Having appeared out of reach for many consumers on headline cost grounds, electric vehicles (EV) are now becoming much more affordable than more traditional, internal combustion engine (ICE) equivalents if longer-term ownership costs are considered. As this price barrier is removed and total cost of ownership (TCO) realities filter through to a fossil fuel-dependent audience, we believe overall EV adoption will grow further, benefiting firms throughout the mobility value chain.

Drivers of this include greater competition brought on by China, lower battery (metal) prices and greater scale that all offer cost savings. Advancing technologies are also abating worries about limited charging networks and range anxiety. In our view the question has already tipped from “why EV?” to “why not?”.

All EV markets were not born equal

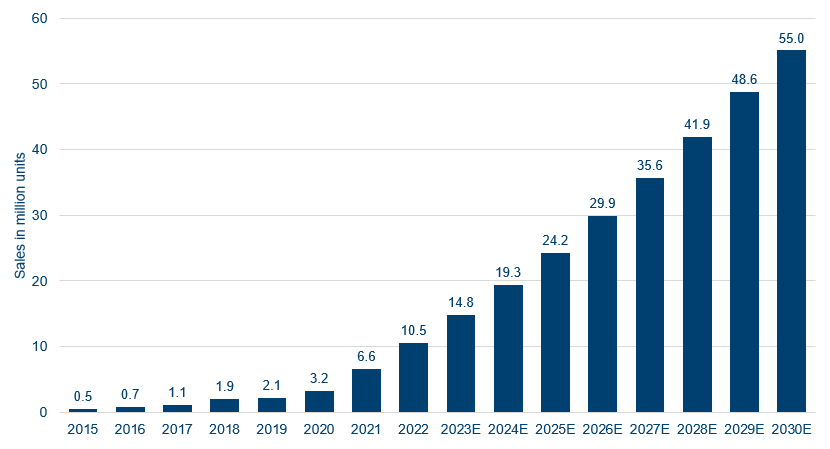

Worldwide sales of EVs reached 6.2 million units in the first half of this year, marking a 49% rise year-on-year1. The lift puts the sector on course to top 14 million units in 2023, a 39% increase on 2022 levels2. Adoption rates are evidently growing although, from a geographical perspective, uptake is extremely uneven with one country dominating. Breaking down 1H23 sales, mainland China made up 55% of the market, with all of Europe accounting for 24% and the US taking a 13% share.

The stark difference between geographies can largely be attributed to contrasting government incentives so far, however that picture is changing. While China’s fervent approach to subsidies and tax breaks has cemented the nation as the largest market for EVs, it has been clear on its intention to scale back these costly programmes, as have most European countries with unique and disparate policies of their own. In contrast, the $7,500 tax credit offer for US buyers of EVs under the Inflation Reduction Act (IRA) means the US could start to close the market share gap. More broadly, and given price has consistently been a limiting factor in outright EV adoption both in headline and general running costs3, a concern for the sector is that governments reducing expensive incentives will stunt global EV adoption, as consumers face relatively higher prices with no government help. We think this reflects a backward-looking view of a once begrudging addressable market limited to EV enthusiasts, and risks missing current market dynamics set to make EVs cheaper, more desirable and easier to maintain than their ICE equivalents.

EV prices are falling

European manufacturers, in particular, are preparing to contend with more affordable imports from China, where automaker BYD is selling its new Seagull model starting at ¥73,800 (c£8,200)4. Logistics, sales and import taxes, and meeting European certification requirements will all add to import costs but the threat has clearly been enough to spark competition. Following Renault introducing “Europe’s most affordable electric car” in its Dacia Spring in 2021 with a price tag of around €22,750 before incentives, Stellantis announced the launch of its Citroën e-C3 at around €23,300 (c£20,300)5 in 2024, with an even cheaper version at a price of €19,990 (c£17,400) in early 2025.

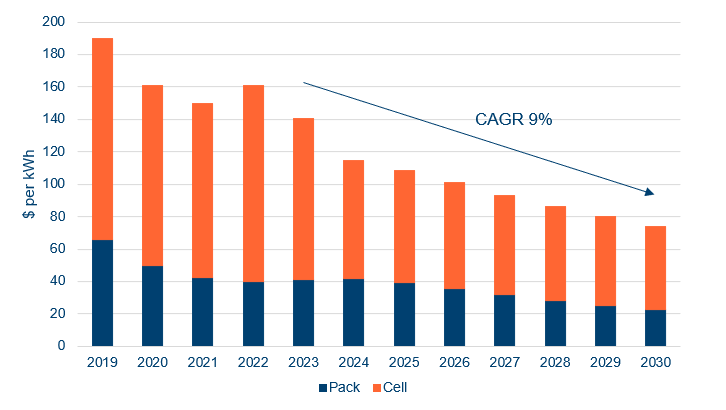

A meaningful factor in allowing manufacturers to bring down headline price is battery costs, which have already fallen significantly over the past decade. While Covid disrupted supply chains and increased logistics costs, we are now seeing the resumption of cost decline, with batteries (the largest share of cost in EVs) more than offsetting the Covid-led increase of the past few years. Battery costs have fallen 90% between 2010 and 2023. After a 7% increase in 2022, battery costs fell by 13% in 2023 driven largely by lower raw material and component costs. We expect a further 47% decline from 2023 to 2030, reaching $74 per kilowatt-hour (kWh), driven by next generation battery technologies, improvements in cell chemistry, pack design and manufacturing. This will significantly improve EVs’ mass-market affordability. Importantly, the IRA has cut the cost of EV batteries built in the US by almost a third by offering battery manufacturers a tax credit of $45 per kWh for each US-made battery pack. As a result, US automakers and their battery partners expect to earn billions in battery manufacturing tax credits over the next few years. This should help support lower consumer pricing, beyond this year’s reductions among the leading automakers names and short-term competition-led price wars.

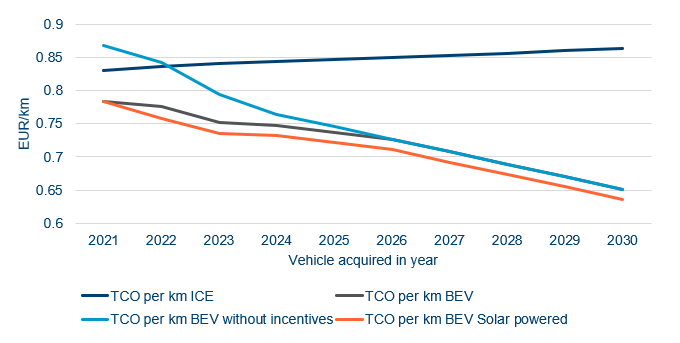

TCO: When battery EVs (BEVs) really start to motor

However, despite price reductions among sector headliners like Tesla to shift inventory or dip under the federal tax credit eligibility’s $55,000 ceiling for EV cars, we believe a focus on upfront unit cost misses the long-term savings evident in EV ownership. In fact, we estimate this apparent EV premium has already waned, with a steady discount gap in the total cost of ownership of EVs only becoming more pronounced as travelled distances increase and battery technology advances.

Subsidies and incentives have been important elements thus far in overcoming the inertia in drivers’ decisions to switch to EVs. While they will undoubtedly still play a part as the industry eyes total adoption, they will be complemented by cheaper costs in other segments of overall vehicle ownership, meaning a focus on headline unit cost risks giving consumers a false impression of overall expense outlay. Key assumptions around ownership expenses that buyers may need to revisit include maintenance and running costs (electricity) and adjacent concerns such as range capacity and available charging infrastructure.

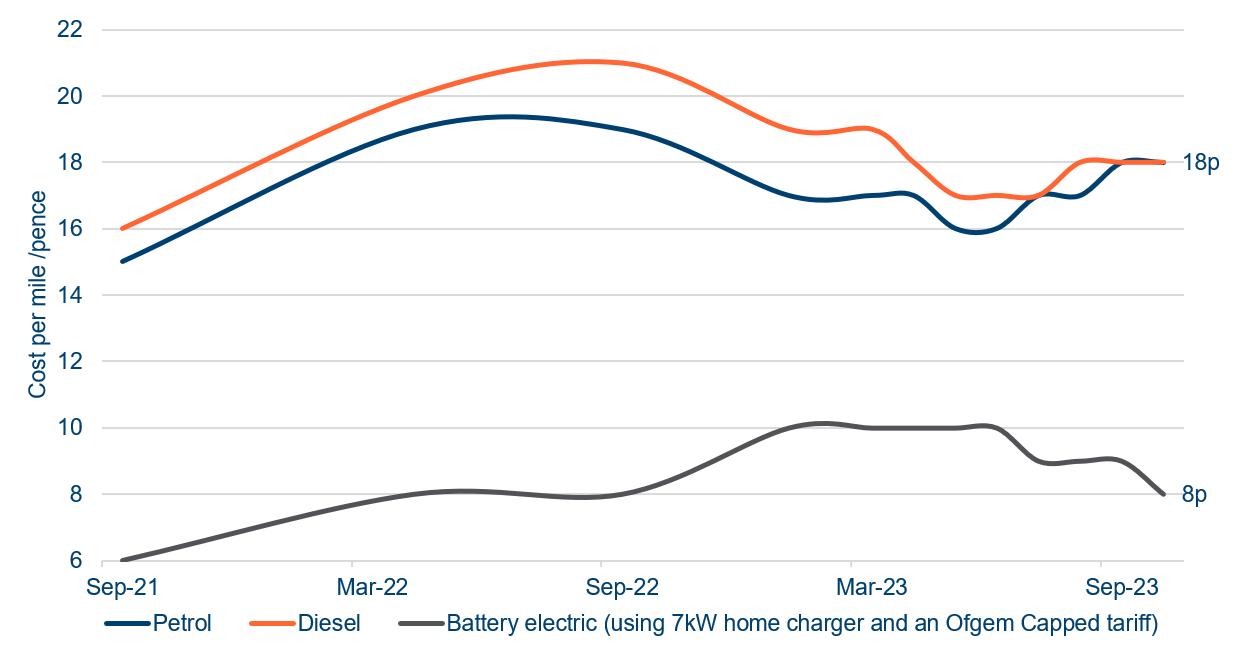

After a volatile period for electricity prices due to the Russian invasion of Ukraine, a blend of corporate price battles and signs of relief as the broader market stabilises6 point to a much lower cost of UK home EV charging compared to petrol and diesel fuelling.

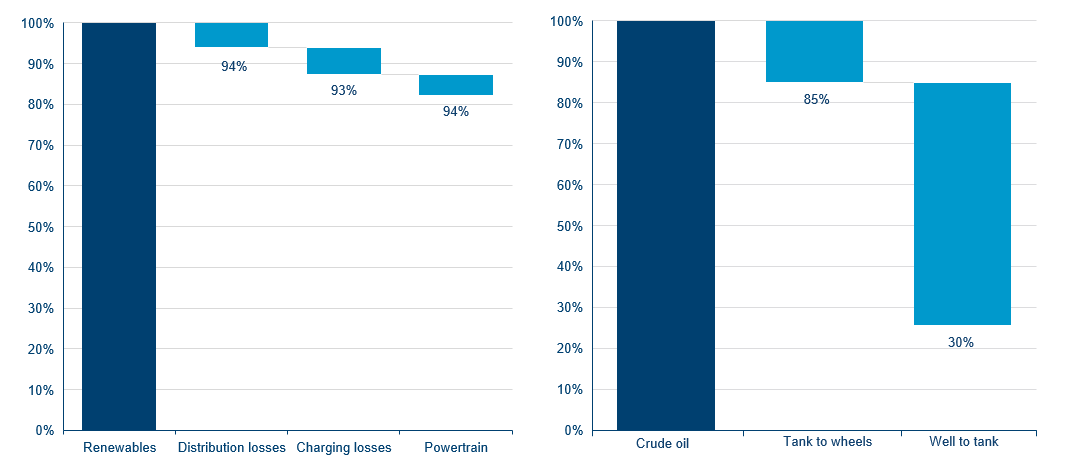

In general, we expect electricity prices to come down and remain significantly lower than the cost of oil over the long term. This becomes even more attractive when we consider the efficiency of both fuel sources. While ICE vehicles burning fuel naturally dissipate energy as heat and through friction, EVs convert electricity directly into movement, losing much less energy in the process.

With much fewer moving parts than incumbents, EVs can offer lower maintenance costs, in turn playing a role in reducing insurance pricing. While electric cars have commanded a premium in terms of insurance in recent years, according to Nimblefins, that gap has now all but closed. A relative scarcity of spare parts, the need for specialised repairs and higher upfront costs had all fed into an average 13% premium for EV insurance at the end of 2023. However, greater accessibility of parts, growing familiarity among mechanics and declining unit costs mean that difference has shrunk to around 1% in a sample of petrol models versus their electric equivalents8.

BEVs’ advantage over ICEs set to grow

With TCO decreasing rapidly, concerns still exist around the viability of EVs in replacing current ICE models in our everyday lives. Again, we believe worries are outdated and comparisons often do not reflect current habitual vehicle use. So-called range anxiety has been a sticking point for consumers, however we believe this is a negligible issue for most drivers now. A 2021 study found that c25% of drivers would have been able to successfully complete all of their journeys for a year, using an EV with a 40kWh battery and an implied range of 143 miles9. Given the average EV range is now 211 miles10, and for those whom current range boundaries were a problem now have greater access to an increasing charging infrastructure, we expect range concerns to fall meaningfully in the near to medium term.

Investing across the entire EV spectrum

As battery prices drop, we expect to see a change in the driving force behind EV adoption, with demand moving from a government push to a product-led draw as prices drop and EVs become more attractive. Ultimately, for investors the phasing out of public subsidies should remove the perception of an artificial crutch and help provide a clearer picture of industry value, as well as that of its participants. As price as an obstacle is removed, we believe consumers will see the benefit of those firms whose EV models reflect an entirely new vehicle architecture.

Our approach to investing in the mobility theme comprises opportunities across the entire value chain, in order to reflect this new architecture as well as the growth and progress in the full ecosystem of EV solutions. Companies serving this new model through electronic infrastructure, charging networks, EV-specific software, the supply of critical components and so on will be able to become leaders in their own right; we believe the owners of EV-dependent intellectual property will benefit greatly and develop the ability to drive pricing power.

Near-term EV adoption risks should be overcome easily

While we expect higher adoption in the coming years, we do not expect annual growth rates to follow a straight line. Macro headwinds such as higher interest rates and the threat of recession could still affect sales volumes. China’s sluggish post-Covid recovery has meant lower demand for EVs in the short term, however we believe this is a temporal issue and worries of an outright slowdown in EVs are overblown.

On the supply side, China’s ambitions to export affordable domestic EV models to Southeast Asia, Latin America and Europe has the potential to hike adoption rates in these markets. However, current geopolitical tensions in Europe, where discussion around fair competition in a bloc known for its automaking economy are ongoing, could hold up plans. While the models offered will likely be priced higher than in China due to increased unit expense and local tax rates, their introduction could stimulate European innovation. If the result is greater competition among existing players, as well as new Chinese entrants, that can only benefit prices.

In essence, the draw of EV is alive and well, with short-term hurdles eventually being replaced by a ramping up of EV adoption, in our view. We believe price parity, falling ownership costs, reduced friction in habit-shifting and genuine superiority in ease of ownership will mean adoption grows more through demand than the sunsetting of ICE availability or desperate incentive programmes.

We remain constructive on the underlying themes in the Fund’s investment strategy. The entire transportation sector is going through unprecedented transformation, driven by government regulations aiming to reduce CO₂ emissions and become energy independent. The clean electrification of the transportation sector is key in achieving these overarching goals. The Fund invests across the smart mobility value chain, addressing these transformational changes, seeking focused exposure to market segments like EV manufacturers and suppliers, power electronics, green hydrogen and the EV charging infrastructure, sensor and data-processing technologies for automated driving, shared mobility solutions or new developments in driverless mobility.

2. Polar Capital Estimates

3. Electric vehicles: The 3 main factors holding back sales | World Economic Forum (weforum.org)

4. https://www.reuters.com/business/autos-transportation/byd-lowers-starting-price-seagull-electric-hatchback-2023-04-26/

6. Electricity prices over the past 10 years UK | Statista

7. Electric car public charging costs | RAC Charge Watch | RAC Drive

8. Average Cost of Electric Car Insurance UK 2023 | NimbleFins