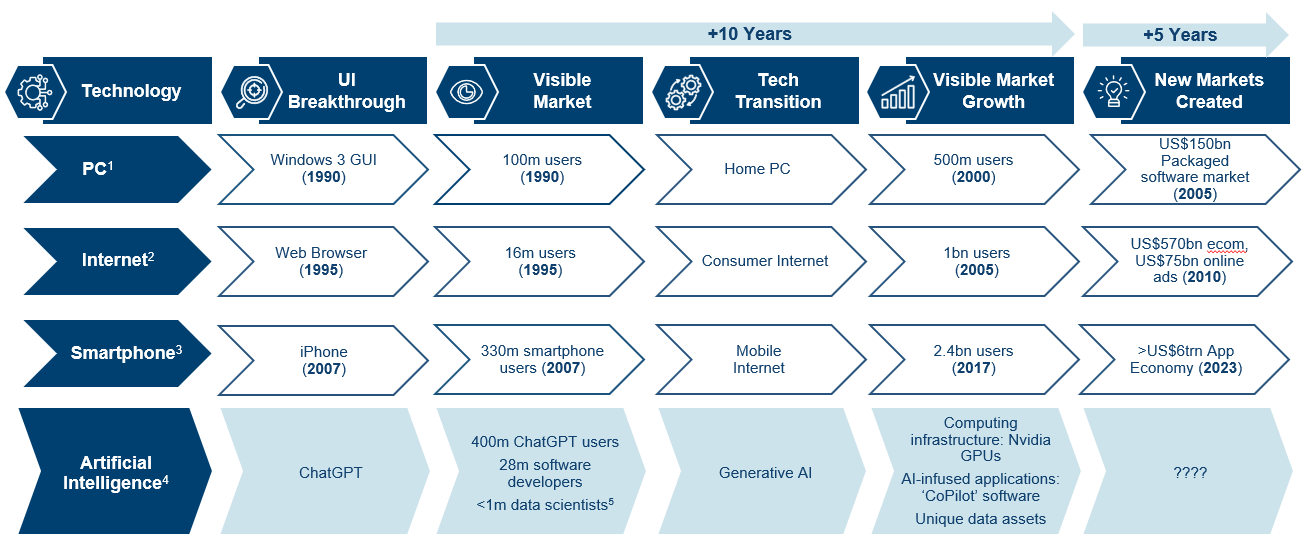

We are strong believers that user interface (UI) breakthroughs drive technology adoption. Looking back at one of the first big transitions in the technology sector, from mainframe to PC, the latter existed long before Windows was introduced, however it was Microsoft’s operating system introducing an easily accessible user interface which expanded the market from 100 million users to 500 million in 10 years.

While an instinctive reaction during this transition might have been to invest in the unique components such as central processing units (CPUs) or hard disk drives (HDDs), in the end the biggest opportunity for investors was an entirely new market or so-called ‘invisible market’ – packaged software. Five years after the PC market hit 500 million users, this industry grew from almost zero to $150bn.

A similar argument can be made for the internet transition. The web browser helped expand the user base but the biggest opportunity was not in the networking equipment, it was in the e-commerce and online advertising business models emerging on the back of the new web functionality. Five years after the Internet hit 1 billion users, those two markets grew significantly from almost zero to $570bn for e-commerce and $75bn for online ads. Again, the invisible market here was significantly bigger than the networking market.

The same narrative played out within smartphones. Apple became the first company to top a $3trn valuation largely thanks to the app economy it created, now worth c$6trn and from which they take up to a 30% cut. Identifying and taking part in the emergence of such invisible markets within AI lies at the heart of our decision to launch the Polar Capital Artificial Intelligence Fund over six years ago.

LLMs understand what you say but LAMs get things done. - Jesse Lyu, Rabbit OS CEO

Most recently, we have seen ChatGPT’s user interface enable the rapid adoption of generative AI and large language models (LLMs). The most obvious visible market at the moment is compute infrastructure and, while a paradigm-shifting new market paralleling our previous examples of technology adoption has yet to materialise, recent green shoots of hardware innovation in AI UI suggest it is only a matter of time.

At January’s Consumer Electronics Show (CES), US start-up Rabbit (private, not held) unveiled its handheld R1 ‘AI companion’ device, designed to signal a break from smartphone ubiquity rather than offer the next iteration of an inbuilt AI assistant such as Siri or Alexa. Its large action model (LAM) is designed to add a layer to LLMs’ ability to generate text from human input by generating actions; from ordering a pizza upon voice command, to organising and booking a holiday, both demonstrated by CEO Jesse Lyu.

In this instance AI is allowing product design to challenge the app-centric and phone-first model of consumption we have grown used to. Rabbit is actively seeking to leapfrog the accepted experience of what it says has become an unwieldy collection of attention-dominating apps through interfaces, using them for assistance as opposed to allowing them to fight for our attention as with the current smartphone economy – prioritising utility over entertainment or novelty.

Humane’s (private, not held) AI Pin, a wearable AI assistant built on the company’s mission to “put us back in touch with ourselves, each other, and the world around us”1, is based on similar post-app/smartphone values.

This is not to say the two innovations are surefire winners or that their approach to UI will prove successful - previous iterations of augmented reality products and physical devices such as Google Glass and Snapchat Spectacles failed to achieve widespread adoption. New products also face the obstacle of convincing users to carry another device and adjusting to favouring it over a smartphone. However, the most important aspect here is the willingness to design beyond accepted user habits and create a new model of interaction, with AI at the core, as opposed to folding a new idea into existing hardware.

If it were to herald the direction of travel for AI-first hardware, these proactive and immersive experiences could feasibly render the smartphone's centralised functions obsolete, making way for a future where AI assistants embedded in our surroundings handle everything from communication to health optimisation. The consequences for companies like Apple (not held), should these efforts or others like them be successful, could be very challenging given Apple's current dominance of the industry's profits - disruption to the status quo form factor could provide great opportunity for new entrants.

Solving for tomorrow

Investing in the enablers of AI, as well as the beneficiaries and those changing the way we interact with the world, allows us to stay alert to AI adoption emerging in ways we might not have anticipated. It is our view that AI will increasingly influence sectors away from mainstream technology and will likely result in meaningful changes in the way companies serve customers, as well as how those customers access existing and newfound products and services. By taking a long-term approach to monitoring and assessing AI readiness in a broad range of potential beneficiaries in a range of sectors, we believe we can position the Fund to benefit from AI-fuelled growth, corporate synergy and burgeoning business lines beyond short-term productivity uplifts.

While elements of the product design evident in Rabbit’s R1 and the Humane AI Pin are early examples of this, the underlying ideas chime with our belief that AI represents a revolutionary force with the potential to completely reshape our relationship with technology. As such, we see a meaningful advantage in investing along the entire AI value chain; in the building blocks of the sector, the likely beneficiaries in all sectors, and those ready to create a new use case in invisible markets beyond what we naturally think of, and design for, today.