We think Europe has been steadily bottoming out relative to other regions, for a number of reasons we have seen.

First, Europe has shown surprising resilience to the shocks of recent years. In our view, there is a lag in how different investors see different regions. Many have made attempts to call the bottom in value or European equities. The relentless outperformance of the technology sector and US shares has created a crowding effect that has left other regions under-owned. Europe’s economy has withstood the Covid pandemic, a slowdown in the Chinese economy, slower global trade growth, the energy crisis linked to war in Ukraine and a dramatic central bank hiking cycle. That European equities have navigated all these scenarios reasonably well is a function of both low investor sentiment and low investor exposure.

Second, there has been a deterioration in politics elsewhere, when comparing the current political environment Europe to other regions. We see a brighter relative picture compared to that of a decade ago, when the Eurozone crisis was followed relatively quickly by the fallout from Brexit. Many of the most pessimistic predictions have proven false for both the UK and the Eurozone. We would argue the politics of both the US and key emerging markets are no longer less worrying.

Third, if growth slows, Europe has room for manoeuvre in both monetary and fiscal strategies. The disbursement of EU recovery funds has been relatively low, which is constructive when trying to slow inflation. The ECB and other European central banks are also comfortably away from the lower bound of zero for interest rates.

Finally, European equities are a compounding asset. The issue has been one of relative performance against the US market. Unlike other potential sources of diversification, the returns of recent years have been reasonable. You can buy and hold European equities in a way that would have been more problematic in other markets.

We see the best opportunities away from the most crowded stocks

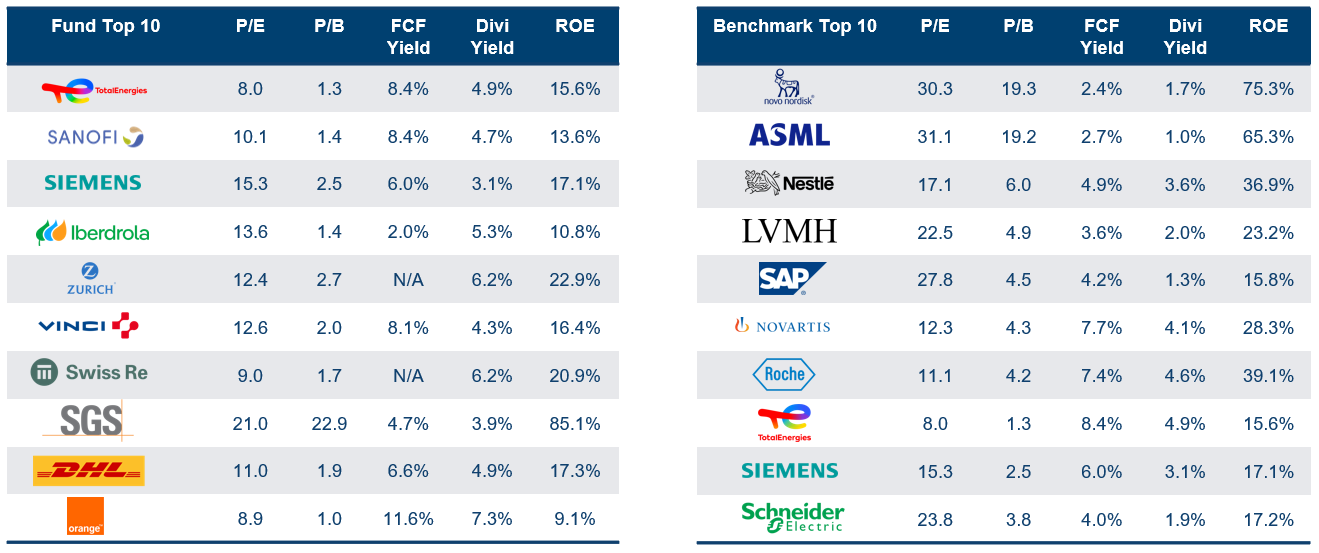

When we look at our top 10 holdings (a good proxy for the characteristics of the portfolio) we highlight their quality value characteristics. Most of our holdings are earning returns on equity (RoE) well above 10%. These are not deep value turnaround stories. In some ways this is an old fashioned GARP (growth at a reasonable price) portfolio, with valuation multiples largely below 16x and consistent growth of mid-single-digit earnings per share. Our investment process looks for stocks with strong balance sheets that can compound earnings growth in most macro scenarios. Our stocks are quality blue chips with attractive valuations whose steady growth is seen as dull – beautifully dull in our view. Our argument is that these are not deep value stocks waiting for turnaround catalysts. They are simply underappreciated compounders.

The top 10 constituents of equity indices tend to change a great deal over time. Contrarians like us typically do not own the largest, most crowded stocks and the rise of passives has truly made these the most crowded markets in history. Our message is there is no permanent high plateau of valuations; there are just stocks trying to defy the laws of mean reversion. There are very few stocks correctly priced for perfection. A basket of such stocks is just a bet against the inevitable mean reversion of most companies. It is impossible to exactly articulate how or when an overvalued stock will go wrong. The forces of mean reversion are ever-present but often invisible. These are a mixture of attracting competition, technological disruption, political and regulatory intervention, and cycles. Everything has cycles upon close examination.

For those looking to diversify or broaden their portfolios, it is worth highlighting we have no exposure to the technology sector and less than 5% in healthcare. We see better dividend opportunities for investors in other parts of the market.

| Fund top 10 versus benchmark top 10 |

|

| Source: Polar Capital, Bloomberg, as at 28 March 2024. |

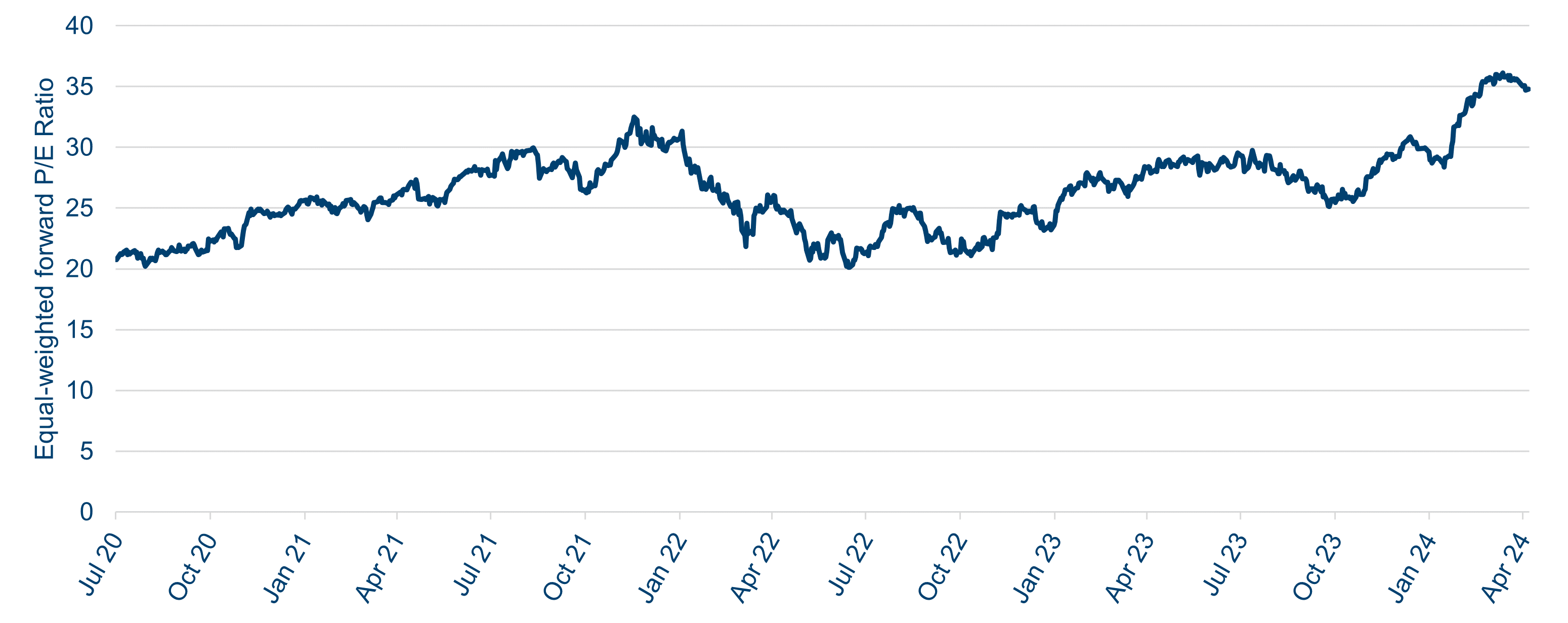

We find ourselves in truly historic markets. In the way the Nifty Fifty stocks of the 1960s are still being talked about 50+ years later, current events will ultimately become warnings to future investors. The extreme market concentration seen today sometimes feels like it will never end, but this is not the history of centuries of financial market history. Any stock’s future returns are a function of its starting valuation and underlying profit compounding power. The higher today’s valuation, the more future compounding power is already reflected.

The most loved stocks have started to rerate: |

|

| Source: Polar Capital, Bloomberg, as at 8 April 2024. Note: constituents include LVMH, ASML Holding, L’Oréal, Hermès International, Cie Financière Richemont, Kering, and Ferrari. |

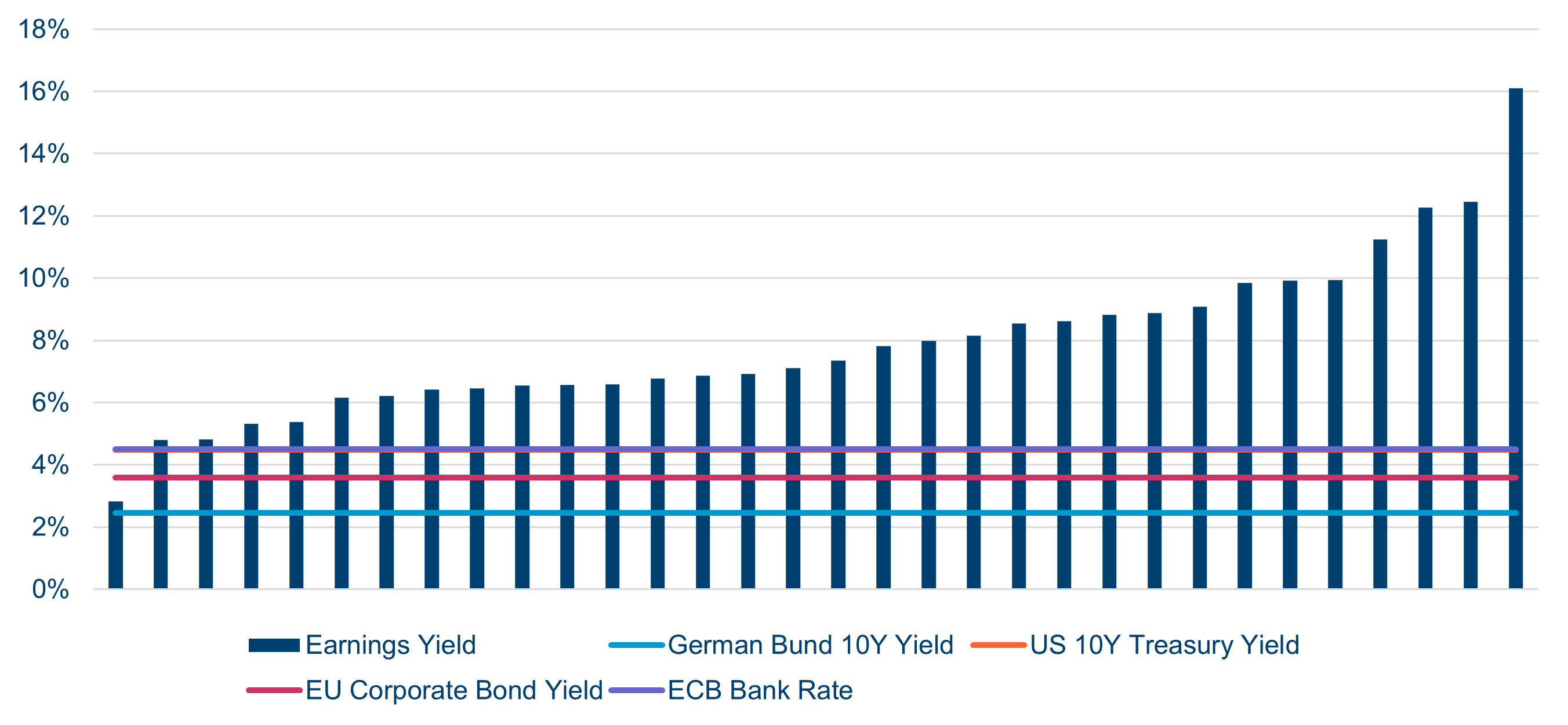

In contrast to the expensive crowded stocks, our portfolio offers very attractive earnings yields compared to the coupons available on debt and credit markets. It is important to compare earnings yield (not dividend yield) to the coupons on other assets as earnings yield captures both dividend yield and reinvested retained earnings. This reinvested retained earnings drives future earnings growth that differentiates equities from bonds. We would argue that the spread of these defensive blue chips versus bonds implies a deflationary scenario that we believe is unlikely.

| Portfolio stocks’ earnings yields versus other assets |

|

| Source: Polar Capital, Bloomberg, as at 8 April 2024. |

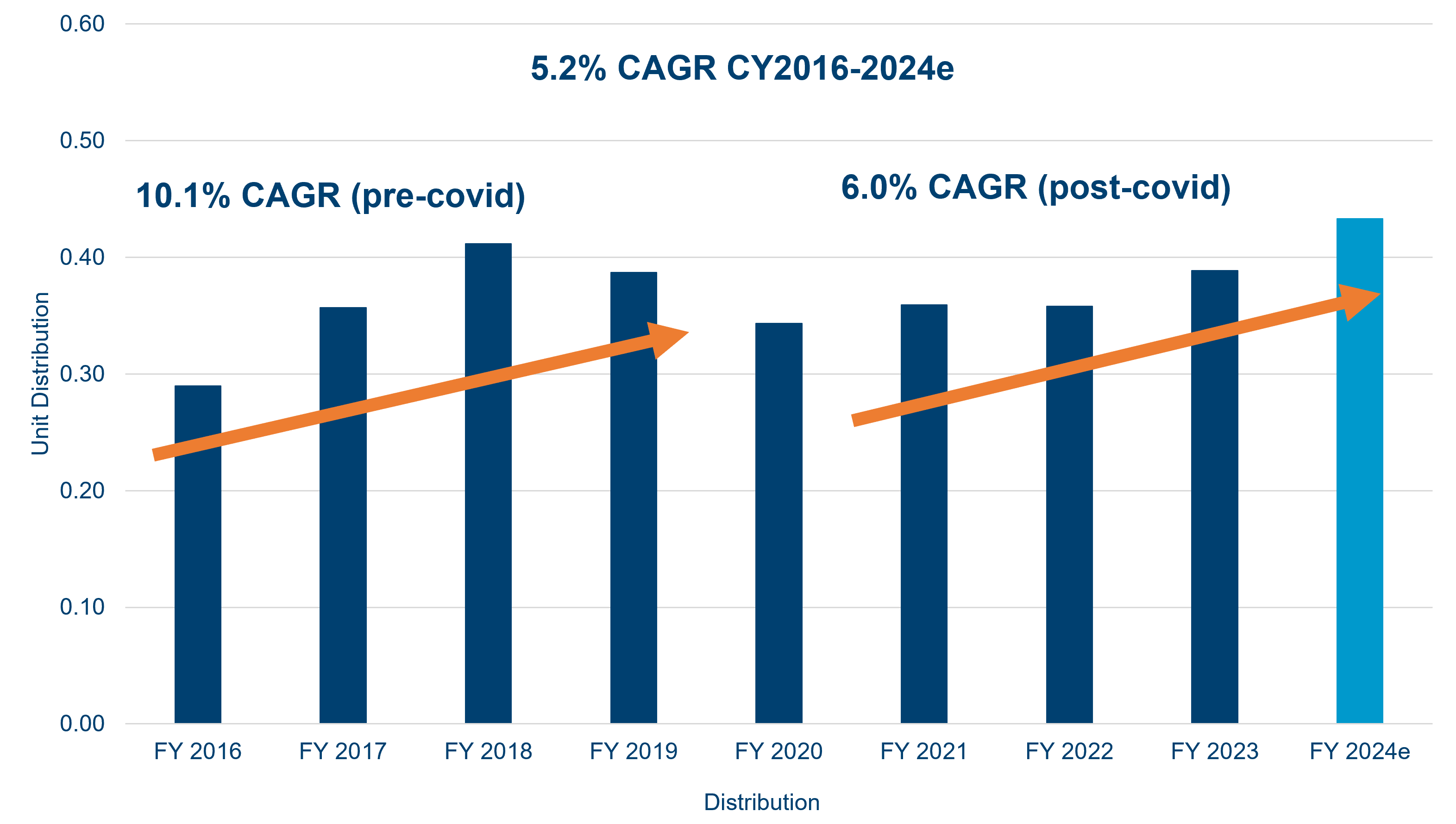

The prospects for dividend growth are extremely positive

We continue to see dividends as misunderstood. Plenty of companies went into Covid with flat and high dividend yields that the market never gave them credit for. The curse of yielding more than 6% was that companies could not cut their dividends because they had promised they would not, but these companies were operating in a market that had learnt not to trust yields above 6%. The taboo of cutting dividends was lifted during Covid. Many companies used this opportunity to pivot to ordinary dividends of roughly 4%, with a layer of share buybacks on top. This is a much more compelling proposition for medium-term capital appreciation. In trickier markets, dividends contribute more to equity returns. This was why income funds did so well in the aftermath of the TMT bubble. A c4% dividend clearly growing in real terms becomes a much easier sell when the party ends. And it always ends.

| Fund dividend distribution |

|

| Source: Polar Capital, as at 8 April 2024. Note: I GBP share class. |

Europe has interesting dividend-paying sectors

We often say that Europe is a dividend nirvana. It has plenty of mature companies with modest growth, but not so much growth to fund that they cannot also pay attractive cash distributions to shareholders.

We are particularly constructive on the following parts of the market:

- Infrastructure: Europe has an attractive universe of infrastructure assets that sit across several sectors. We particularly like transport assets (airports, Eurotunnel and toll roads), telecom infrastructure (particularly fibre networks and mobile tower assets) and power grids. Europe has solid regulatory frameworks that should make a diversified basket of infrastructure assets a relatively low-risk compounding proposition. Many of these assets trade at a material ‘public equities’ discount relative to private markets despite the latter supposedly benefitting from an illiquidity premium.

- Non-life and reinsurance: We think these stocks are in a sweet spot as both underwriting income and investment income are improving. Normally higher investment income has meant less discipline in underwriting. However, underwriting discipline is being driven by climate change worries and inflation, therefore we do not see this sweet spot reversing quickly.

- Selective consumer staples: For several years, many consumer staples stocks looked too expensive to us. The derating of the sector has started to present interesting opportunities with many investors chasing the cyclical rally. The unwinding of margin pressure from cost input inflation can be split between margin expansion and reinvestment for top-line growth. In addition, easing inflation should eventually improve consumer confidence through rising real wages.

- Testing, inspection and certification: This sector is a good example of Europe having global leaders in a niche attractive industry. We see strong tailwinds for these businesses after several years of subdued growth and recent margin pressure from wage inflation. Areas like sustainability and supply chain due diligence look set for strong growth.

Time to think about Europe

The Magnificent Seven narrative is making many investors think about broadening their portfolios. We believe Europe represents the best of the rest at the very least, and potentially an even better option than the US, as that market’s overconcentration and unsustainable fiscal excesses play out. We see plenty of GARP opportunities in the European market. Inflation has now fallen to a level that can be considered positive for equities. After a decade of battling deflation, a more inflationary backdrop is a positive for the European market.