The US Inflation Reduction Act (IRA) signed by President Biden in August 2022 heralded one of the most comprehensive sets of climate change measures ever launched. While its design has raised protectionist concerns over promoting local-content requirements, together with the European Green Deal Industrial Plan we believe it will lead to a significant acceleration in the global transition towards a cleaner, more efficient and sustainable energy future. The heightened climate emergency measures have been complemented by the urgent call for a more secure energy supply in light of Russia’s invasion of Ukraine, with further significant cost improvements for renewable energy to facilitate the move from fossil fuel-based end markets to renewable electrification.

Green light for a carbon-free energy future

The US IRA aims to improve energy security and reduce US carbon emissions by 40% by 2030 compared to 2005 levels1. Critically, this will involve offering investment and production tax credits across renewable energy sources, hydrogen, electric vehicles (EVs) and storage supply chains, allocating c$370bn in tax and rebate incentives for the different energy transition technologies.

Mirroring the efforts in the US, the European Green Deal Industrial Plan presented during H1 2023 builds on the European Union (EU)’s 2050 climate neutrality goal, targeting the reduction of greenhouse gas emissions by 55% by 2030 compared to 1990 levels2. The goal is to simplify and accelerate the approval process for clean energy technology initiatives, as well as applications for financial aid.

Importantly, the programmes are expected to unlock several trillion dollars3 of cumulative investments in clean energy development over the coming decade, with more announcements expected as the procedural processes are clarified. The magnitude of the measures brings into sharp focus the potential available to investors in sustainable energy, highlighting the need to be positioned appropriately.

The Smart way to invest in sustainable energy

While the traditional energy sector is largely a play on commodities, the clean energy sector (based on renewable power generation) relies on continuous and significant improvements in process technologies increasing power conversion efficiencies, while advanced large-scale manufacturing drives down unit costs and lowers the use of materials.

The energy sector is seeing a significant transformation towards electrification, based on clean power generation. Hereby, a smart and decentralised electrical grid is increasingly integrating demand-side management solutions to match demand and supply, while buffering any temporary surplus energy in storage elements. The latest energy efficiency technologies allow the containment of energy consumption, be it in the building, industrial or IT sectors. Entire end markets still relying on fossil fuels, such as transportation, the heating of buildings, industrial sectors and even fertiliser production will become electrified. It is this all-encompassing decarbonisation and electrification of the energy sector that underpins the strategy behind the Fund.

Our four-stage investment process

We have developed a four-step investment process, starting from the definition of the eligible universe, assessing how attractive each subsector is, and identifying the most compelling investment ideas before combining them in a high-conviction portfolio. Fundamental research drives our approach to stock selection, with sustainability factors integrated across every step in the process.

For the definition of the eligible universe, we have identified sectors and subthemes across the whole clean energy value chain, vital for the decarbonisation and electrification of energy. We incorporate thematic and norms-based exclusion filters, assess the companies on good governance practices and exclude those violating the ‘Do no significant harm’ principle. The result is a proprietary universe consisting of c250 eligible companies with a high thematic purity level.

We have developed own sector models, serving us well to better assess the attractiveness of subclusters. We also incorporate regulation and jurisdiction policies as those can have a strong influence on market dynamics.

From here, we conduct fundamental analysis on individual companies, including in-depth, stock-specific due diligence, incorporating data from our sector models for growth projections. The modelling framework takes into account our own assessments as well as scenario tests, pitting companies against possible directions for their businesses, given changing macroeconomic or geopolitical influences. Our aim is to identify innovative companies with differentiated business models and high barriers to entry. We also include sustainability analysis of the company, on a standalone basis and relative to its peers.

The fourth stage encompasses portfolio construction, where we ensure the Fund is diversified across our four investment clusters, while maintaining a high-conviction profile with typically 40-60 holdings. Our goal is to compose a portfolio of companies addressing different market segments, with protectable business cases and a long-term competitive edge. We also engage in active ownership activities, consisting of proxy voting and engagement.

We divide our holdings into four investment clusters, reflecting our allocation to opportunities throughout the clean energy value chain:

- Clean power generation

- Energy transmission and distribution

- Energy conversion and storage

- Energy efficiency

The structural growth towards electrification will be in motion for at least the next three or four decades, offering highly appealing investment opportunities notably for long-term investors. We focus on leading technology enablers, which can be components or systems suppliers. For example, we have exposure to semiconductor power management companies that manufacture highly efficient power conversion devices used in EVs or solar inverters. We also think of segments such as batteries and green hydrogen, benefitting from the need for dramatically increased energy storage. New AI-focused data centres need new power-efficient solutions for processing as well as the sophisticated thermal management of their servers, including liquid cooling. Electric heat pumps are replacing oil and natural gas to heat buildings, allowing the decarbonisation of the building sector. Through electrolysis, green hydrogen will be mass produced, serving as an energy carrier for additional processing into synthetic fuels used to supply the aviation industry or into ammonia for fertilizer production.

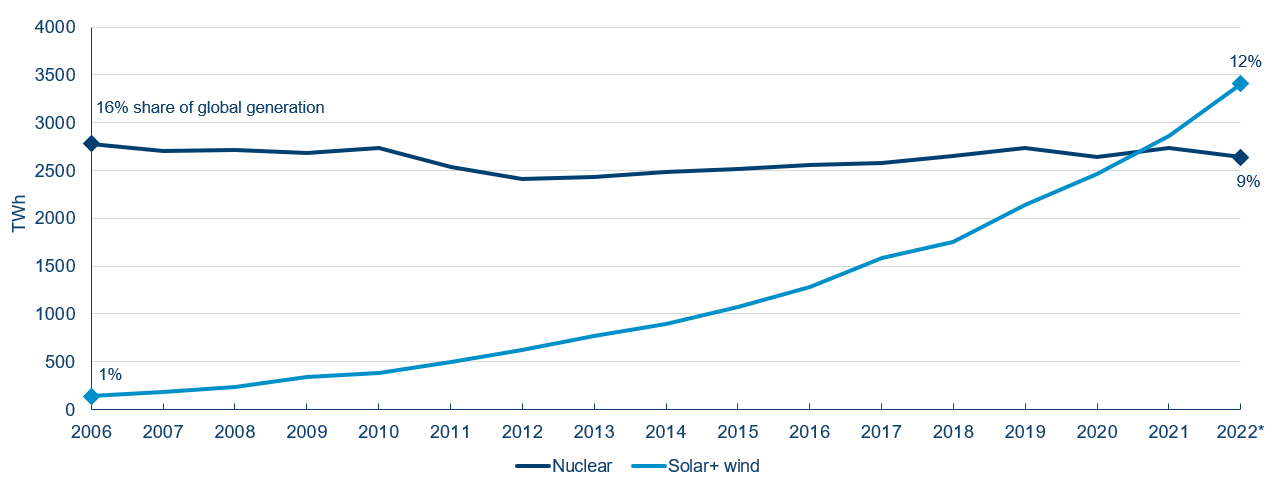

Solar in combination with wind overtook nuclear

Perhaps just as important is where we see limited or weakening opportunity sets. To this end, we exclude any investments in nuclear power utilities, as we maintain our stance that the economics as well as the environmental impact of the nuclear industry remains highly compromised. Significant concerns around the management of nuclear waste remain, let alone the ever-present chance of a nuclear accident or potential terrorist attacks. The geopolitical instability of countries in which uranium deposits are found, which includes Russia, presents another hurdle, as do long construction times and costs.

Today, solar and wind accounts for 12% of power generation overtaking nuclear at 9%

Global electricity generation by technology

Sources: Polar Capital, Bloomberg BNEF, https://www.iaea.org/, 31 January 2021. *Data for 2022 is sourced from EMBER, https://ember-climate.org/, October 2023. % figures are rounded up/down to the nearest whole number. World Nuclear Association,https://world-nuclear.org/, April 2023. Forecasts are based upon subjective estimates and assumptions about circumstances and events that may not yet have taken place and may never do so. Forecasts contained herein are for illustrative purposes only and does not constitute advice or a recommendation.

We forecast only a modest increase in nuclear power generation by c20% from now until 2050, a period during which global electricity demand will very likely increase by a minimum of 2.5x. This means nuclear’s share in terms of power generation will continue to come down, from 9% currently to c5-6%.

Conversely, solar in combination with wind power will become the dominant provider of electricity in the coming decades, allowing an abundant, widespread and cheap supply of electricity, driving the electrification across global industries. Grid and residential storage units, connected through an intelligent grid management system, will make sure that new demand drivers like EVs and heat pumps are served reliably. Summer surplus energy will be converted into green hydrogen as an energy carrier for the winter months.

Overall, we see the pro-climate policies introduced on both sides of the Atlantic as meaningful catalysts, carrying long-term value creation for companies serving the transition towards a clean energy future. Of course, momentum may be uneven across the supply chain and an indiscriminate allocation to clean energy is likely to yield volatile and unpredictable returns over the short to mid-term. Instead, we continue to focus on technology companies driving electrification while demonstrating sensible capital allocation, cost efficiencies, high barriers to entry and strong sustainable credentials. Selectivity will remain key in identifying market leaders along this decades-long time horizon, as will acute attention to the changing geopolitical backdrop. We believe we are well positioned to tap into developing themes across our investment clusters and the wider clean energy spectrum.

1. Inflation-Reduction-Act-Guidebook.pdf (whitehouse.gov)

2. A European Green Deal (europa.eu)

3. REPEAT_IRA_Prelminary_Report_2022-08-04.pdf (repeatproject.org)