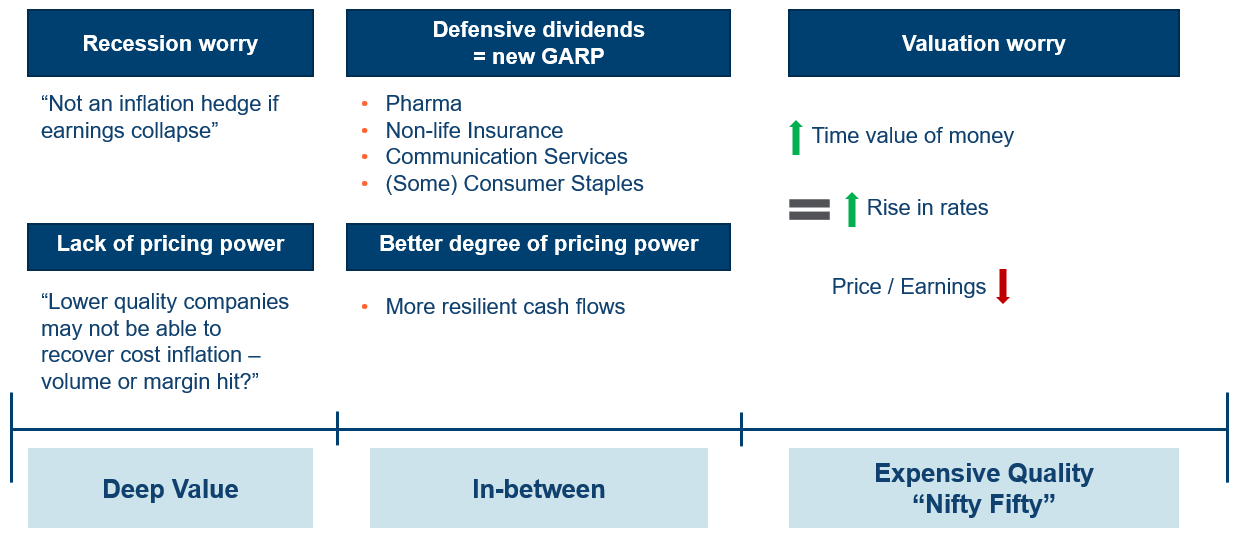

- The dramatically high valuations of crowded quality stocks need an economic hard landing to make sense

- The very lowest quality cyclicals need a very soft economic landing to be worth the risk

- Defensive value sectors offer a compelling alternative to valuation and cyclically exposed stocks

Given how many different shocks investors have had to navigate over the past 15 years, the default setting for many was to hold quality growth and avoid value. Those that did hold some value tended to do so with relatively small weightings in deep value that offered a high beta to value rallies. This has created a market where defensive value sectors are under-owned and too cheap. Many investors would sporadically try to call the bottom in value then retreat into an increasingly crowded group. In addition, many stocks steadily rerated over the period 2009-21, so valuation risk could be safely ignored in the context of only short countertrend value rallies that quickly fizzled out.

Those holding expensive equities should be hoping for a hard economic landing that recreates the deflationary themes that created their dramatic valuation re-ratings. A broad nominal growth environment undermines their relative growth merits. By contrast, those holding a great deal of deep value cyclicals are hoping for no/very soft landings. The cliché “long and variable lags” of monetary policy are creating a window where data noise oscillates between both scenarios.

We still think the framework in the table below is a good way to think about the issues that both ends of the investment style barbell face.

How much should investors worry about valuation risk?

Investors need to take a view on whether we are returning to 2019-21 style markets, post-global financial-crisis (GFC)-until-2018-style markets when growth outperformed value but only steadily, or pre-GFC markets when value consistently outperformed. We think a return to a 2019-21 growth bubble is relatively unlikely though it is less clear to us whether we return to pre- or post-GFC markets.

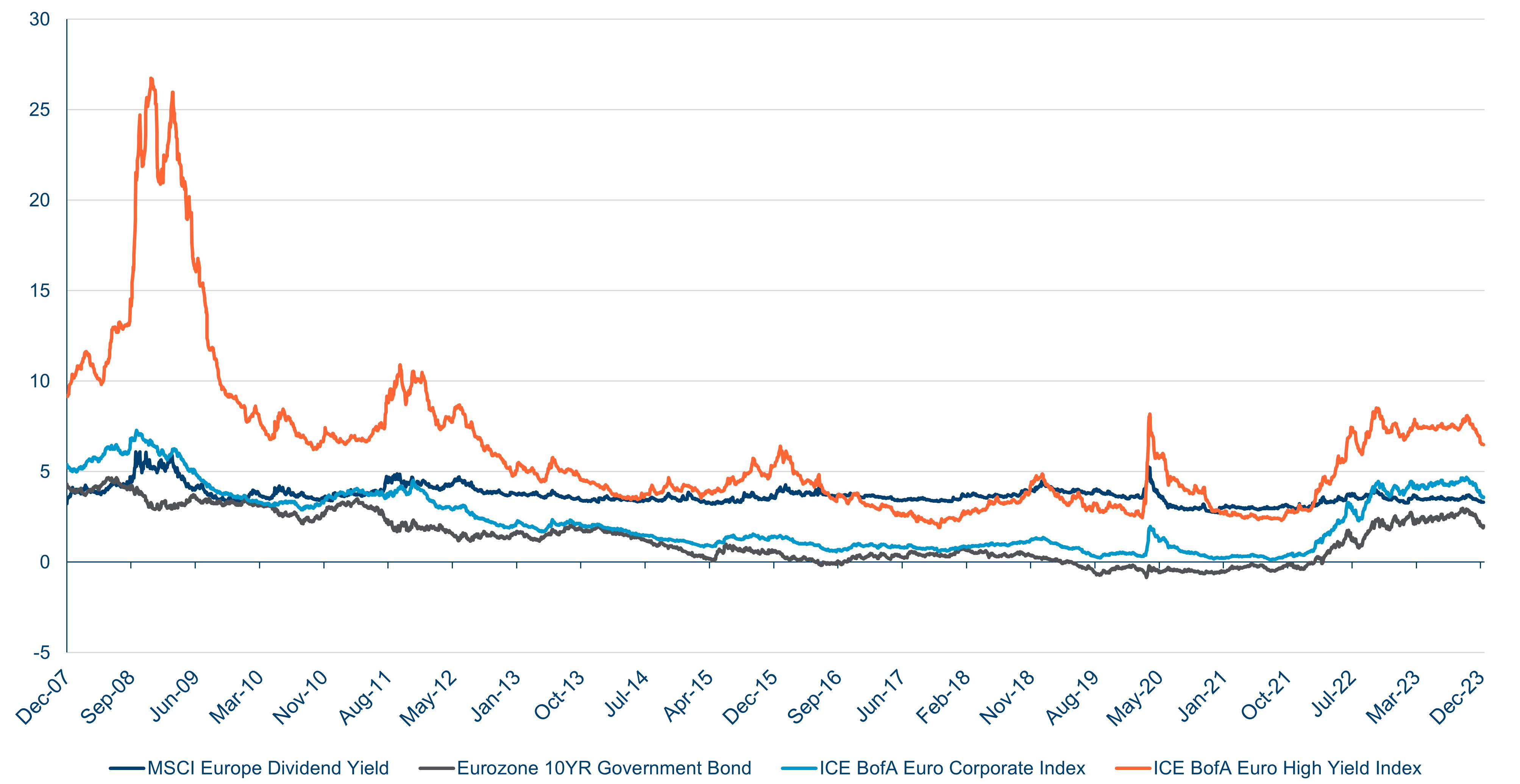

An important distinction we would make is that markets rewarded profitable growth with steady outperformance between the GFC and early 2019. After that, any growth was re-rated by markets in the growth bubble. We think we are now back in an environment where value creating growth is key given an end to the era of easy money. It is now both harder and more expensive to raise funding for growth. The distortive effects of extreme monetary policy can be seen in the graph below.

There is a general ‘wait and see’ approach to where bond yields end up that is stopping a genuine clearing process across all asset classes. As the graph clearly shows, the past two years have been a return to an ‘old normal’ in terms of pricing risk. In residential property, market activity is dropping in many countries as buyers and sellers cannot transact until a clear mortgage rate outlook emerges. In high yield debt, many companies have been delaying any refinancing given the current elevated borrowing costs. In equities, the standoff relates to what is the right valuation multiple for many of the stocks that materially re-rated in the zero interest rate period. The constant efforts to price a Fed pivot is driven by the experience of recent years, where investors have been conditioned to focus on central banks driving risk assets, not economic fundamentals.

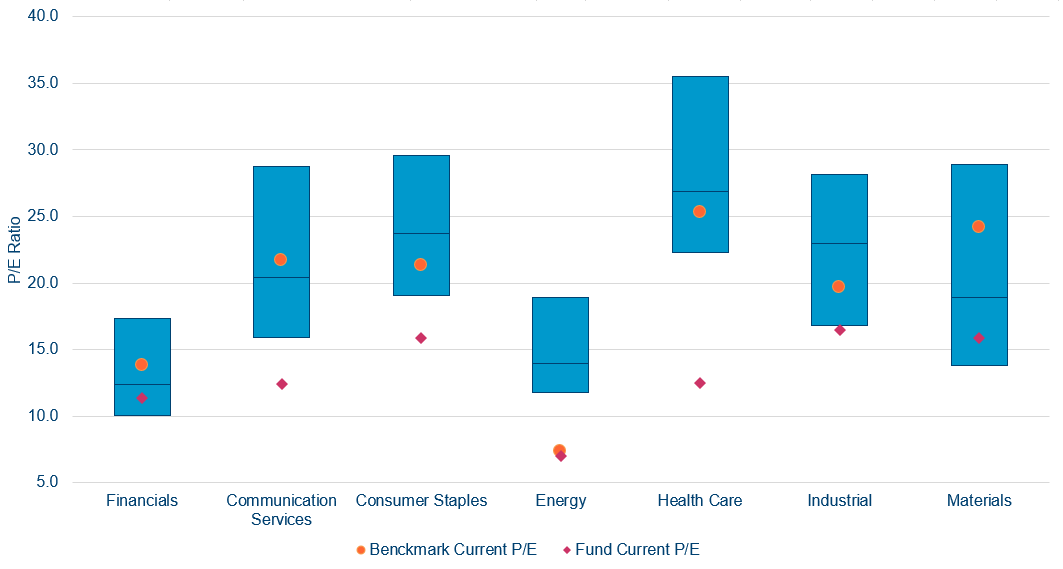

We think earnings yield is a quick way to compare the valuation of an equity instrument to a credit one or the interest rates available on cash. Many of our stocks are on high single-digit earnings yields which continue to make them compelling compared to yields on cash. However, we still think free cashflow yield is the best equity valuation metric. As a general rule of thumb, we think a blue chip equity is compellingly valued when its free cashflow yield is above 4%. This is driven by three factors – investors are sufficiently compensated for the risk of equities, free cashflow conversion is a good proxy for earnings quality, and good companies can create value through the optionality of strong cash generation. As the chart below shows, many of the stocks we like look very compelling relative to their sectors and valuation histories.

How much should investors worry about cyclical risk?

Cyclical risk is a challenge for income and value funds. Equity markets are relatively consistent in offering optically attractive dividend yields to entice investors to accept cyclical risk. This is the classic phenomenon of ‘reaching for yield’, simply meaning having to take more risk to generate more yield. Cyclical risk poses a challenge to portfolio construction because it is harder to diversify than stock or sector idiosyncratic risk. A cyclical downturn flows through all cyclical exposures at once, exacerbating drawdown risk – in other words, banks, autos and commodity chemical selloffs are ultimately driven by the same end-market demand weakness. Sector idiosyncratic cycles, by contrast, tend to be less correlated. Examples of meaningful sector cycles include reinsurance pricing, pharmaceutical drug life patent cliffs and telecom investment cycles in fixed and mobile networks.

While it is hardly a new insight to highlight the need to avoid weak balance sheets, it continues to be very important. Weak capital structures materially increase the equity risk. Even if a deep recession dilution scenario is avoided, many of these stocks will face punitive debt refinancing because the previous QE period drove corporate bond yields to absurdly low levels. Better balance sheet companies benefit directly (lower borrowing costs) and indirectly (increased financial pressure on weaker players may present opportunities).

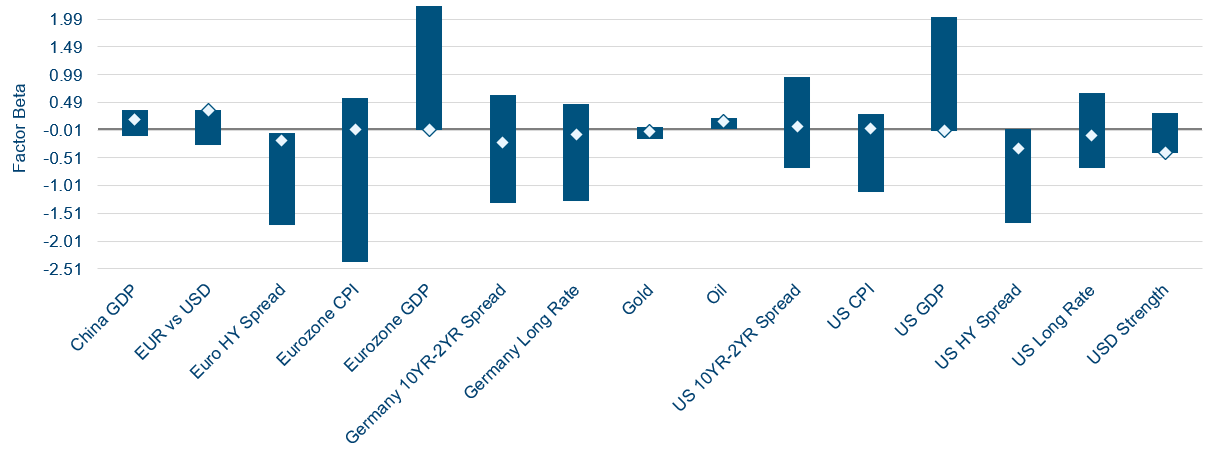

We like to take as much stock and sector risk as possible and as little generic macro risk. At a stock level, we are looking for companies that do well in all macro scenarios rather than erratically brilliant or terrible depending on certain conditions. This can be observed in the factor sensitivities of the Fund that can be seen below.

We seek to take as much idiosyncratic sector and stock risk as possible – and neutralise macro sensitivities.

Conclusion

We remain very constructive on the outlook for Europe’s defensive value sectors – we see them as well-positioned in the face of both valuation pressure, if bond yields stay higher for longer, and cyclical risk, if the long and variable lags of monetary tightening play out in 2024. The crowding in quality growth stocks perceived as safe havens has created a situation where many traditional defensive stocks have valuations that are very compelling in absolute terms and relative to their own histories.