European small and mid-cap companies (SMIDs) have suffered heavily on the back of a multitude of concerns weighing on the region over the past two years. However, we believe an inflection point is approaching that will allow solid fundamentals underpinning select smaller companies on the continent to shine through, prompting a volte face in performance in 2024.

Rate fears have hit small caps the hardest

A rising interest rate environment and unprecedented volatility in supply chains in the aftermath of Covid, including instances of significant inventory destocking, have provided meaningful hurdles for European companies since the pandemic. The market has designated small-cap companies the biggest casualty of the former, partly as they are generally perceived to be more indebted, with a higher weight of floating debt, and therefore more vulnerable to rising rates as well as a slowing economy. While this may be true, it is not universally the case. However, it is this indiscriminate blanket dismissal of smaller companies that we believe presents an attractive entry point for medium-term investors exposed to high-quality balance sheets among what we see as mispriced market minnows.

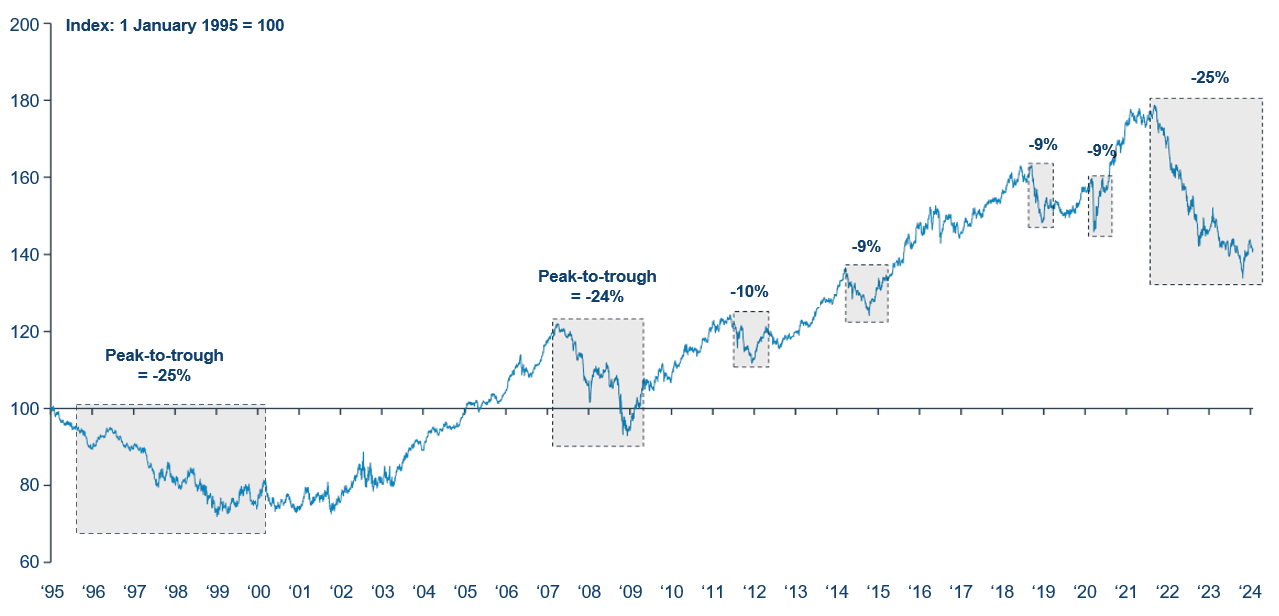

SMID underperformance comparable to financial crisis levels

Putting the aversion to European SMIDs into context, what we have seen since September 2021 is a degree of underperformance rarely seen historically and matching the worst periods over the past 30 years. Relative underperformance of 25% for SMIDs versus large caps compared to recent periods of market drawdown such as the pandemic (-9% peak to trough), 2018 (-9%) and the euro crisis in 2022-23 (-10%) gives a sense of the current magnitude. Indeed, the cumulative underperformance is comparable to the market dislocation of both the global financial crisis (GFC) and the dot.com boom of the late 1990s.

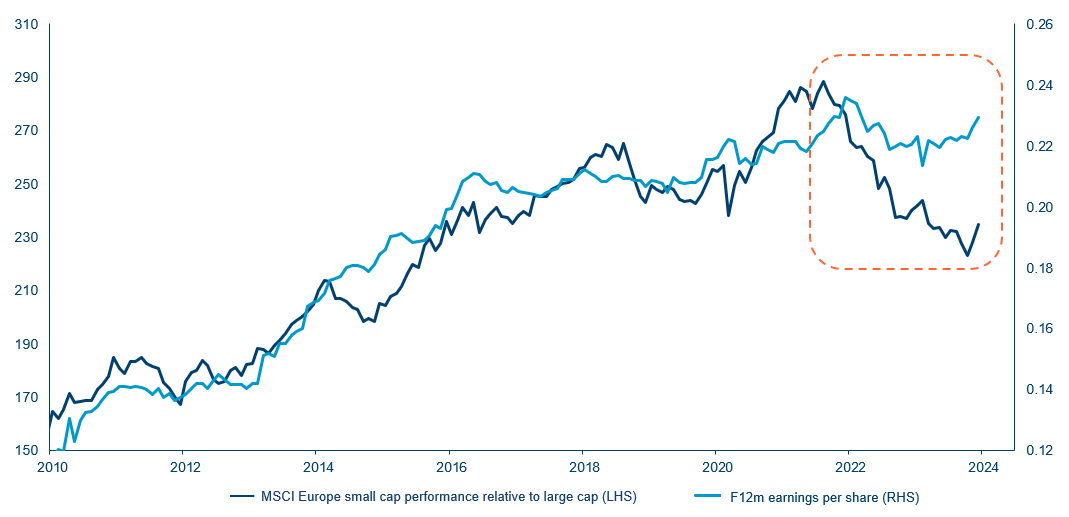

This degree of underperformance is even more stark given the underlying earnings resilience of many European SMID companies. Over time, small-cap names have outgrown their larger peers however it is notable that, while the past two years of high rates, high inflation and supply chain disruption have tarnished the perception of small-cap solidity, in reality small-cap companies’ earnings have actually held up relative to larger peers, contrary to this perception of increased vulnerability.

Despite this relative resilience we have seen, in many cases, a clear disconnect between company fundamentals and relative share price performance.

In terms of our own portfolio, earnings growth outstripped the market both in 2022 and is expected to do so in 2023, with the SMID-cap holdings in our portfolio carrying an average net debt-to-EBITDA of just 0.4x, presenting healthy balance sheets amid a backdrop of market malaise.

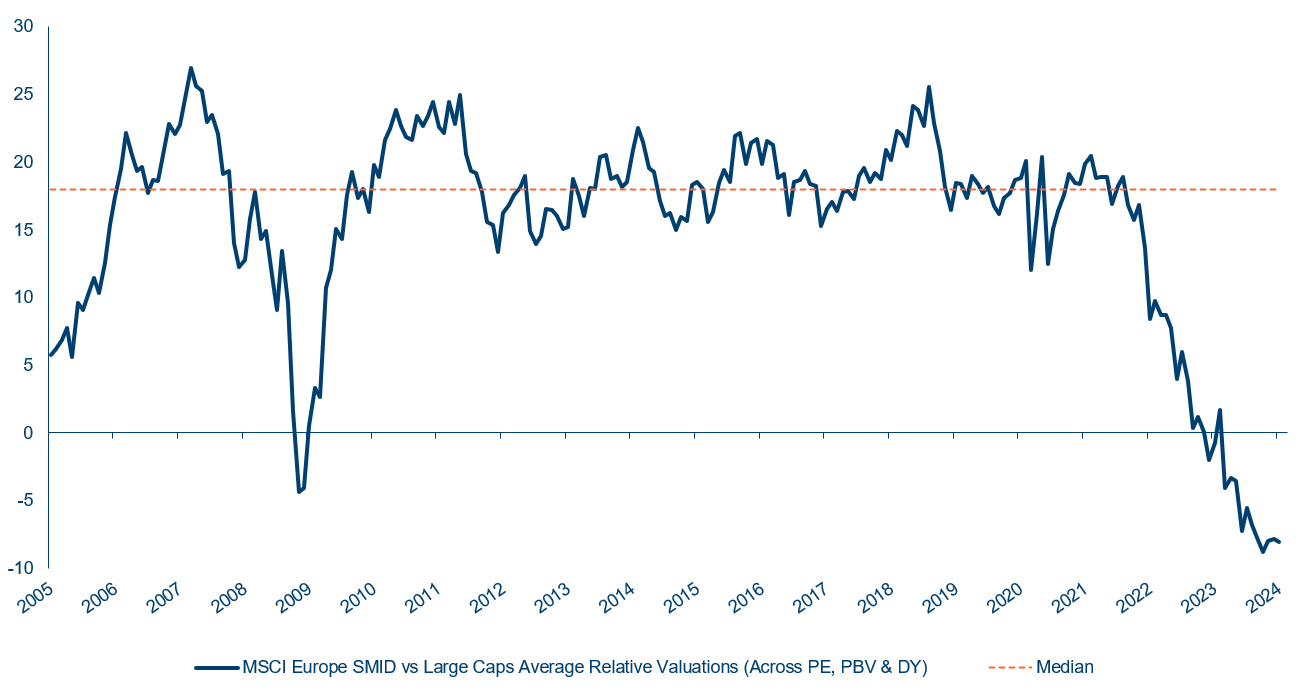

Valuations present largest discount for SMIDs this century

This fundamental disconnect is best shown in the context of long-term valuation comparisons between market capitalisations, across three different valuation metrics.

What is clear here is that SMIDs in Europe currently sit at their largest valuation discount to larger companies this century – greater still than the depths of the GFC. We believe this discount offers a very compelling opportunity to invest in high-quality balance sheets misunderstood or ignored by the market. However, while valuation metrics may suggest an attractive entry point for medium-term investors, valuation alone is rarely a reliable gauge for timing a market turn. Therefore, what will turn the tide?

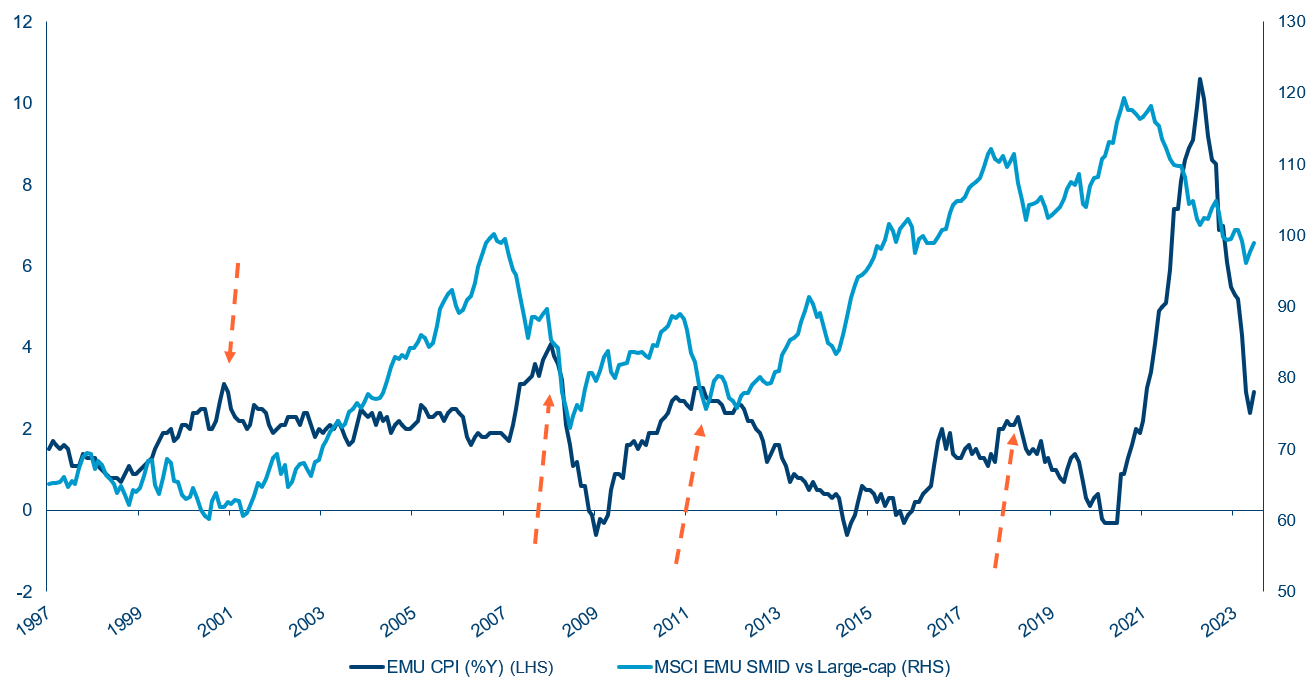

Is peak inflation the performance catalyst?

Historically, as inflation peaks and begins a path of disinflation, the changing interest rate environment coincides with a positive inflection in the relative performance among European SMIDs. This pattern is evident in 2001, 2008, 2011 and 2018 – all periods in which a moderation in inflation led to improving market breadth. However, as the chart below shows, the one major exception to this in recent history has been the past 12-18 months, during which inflation has fallen sharply, without inflection in SMID outperformance as in previous instances of a changing inflation trajectory. We believe the reason for this was that, because the inflation in peak in 2022 was so extreme, central banks continued to tighten monetary policy through 2023, even as inflation moderated.

With the effects of higher rates now feeding through into the economy and the market anticipating at least three, if not four, rate cuts in 2024, we believe the changing outlook for monetary policy will lead to a shift in the market environment. We believe the potential for rate cuts, combined with an improvement in the economic outlook, should be supportive for SMIDs.

Supply chain normalisation a boon for European SMIDs

While not strictly a small and mid-cap strategy, over half the Fund’s current market-cap exposure is to small and mid-sized European companies – while this has been a material headwind, we believe this will soon reverse.

Over the past 12-18 months, as supply chains have normalised, financing costs have risen and commodity prices have come down, with many companies and sectors seeing significant destocking, including some that are not normally cyclical. However, the manufacturing downturn is already very mature, with the euro area manufacturing PMI below 50 for 19 months and counting, and our conversations with companies suggesting inventory levels in many sectors are already close to normalisation, with destocking starting to moderate. Indeed, the most recent US ISM survey for February shows twice as many respondents report their inventories are now too low as those saying theirs are too high. In our view, this suggests there is a strong probability of improvement over the coming year, with the possibility of a restocking cycle in some areas in 2024.

There are, of course, wider factors to take into account ahead of a change in performance for SMIDs – not least an increasingly unpredictable geopolitical landscape. However, after a period in the market wilderness, with valuations now close to the lows over the past decade, we believe a blend of solid fundamentals in our companies and a promising near-term mix of inflation cooling and interest rates receding should prompt a much better performance for SMIDs in 2024. History would suggest this is a more productive environment for European small and mid-caps at a time when, in our view, much of our investment universe is on sale.