While stronger-than-expected economic growth, particularly in the US, meant the healthcare sector lagged the broader market in 2023, we think GDP growth is now slowing and it is this environment in which healthcare tends to outperform the market.

Putting this current backdrop and our positivity in context, there have been mini-cycles of healthcare’s relative outperformance and underperformance over the past several decades in which it has been, alongside technology, the best returning sector, generating an annualised return of c11%. The most recent of these positive cycles, or healthcare bull markets, began in 2011 and ran through to July 2015, during which time the MSCI ACWI Healthcare Index returned 141%, beating the 84% delivered by the S&P 500 and the MSCI World Index return of 46%.

Distilling the drivers behind this outperformance throws up four clear positive factors, in our view. Importantly, we see parallels with four critical ingredients and the setup we believe is building for the healthcare sector in 2024:

1. Supportive macroeconomic backdrop

In 2011 the US economy moved into a period of steady growth after a significant acceleration in late 2009-10 following the financial crisis. However, as this growth started to slow, it precipitated the conditions most closely associated with healthcare outperformance and resulted in exactly that, with healthcare stocks generating significant gains.

Turning to 2024, after a period of unexpectedly high economic growth, we anticipate a slower steady US GDP growth outlook. We view 2023 as similar to the 2009-10 timeframe, and now in our view, the macro perspective is shaping up in 2024 to be just like what we experienced in 2011.

2. Procedure growth

2011 saw the launch of Obamacare in the US, prompting a huge expansion in insurance coverage for the broader US population, with the creation of health exchanges and expanded coverage under Medicaid. This led to a significant increase in demand for healthcare services, with procedures accelerating through the period.

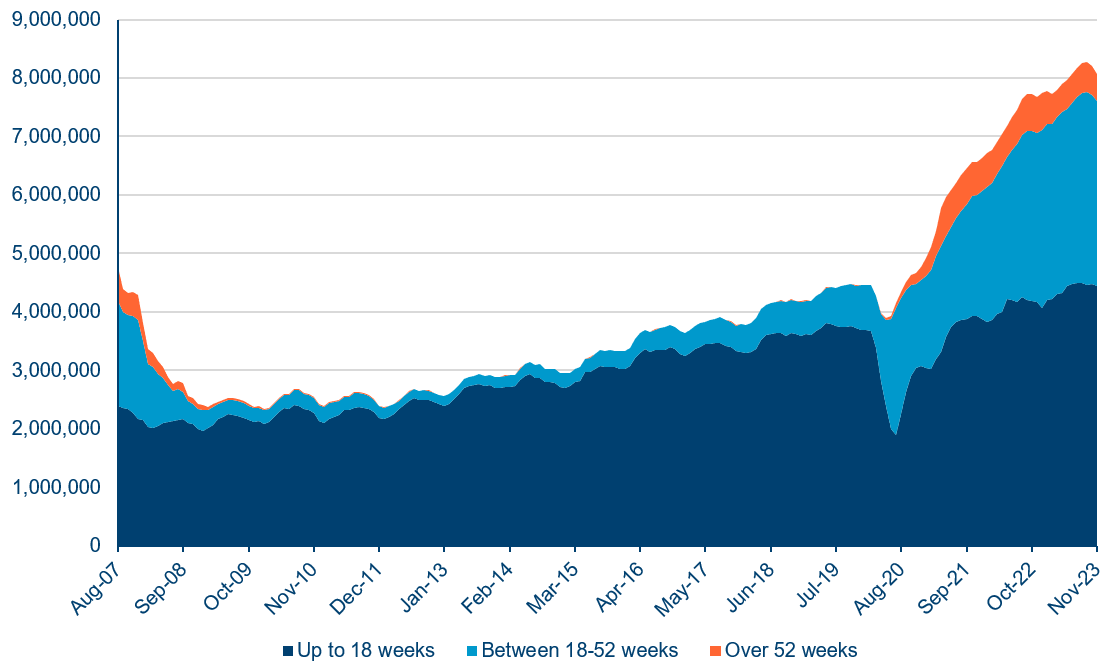

More recently, the pandemic prompted a slowdown in procedure volumes and a significant build-up in backlogs in healthcare systems around the world. However, we are now seeing utilisation returning to trend and backlogs slowly coming down, bringing with them a strong growth outlook which is constructive for the sector.

Healthcare utilisation catching up to pre-Covid levels plus a multi-year period of dealing with backlogs means the potential is there for very strong demand growth over the next few years, echoing 2011’s driver with Obamacare.

3. New product cycles

In 2011, the healthcare sector benefitted from a wave of innovation, which triggered the launch of new treatments for hepatitis-C, multiple sclerosis, cystic fibrosis and cancer, driving a significant acceleration in revenue growth and earnings, in turn helping drive healthcare outperformance.

New product cycles are, in general, a key driver of stock performance for pharmaceutical, biotechnology and medical device companies and 2023 was the second-biggest year for new product approvals in the US in 30 years. This sets the stage for a raft of new product cycles. Key launches we are focused on are drugs for obesity, Alzheimer's, respiratory disorders including COPD (chronic obstructive pulmonary disease) where there is a huge unmet need, and a new class of devices for atrial fibrillation which should be a multi-billion-dollar category. There are many others that should accelerate the sector's revenue, earnings and operating leverage, which will hopefully drive stocks higher.

4. Stock market setup

The current stock market setup for healthcare mirrors that of 2011, after a period of poor relative performance from the sector was driven by flows into more cyclical areas of the market. This weakness has caused sentiment to decline significantly as shown by negative ETF flows in the sector. When flows are very negative, sentiment is typically very bearish and thus supportive of buying the sector. For us, another positive contrarian signal is the five-year relative performance for the sector being in the bottom decile. This has often preceded a turn in performance. In our view, the sector is cheap – large/mega-caps trade at a discount to the market, having historically traded at a premium, and small and mid-caps are in line with the relative lows of the past 35 years.

As such, we believe we now have the four critical ingredients in place for a new bull market in healthcare. While history rarely repeats itself, it often rhymes and we remain extremely constructive on the healthcare sector, buoyed by these near-term dynamics. For us, they present a compelling case for investing in healthcare now.