Liberation Day marked a decisive turning point for UK markets. The underperformance of UK domestic shares in Q1 sharply inverted on 2 April and we believe this new trend of UK domestic outperformance has set in. Understanding the drivers of this turnaround is critical to assessing its (positive) trajectory for the rest of the year and beyond. We see three key drivers of domestic outperformance:

Minimal impact from US tariffs

First, the UK has a lower exposure to US tariffs than other developed countries. The UK was the first nation to agree a trade deal with the US, securing a relatively low tariff rate (10%) thanks to cordial US/UK relations. It also applies to a fairly low level of exports – in 2024, the UK exported £58bn of goods to the US compared to UK GDP of £2.8trn1. The tariffs’ indirect effects are likely to be an even more powerful force for the outperformance of the UK’s more domestic-focused companies.

Gas-fired deflation leading to lower interest rates

The second driver of the turnaround in the fortune of domestic stocks is that the tariff announcements sent a deflationary pulse through the UK, most strikingly in lower oil and gas prices which fell in anticipation of a global economic slowdown. The UK economy remains exceptionally tightly correlated with the gas price as the electricity price is based on the marginal gas price.

Further deflationary forces have come from a stronger sterling and the potential for cheaper Chinese goods to be available in the UK.

The outcome of all this has been a downwards shift in the interest rate curve since the start of the year. This has been a key driver in the market rerating UK domestic shares, in anticipation of lower mortgage and savings rates, leading to higher consumer spending.

The UK has suffered three years of an extreme refinancing headwind and a savings rate roughly double its pre-Covid level. This has largely been responsible for why two years of growing real income has not fed through into UK spending growth. The forthcoming removal of the refinancing headwind and lower savings rates should channel more saving into spending. Returning to even pre-Covid savings levels would add 0.6% to UK GDP per quarter.

Potentially lower interest rates have led to the anticipation of better UK GDP growth and upgrades to earnings, sparking a reappraisal of the fortunes of domestic earners and rate-sensitive areas such as housebuilders, REITS and consumer shares as well as mid-cap stocks more generally.

De-dollarisation

The third factor we see driving domestic outperformance is the hardest to measure – shifting risk premium. The UK’s pursuit of more open trading links is seemingly perceived as a positive shift in the eyes of international asset allocators. Trade agreements, however limited, with the US, India and EU are striking a more progressive outlook at a time when others are more protectionist. At the same time, the US’s weaponisation of trade and, potentially, capital is making the international community more cautious on investing in dollar-denominated assets. There is tangible evidence that Europe is beginning to deallocate from the US and anecdotal evidence that US institutional investors are looking more outside the US.

Supportive valuations

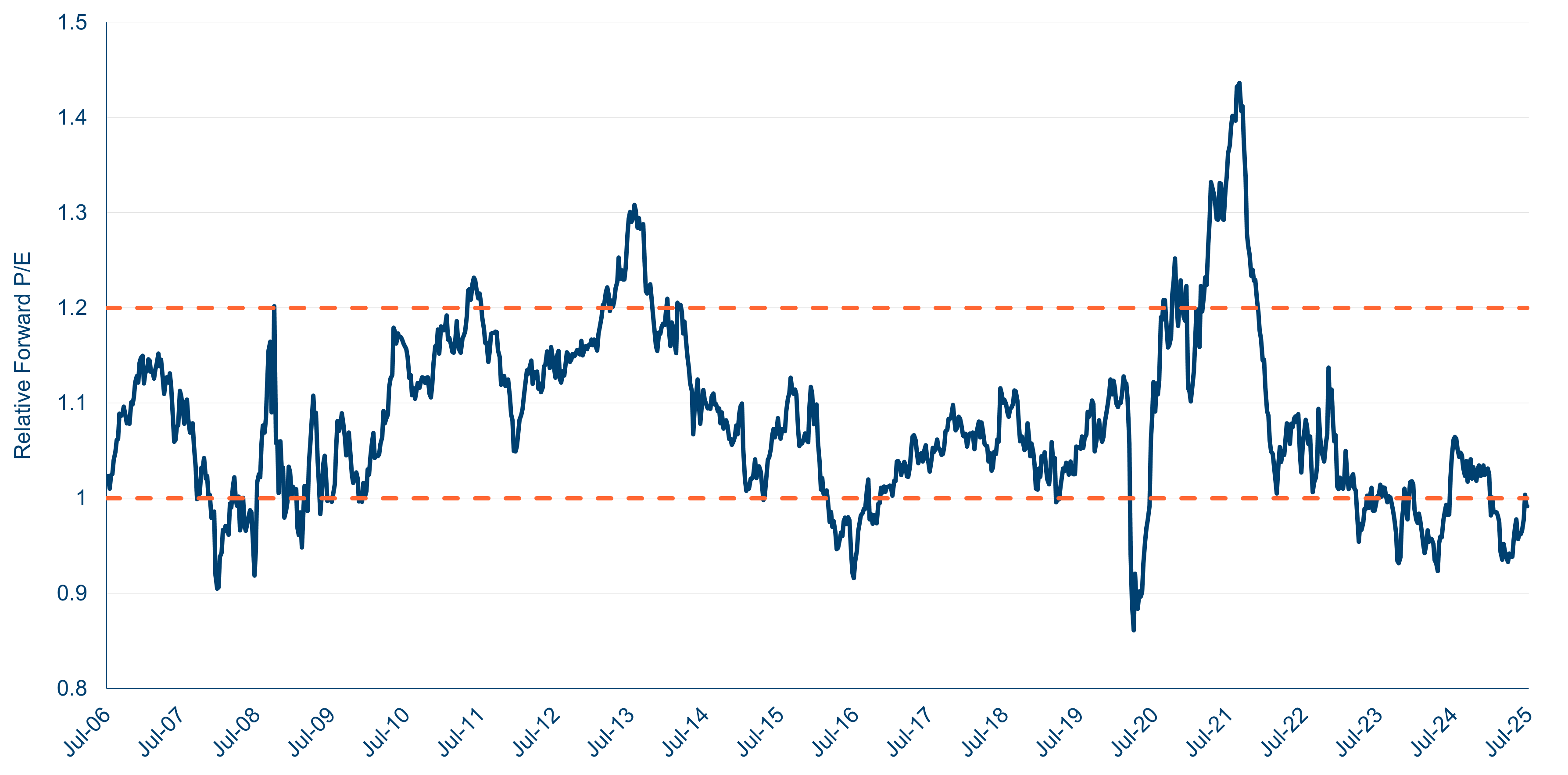

Underlying these drivers are supportive valuations. While the UK market has started to rerate, it remains undervalued compared to its history. In particular, mid-cap shares are at a rare discount to the FTSE 100.

| FTSE 250 valuation relative to FSTE 100 12-Month forward p/e |

|

| Source: Polar Capital and Bloomberg, 7 July 2025. Note: Orange dotted line shows the valuation gap. |

For the effects of Liberation Day to continue to trigger UK domestic outperformance, UK interest rates need to continue to come down. The Bank of England has cut interest rates three times in 2025, the latest cut taking them to 4%, the lowest level for two years. Despite a more hawkish meeting in August, when stubborn inflation was highlighted, the path of rates looks set to continue downwards.

Steady oil and gas prices will be essential – and events in the Middle East could complicate matters.

Set against the potential benefits of lower interest rates are UK fiscal concerns. At the start of July, a tearful Chancellor of the Exchequer at PMQs caused a ripple of panic through the bond market. The Prime Minister’s subsequent defence of the Chancellor calmed the market in the short term. However, it remains the case that the UK is in a tight fiscal position and is having difficulty balancing the books.

Given the Labour government’s struggle to cut the welfare budget, there are likely to be further tax rises in the Budget in November. This is weighing on consumer confidence and the outlook for UK growth and could counteract the positive impact of lower interest rates. Arguably, these uncertainties are reflected in the market’s low valuation.

Mindful of these risks, the aftermath of Trump’s tariff announcements has the potential to act as a positive catalyst for domestic shares in the years not just months ahead as part of a longer-term rerating opportunity combining both a lower risk premium and higher growth.

The Fund is biased towards domestic earners and mid-cap stocks, which we think should be beneficiaries in this environment. Our holdings are in aggregate cheaper than the market with better earnings growth potential and stronger balance sheets. On a stock-specific level this should continue to stand us in good stead in the months ahead.