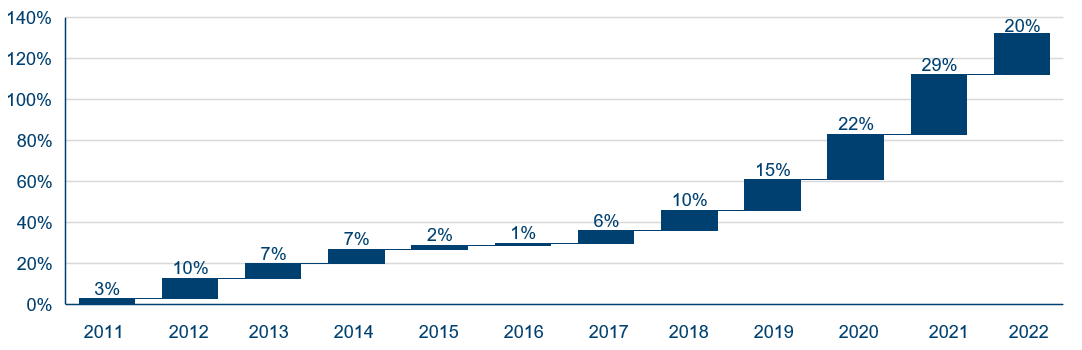

As a result, more business is moving into the specialty or excess and surplus lines (E&S) markets, such as at Lloyd’s of London, as an increasing proportion of risks fall outside the mass market-focused underwriting capability of larger companies. Prior to 2017, around 10% of US commercial business was placed in the E&S markets; today this stands closer to 20%, a tailwind that continues to drive growth at portfolio companies. Growth in E&S premiums continues to be well ahead of the US market average.

Many risks are simply too hard for generalists to insure, whether because of complexity arising from supply chains, technology and innovation or the propensity to be impacted by convective storms, floods or wildfires. The most common underwriting models typically struggle to adequately manage or underwrite such risks. Premium rate changes in the US standard admitted non-E&S markets need approval from locally elected insurance commissioners. It is unsurprising that persuading them that consumers and businesses should pay higher prices to reflect the growing levels of risk can be difficult and time-consuming.

In contrast, the specialty E&S markets have the freedom to price to a level commensurate with the risk and can use terms and conditions they deem appropriate. Many of the portfolio companies have large footprints in the E&S markets and have proved adept at managing the underwriting market cycle by growing into these more specialty risks as the traditional markets have pulled back their risk appetite. In addition, clients benefit from access to bespoke risk programmes tailored to their specific needs and can speak to underwriters with a deep understanding of their business while gaining support in mitigating risk and managing the net-zero transition.

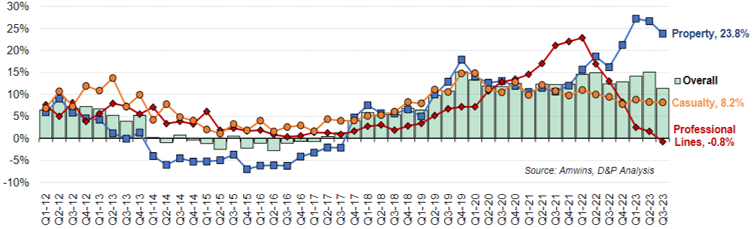

The renewed market discipline since 2017 has led to a robust upswing in pricing. The quarterly Global Insurance Market Index, published by insurance broker Marsh, has seen compound rate rises over the past four years to 4Q23 up a significant c60%, which we believe is far in excess of loss cost trends. Given the increased demand for solutions insurance, rate rises are particularly pronounced in the E&S market; the E&S pricing index from Amwins, a wholesale broker, showed property rates rising more than 20% in each of the past three quarters to 3Q23, a step up from the low double-digit increases of 2021 and mid/high double-digit rises of 2022. Across all lines, its pricing index again rose by double-digits in 3Q23, continuing the trend we saw all year.

In addition to this, the reinsurance market saw a generational reset at the 1 January 2023 renewals. As pricing moved rapidly upwards and terms and conditions tightened, primary insurers need to pass these higher reinsurance costs through to customers. At the same time, primary insurers are now retaining a much larger share of catastrophe risk given the significant rise we have seen in retentions. Primary companies are particularly exposed to high frequency small and mid-size catastrophe losses, with reinsurers once again more exposed to larger catastrophe events. 2023 has been particularly painful for primary personal lines companies with reinsurers moving away from the risk given that Gallagher Re, a reinsurance broker, estimated claims associated with severe convective storms in the US alone were close to $60bn. The Fund continues to have a low exposure to personal lines companies so our exposure to these types of catastrophe events is modest.

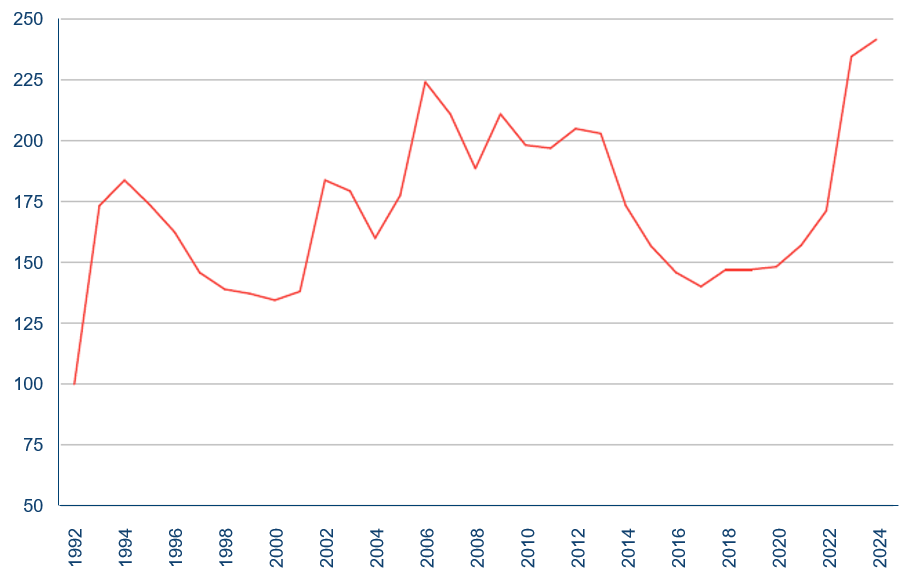

The reinsurance market trends that began on 1 January 2023 have continued into the recent 1 January 2024 renewal, with increasing market acceptance of the new reality for clients resulting in an orderly renewal. Property catastrophe reinsurance pricing was up by mid-single digits in January 2024, further extending the rise of 25% in 2022 and 37% in 2023, bringing the reinsurance broker Howden Tiger’s index to its highest level since the 1992 inception.

The significant rise in reinsurance pricing, and expected profitability, presents an opportunity for many of our companies who had previously cut back on their reinsurance exposures significantly during the soft market years prior to 2017, to sell more reinsurance covers. During this period, the Fund had its lowest ever allocation to property catastrophe reinsurance at 4% of look-through premiums. Today, this is close to 6-7% as our companies grow into this much stronger market and we have nudged our weightings higher. This increased level remains well below our self-imposed limit of 10% of premiums as we are mindful of the ongoing elevated levels of catastrophe activity. Furthermore, profitability remains excellent in primary commercial markets so there is no incentive for us to take on anything more than a modest increase in catastrophe risk.

The hard reinsurance market adds backbone to the need for primary insurers to continue to put more rate through to their customers, further sustaining the positive outlook for premium rates that began in 2018. As well as continued robust property pricing there are indications that casualty primary rates will accelerate again given an increasing level of caution from the large European reinsurers towards US casualty risks. These European reinsurers, not owned by the Fund, grew during the softer part of the cycle and are having to address challenges with their reserves, tempering their overall casualty risk appetite. As we look forward, the prospects for market conditions remain strong with rates continuing to rise in line with loss cost trends across the majority of lines of business, thereby sustaining what remain very strong underwriting margins. We expect underwriting markets to remain robust and underwriting opportunities to abound for Fund companies.

The Fund is benefiting from these secular and strucutral trends, leading to the portfolio's companies delivering profitable growth. This can be seen by the fact that during 2023 we estimate our companies delivered book value growth of c21%, roughly double our historical book value growth of c10-11%. This reflects the strong underwriting markets discussed above, as well as materially higher investment returns generated from their low-risk investment portfolios due to higher interest rates. As we begin 2024, we have not changed our 16%+ book value growth best estimate for the next 12 months. We believe our assumptions are conservative even after the fall in short-term bond yields seen in 4Q23.

2023 book value growth, at an expected 21%, is a strong indicator of the robustness of the fundamentals for our portfolio companies going forward and speaks to a material step-up in earnings power we have seen for them over the past 12-18 months. However, it was disappointing that, despite their strong fundamental performance in 2023, this was not reflected in Fund performance with the Fund price rising c5% in constant currency. Given the outstanding book value growth against weaker Fund price performance, our portfolio suffered given a significant derating. We believe this is unwarranted and driven by more short-term macroeconomic influences rather than any deterioration in our company fundamentals.

Consequently, we believe this presents an attractive opportunity for investors to revisit the sector. Strong expected book value growth in 2024 and beyond may well be augmented with price-to-book multiple expansion if our expectation of high/mid-teens book value growth is correct and continues for the foreseeable future, as we believe it will. As we write this, the Fund is enjoying a strong month driven by an excellent start to 4Q23 earnings season, which will be discussed further in the January factsheet. We believe this may prove to be the start of a reversal of the unwarranted derating we suffered last year. Irrespective of the prospects for multiple expansion, should Fund returns over the next few years meet our 16%+ book value growth expectation, given the Fund price has historically been closely correlated with the book value growth of our companies, we think the outlook for returns for your money and ours (we eat our own cooking) remains very attractive.