Grid-connected battery energy storage systems (BESS) should remain one of the highest growth areas in clean power generation and distribution for many years to come, offering compelling investment opportunities.

BESS act as a bridge between intermittent energy production and consumption, storing electricity during off-peak periods, thereby helping to maintain grid reliability. They can be installed standalone, co-located with renewables or residential and commercial properties. They offer grid flexibility, can be operated when the grid is not available and do not need extensive connections as they either sit alongside existing generation capacity or next to consumers, whether industrial or domestic. BESS have become essential to buffer electricity at sites of high load points, such as data centres and electric vehicle (EV) charging stations.

BESS reduce the curtailment of renewables, allowing deferrals in grid investments and optimising self-consumption. They allow energy arbitrage by storing excess energy generated during peak solar or wind times when prices are low, and releasing it during peak demand when prices are high. In EV charging stations, onsite batteries can increase the maximum charging power. In data centres, BESS ensure a stable power supply by regulating voltage fluctuations and filtering electrical noise. They also provide fast-deployment backup power, thereby decreasing the need for diesel generators. To understand the potential benefits of BESS to consumers and the grid operator, please have a look at the below case study ‘California: Smoothing the duck curve’.

Driving down the costs

With significant technical and cost breakthroughs in recent years, lithium-ion batteries have become the most widely deployed storage solution for short-duration storage (of typically 2-6 hours), having overtaken electricity storage through pumped hydro. Improvements in battery chemistry and manufacturing processes have allowed the production of batteries with higher energy density, better round-trip efficiency and increased cycle life at lower costs. Other early-stage technologies like flow batteries with different chemistry and gravitational energy storage for long-duration storage are in the development and piloting stage, and are expected to complement the current offering.

Battery cell price declines are essential to boost project economics and demand. The average cost of a four-hour turnkey energy storage system decreased 23% in 2023 compared to 20221. Costs are expected to further decline by 7% per year until 20301, allowing the addressable markets to expand even further.

Big Tech’s energy needs

As well as the overall, industry-level dynamics in BESS, there is also a distinct corporate side to the increasing demand for storage, in particular as the Big Tech companies aim to reconcile the huge electricity demands of their AI data centres with their clean energy commitments. The four biggest technology companies (Microsoft, Google, Amazon and Meta) account for close to a 40%2 share of global corporate renewables PPA (Power Purchase Agreement) contracts in 2024 so far. Their 100% renewable energy goals largely disregard the mismatches between the time of generation and time of consumption. However, Microsoft and Google have stated goals to move to “100% matching with carbon free energy” and will require battery storage to meet these goals3. Currently, the total electricity demand from these four companies is c100TWh3, close to the level of demand for the Netherlands. To shift just 10% of that total demand will require over 30GWh4 per annum of storage, which is more than the total BESS deployment of 22GWh1 in the US in 2023.

In the wider market, policy mandates are also driving the adoption of BESS. For example, in China, which is the world's largest energy storage system market, most provinces currently require renewables to have 10-20% of capacity integrated with energy storage systems that have two to four hours of storage duration. South Korea is targeting an extra 25GW storage by 20361. In the US, 12 states have approved energy storage targets totalling more than 20GW by 2030-351.

Accelerating BESS deployment

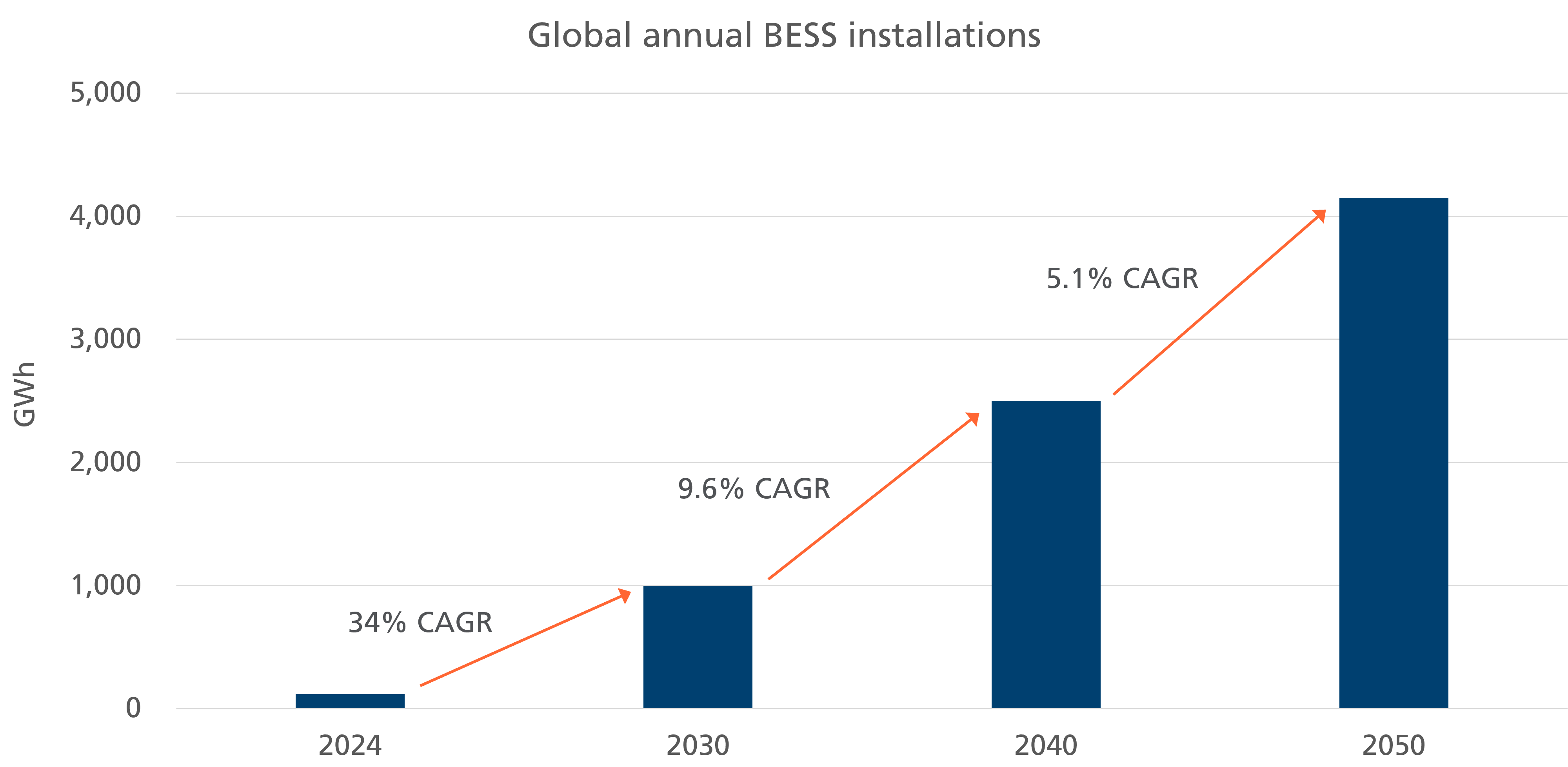

From a very low base, global annual BESS deployments have increased 11x over the past five years, adding 96 GWh last year compared to 7.5GWh in 20181. The strongest growth over the period has been seen in China, Texas and California. China dominates and accounted for 55% of the total global BESS market in 20231. We expect global annual BESS deployment to increase 5.8x with a 2024-30 CAGR of 34%, from 173 GWh in 2024 to 1000 GWh4, representing an investment value of $160bnin 2030, with the attachment rates at 32% of total newly installed renewable (solar and wind) capacity in 2030 from 8% in 20234.

|

Source: Polar Capital estimates as of 2024

Compelling investment opportunity

BESS has become a strong growth area within clean energy, constituting an essential building block for the seamless integration of intermittent renewable power into the grid and offering excellent suitability to buffer electricity for data centres and EV charging stations.

While the BESS market is still very nascent, the growth potential is enormous. The Polar Capital Smart Energy Fund has exposure to leading companies addressing the battery storage value chain, including BESS integrators, suppliers of battery and management systems and lithium chemical producers.

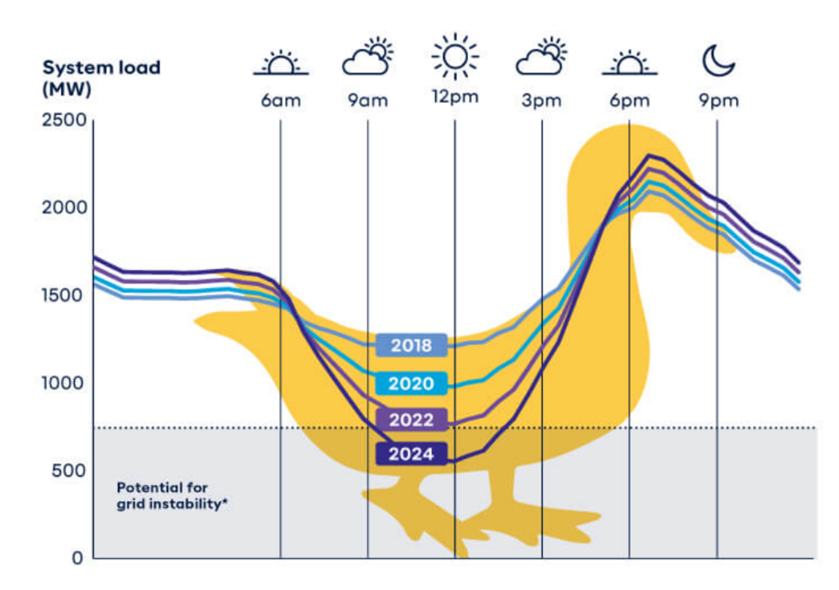

Case study - California: Smoothing out the duck curve In California, solar generation already accounts for about 30%5 of the total annual power supply. The net demand seen by the grid operator, the so-called ‘system load’ as defined by the total electricity consumption minus solar-generated electricity, dips around midday as solar generates most of the power. It soars again in the late afternoon as the sun goes down and residents come back home, driving up electricity consumption (through air-conditioning, cooking, TV etc). This creates a so-called ‘duck curve’, which is a major issue for the grid operator as it increases the need for a massive ramp-up of electricity capacity in the evening, mostly through expensive gas turbines. BESS are very well suited to smooth out the duck curve. Utilities and consumers can charge grid-connected batteries at midday when solar power is abundant and cheap, and release the stored electricity in the evening. Consumers can also sell their surplus electricity to the grid in the evening, generating revenue through energy trading. Solar-plus-storage has been proven to almost eliminate the duck curve. California’s duck curve4

Source: Reuters, May 2024. The Net Energy Metering 3.0 mechanism that came into effect in April 2023 has accelerated the deployment of BESS with solar systems to maximise utility bill savings. It is estimated that up to 90%6 of new residential solar photovoltaic installations are paired with battery storage, compared with just over 20%7 in October 2023. On 30 April 2024, for two hours in the evening peak battery storage output was the largest source of power supply, supplying more than one-fifth of California’s electricity – more than gas, hydro, nuclear and other renewables8. The total battery storage capacity in California has increased significantly since 2018 from 500MW to more than 10,000MW8, sufficient to powering more than 10 million homes for up to four hours. As renewables’ penetration increases, negative power prices are becoming more prevalent, creating more opportunities for BESS to take advantage of price arbitrage and therefore driving the growth of BESS deployment. |

1. BNEF, 1H2024 Energy Storage Market Outlook

2. BNEF, Corporate PPA, Deal Tracker September 2024

3. Google targets 24/7 carbon-free energy on every grid where it operates by 2030. Microsoft targets 100% of its electricity consumption will be matched by zero carbon energy purchases 100% of the time by 2030. Microsoft’s environmental sustainability report 2024, Google’s Environmental report 2024. Meta’s Sustainability report 2024, Amazon’s sustainability report 2023

4. Polar Capital’s estimates

5. S. EIA, Electricity Data Browser, Net generation for all sectors, California, All fuels, All solar, All utility-scale solar, Small-scale solar photovoltaic, Annual, 2001-23.

6. https://www.solarpowerworldonline.com/2024/08/california-solar-installers-get-well-acquainted-with-batteries-in-nem-3-0-era/

7. EIA, California residents are increasingly pairing battery storage with solar installations, 18 July 2024, https://www.eia.gov/todayinenergy/detail.php?id=62524