Consumer confidence in the UK is improving with much-needed political clarity, economic growth, inflation hovering around the government’s 2% target and the first cut in interest rates since March 2020. Valuations have caught the eye of corporate investors, as shown by significant levels of M&A this year, while institutional and retail fund flows are starting to build.

Stable politics and a cheap UK

The opening weeks’ reaction to the new Labour government has been positive and, from both an international and domestic standpoint, it draws a line under the past few years of political chaos. Sir Keir Starmer is a reasonably centrist prime minister when other developed nations are facing more volatile and extreme political backdrops – being more politically stable than the US and many of our European peers should attract capital.

One data point the new government has inherited is a rapid fall in inflation, to the extent that the UK was the first G7 nation to see inflation reach its [2%] target. The UK’s gradual improvement in economic growth looks set to continue as GDP estimates for the year are consistently being upgraded by economists, albeit from a very low base. Real wage growth is the strongest it has been for almost a decade, outstripping inflation by over 2%.

The UK is now on a rate-cutting cycle. Recent weeks have seen a significant shift down across the interest rate curve with the UK resting rate moving from 4% to below 3.5%. A falling cost of capital should be positive for small and mid-cap companies, which tend to outperform larger-cap shares once the rate-cutting cycle begins.

The falling interest rate expectation curve has driven the five-year swap rate lower. Were it to fall to 3.5%, mortgage rates could drop to the all-important 4% level, translating into higher consumer confidence and lower savings rates, enabling the rise in real incomes to flow through to higher consumer spending.

The underlying picture is still complex, however, and the legacy of the short-lived Liz Truss government is that future plans must be fully funded, which gives Labour little wiggle room on spending. They have ruled out raising income tax, national insurance or VAT, but other tax rises will be announced and the pre-election commitments may be revisited if growth does not come through. This is a potential risk that we will keep our eye on.

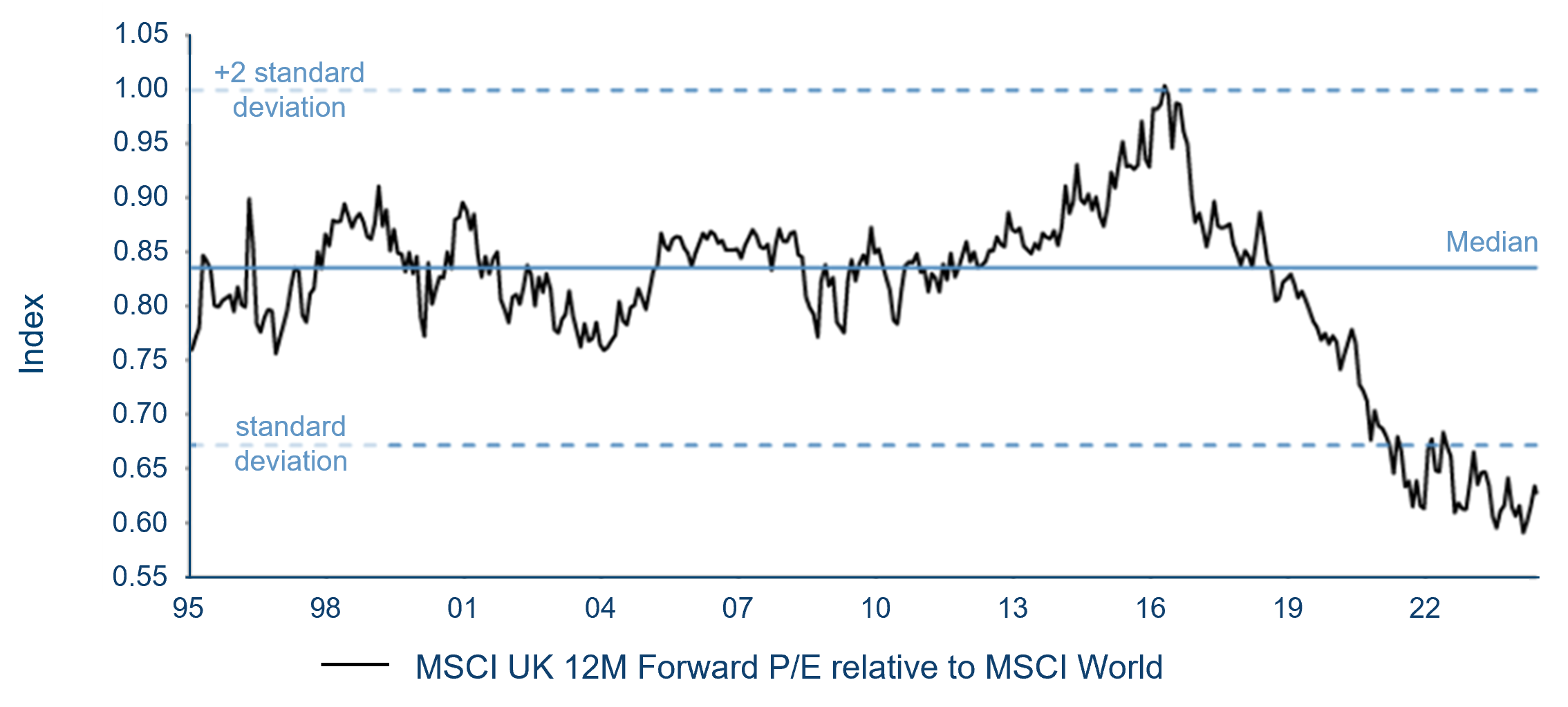

On many measures, the UK is cheap relative to other developed markets compared to its long-run historical average. We feel the MSCI UK forward P/E relative to the rest of the world – showing the UK to be more than two standard deviations cheaper – illustrates this particularly well.

| MSCI UK 12m forward P/E relative to MSCI World |

|

| Source: J.P. Morgan Cazenove, 16 June 2024. |

This relative value is broad-based, with the FTSE 100, 250 and small-cap indices all trading at 11x earnings, so the opportunities are right across the market-cap spectrum.

There have been 12 M&A deals so far this year, for $27bn, and counting. They represent an astonishing 6% of the FTSE 250 by value that has been bid for at a c40% premium on average. This could deliver a 5%+ return for the FTSE 250 from bids alone. Interestingly, more than half of the bids are corporate rather than private equity deals, and many are competitive.

UK inflows

There was already increased interest from international investors in UK stocks, with significant positions from US funds in particular appearing on UK shareholder registers. Following the election, we felt that everything was in place for the wider market to buy into UK equities and institutional flows have indeed now turned positive.

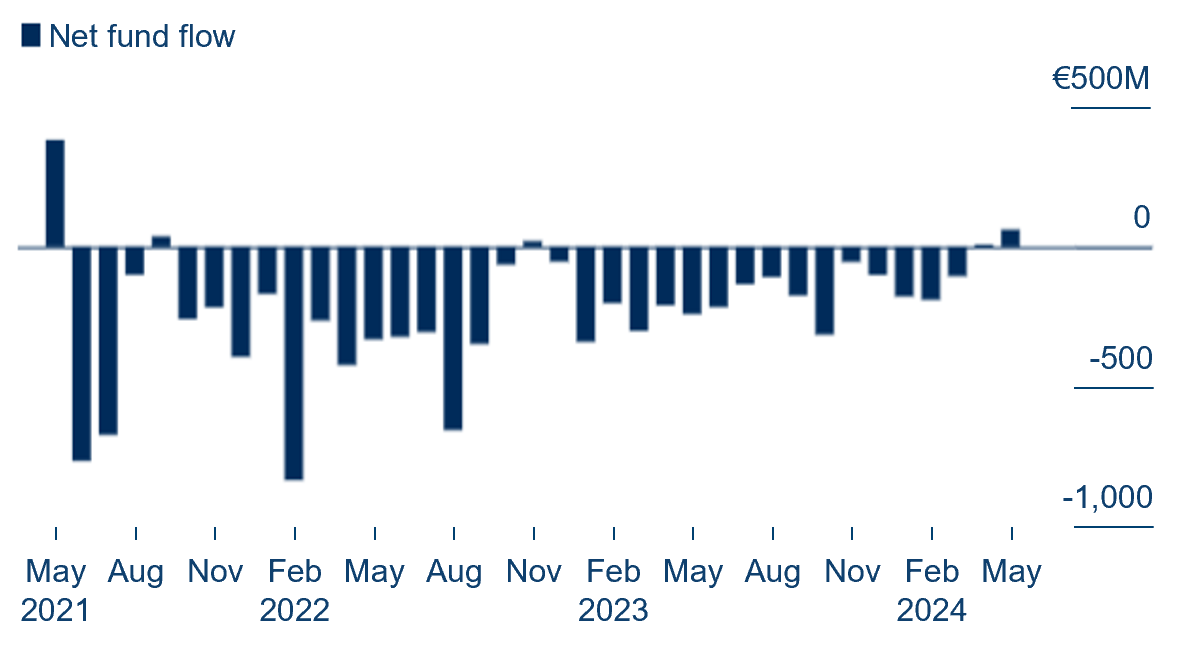

On the retail side, with just two (very small) exceptions over nearly three years, UK mid-cap equity funds had seen sustained monthly net outflows, but there are signs that things are improving, with the first consecutive monthly inflows, in April and May.

UK mid-cap equity flows are improving

Funds see first consecutive monthly net inflows in three years

|

| Source: Morningstar Direct, Bloomberg, 21 June 2024, https://www.bloomberg.com/news/articles/2024-06-21/uk-stocks-revival-gets-fresh-boost-from-inflows-and-bullish-sentiment |

There have been burgeoning discussions among politicians about the poor UK equity allocation by institutions. However, so far it has just been talk as, despite the Mansion House Compact (announced in July last year), the Lord Hill Review (March 2021) and various other reforms, in our view nothing is actually being achieved. Yet the UK does have the tools to shift asset allocation.

The UK pensions market is one of the largest in the world with over £2trn in assets. Developed countries such as the US (64%), Japan (49%), Italy (41%) and France (26%) have a higher pension allocation to their domestic equity market than the UK (3%). The UK is the only country in the world which is underweight its own equity market. Obviously, neither governments nor regulation should dictate asset allocation, but the disparity between the UK and the rest of the world is nonetheless remarkable.

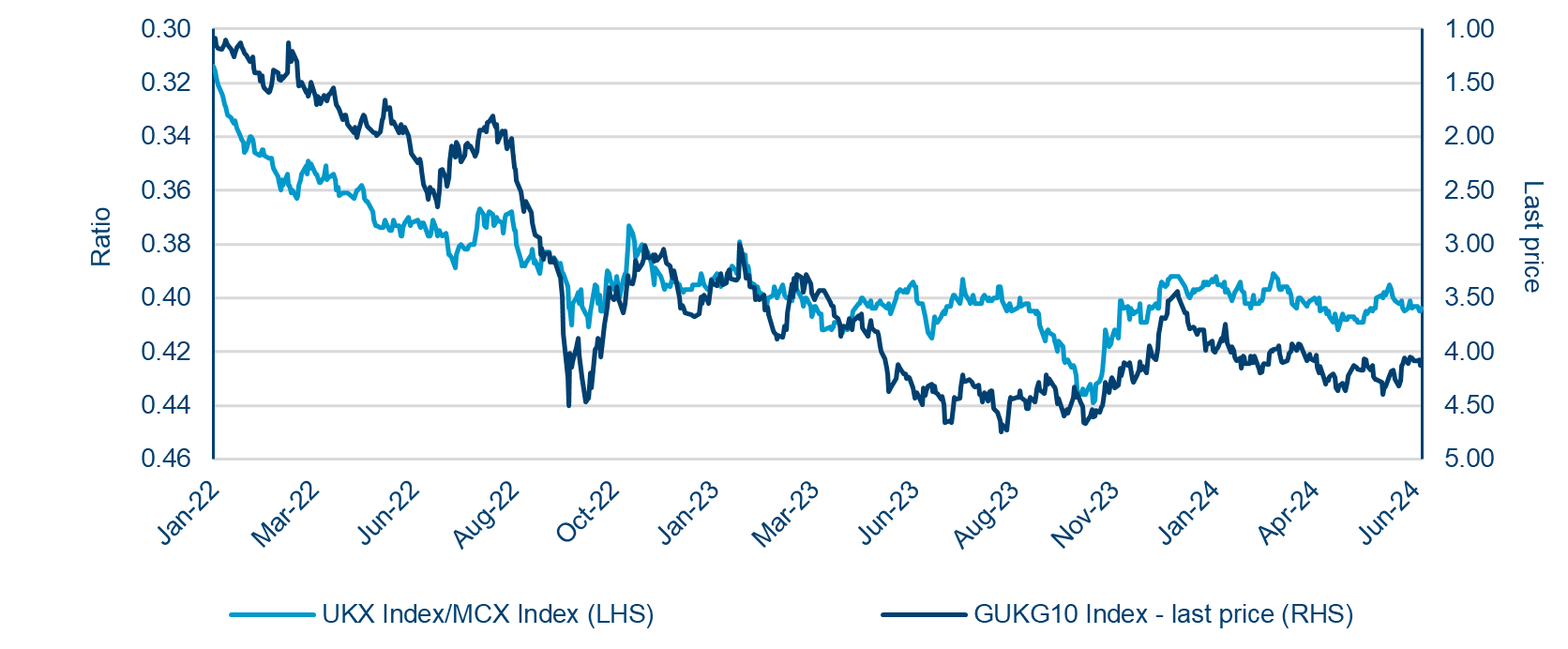

Cost of capital/interest rates

The next chart shows the relative underperformance of the FTSE 250 compared to the FTSE 100 over the past two years. There is a very close relationship between this and the cost of capital rising so, when interest rates are cut and the cost of capital falls, mid-cap stocks should disproportionately benefit.

Interestingly, historically small and mid-cap companies tend to start outperforming large caps on the first rate cut.

| FTSE 250 relative to the FTSE 100 vs the UK 10-year yield (Invested) |

|

| Source: Bloomberg, 27 June 2024. |

We believe the Polar Capital UK Value Opportunities Fund is well positioned for the positive UK outlook we are seeing. A key differentiator for the Fund versus its peers is its small and mid-cap exposure, which now stands at around 65%, and, as the name suggests, its tilt towards value stocks.

We believe there is tremendous value in FTSE 250 companies, as shown through 6% of the FTSE 250 by value being bid for already this year, at a 40%+ premium. The backdrop in the UK has changed positively: real incomes are set to accelerate, GDP is being upgraded and consumer confidence is trending upwards – all of which help domestic earners, which are the backbone of the small and mid-cap indices.

With this in mind, for us the UK market remains cheap and we are looking forward to taking advantage of this window of opportunity.