Corporate reform in the Japanese equity market is drawing investors back to the country having been banished to the wilderness since the early 1990s. While flows into Japanese stocks have been marred since the early 2000s by a slew of concerns over low growth, a strong currency, poor governance standards, an ageing population and the slowing momentum of Abenomics, 2023 paints a different picture.

Allocation to Japanese equities has risen this year largely thanks to a blend of supportive market policy, a unique inflationary environment, a weak yen and a perceived post-Covid earnings boost. However, all tailwinds are not born equal and while some short-term performance drivers will have been the pull for many so far this year, we believe there are much longer-term growth catalysts at play, for small-cap names in particular. With the Tokyo Stock Price Index (TOPIX) up 19.9% year-to-date, outstripping the 12.4% return of the S&P 500 and the MSCI Japan Small Cap Index’s 15% (all in local currency terms), it is worth interrogating these factors to discern which are likely to peter out, which could support further growth and the extent of the opportunity set they represent.1

1. Corporate governance reforms encouraging income and buybacks

It has been our view for some time that the most significant growth driver for Japanese equities will be the steady adoption of structural corporate reforms, first introduced in 2012 by then Prime Minister Shinzo Abe, in a bid to improve companies’ corporate governance practices. Measures such as 2014’s Stewardship Code and the Corporate Governance Code the following year were designed to rejuvenate a stale culture of keiretsu, typified by long-term transactional corporate relationships and cross-shareholding, where listed firms own shares in each other to ensure all-weather support for respective management teams.

It is the underlying goal of improving corporate governance that has intensified in 2023, primarily through the Tokyo Stock Exchange’s (TSE) call in January for firms trading below book value to show how they plan to rectify the situation through capital improvement initiatives. As sleepy shareholders are replaced by return-conscious investors and board oversight intensifies, we should see greater pressure on company management to allocate capital efficiently, justify how it is being deployed and explain how they plan to rectify sub-par book values.

P/B distribution of TSE Prime and S&P 500

Source: Man Group, February 2023.

Given Japanese companies currently sit on a cash pile equal to 17% of the market cap of the TOPIX Index versus 4.5% for S&P 500 constituents2 increased investor engagement and adherence to the TSE diktat will likely lead to bigger buyback programmes and more committed dividend policies.

2. Attractive valuations are still ignoring the potential impact of reforms

January’s note from the TSE underlines a broader ‘no nonsense’ approach to enacting government reforms and has put further weight behind what investors can expect in terms of market oversight. However, even with valuations rising alongside equity prices over the past year on the back of renewed faith in the reform rollout, the Japanese market is still attractive on a historical basis and when compared to developed market peers. While the S&P 500 trades on 19.1x forward earnings and the MSCI World Index sits on 16.1x, the MSCI Japan Index is currently on 14.2x. This difference is greater still further down the cap scale, with the MSCI Japan Small Cap Index on 13.5x.3

Of course, relative cheapness says nothing of actual value but we believe the staid reasons behind Japan’s unpopularity have yet to reflect the new corporate environment, ignoring the value potential therein. With more than one in 10 people in Japan now aged 80 or over4 and every one of the country’s 47 prefectures posting a decline in population in 20225, it is perhaps understandable to hold low expectations for corporate growth. However, the most recent reporting season (April to June 2023) saw earnings rise by 11% y/y – an all-time high for a quarterly reading.

Japan’s relatively late economic reopening after Covid (allowing individual travellers back from October 2022 and dropping all tourist entry requirements in April 2023) will have contributed to the uptick but as this effect fades and share buyback programmes continue to ramp up, earnings per share should naturally follow. While there may be a short-term boost as companies begin to release cash, the important aspect here is that it signals a long-term change in capital management. In our view, valuations do not yet reflect the potential inherent in this pivotal change, making Japan currently one of the most attractive markets for investors.

January’s announcement was not lost on all investors, however. While the quick money responded to the TSE’s pointed finger and Covid reopening positivity by allocating to Japanese large and mid-caps, flows into small caps have seen less fervour. This is where we see the greatest opportunity as smaller businesses tend to be the worst offenders in terms of wallowing book values, allowing for greater recovery potential. Another factor is the lack of analyst coverage among the market minnows. Taking the whole index into consideration, almost 80% of TOPIX-listed stocks are covered by fewer than 20 analysts, compared to just over 40% for the FTSE All-Share and under 20% for the S&P 5006. This coverage drops off as firms get smaller, presenting significant mispricing opportunities at the foot of the cap scale. We believe this highlights the need for an active approach to this end of an already under-researched market. Indiscriminate passive allocation risks buying into companies already above a book value of one, missing the most significant opportunities the current environment throws up.

Higher liquidity, brought about by an eventual reacceptance of small caps in light of their rerating potential, should make them easier to trade. However, as large foreign buyers look to re-enter the market, they might find there is no obvious seller. Should these investors decide to increase allocations consistently, they are likely to be joined by domestic corporates buying back at increasing levels, a central bank and Government Pension Investment Fund who show no signs of reducing their Japanese equity exposure and retail investors taking advantage of an improved Nippon Individual Savings Account (NISA) system, which now enjoys an unlimited tax exemption. The result is a likely tailwind for shares in general, particularly those further down the cap scale as confidence in reform follow-through grows and interest moves beyond the biggest index names.

3. The return of inflation and the final throes of yen weakness?

After being dogged by decades of dipping in and out of deflation, inflation has finally returned to Japan with core consumer inflation rising above 4% for the first time in 40 years.

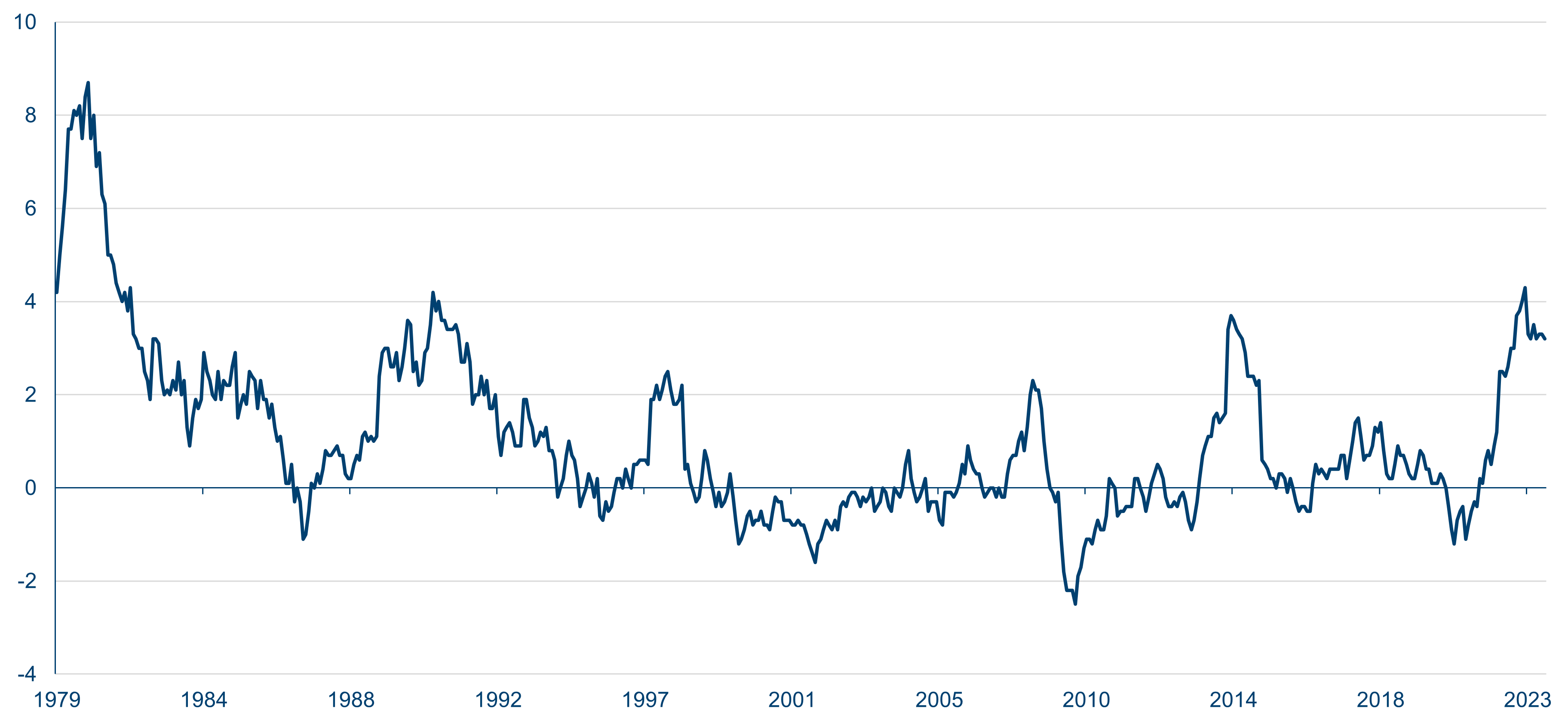

Japan Consumer Price Index (y/y,%)

Source: Bloomberg, October 2023.

Japan may be on the cusp of higher corporate investment if moderate inflation raises business confidence. Signs of this appeared in the 3.8% pay rise offered by major Japanese firms to employees during this year’s spring wage talks. While it is far from a sweeping national change and only affects select employers, it signals the highest uplift since 1993. Increased consumer spending in light of negative rates and wages broadly rising in line with inflation should benefit domestically-focused companies, especially those in the service sector which are well positioned for pent-up discretionary spending and are harder to displace with cheaper foreign alternatives.

Regarding currency, the Bank of Japan’s ultra-easy monetary policy has resulted in a weak yen, most recently sending it down to 148 against the US dollar, from 128 in mid-January7. While this strengthened Japanese competitiveness on the global stage to a level not seen in decades, we believe we will soon see a reversal and, if the yen were to strengthen, those exporters benefiting from the first half of the year may find a more challenging future. However, while a stronger currency would hurt large international companies, smaller domestically-focused firms which have already weathered a huge currency headwind would feel little to none of this pressure.

This said, while a turning point for the yen may be ahead, we prefer to concentrate on business fundamentals, sticking to companies with attractive valuations and which carry the greatest opportunity for a rerating as they implement capital reforms.

Corporate reform remains key

While there lies ahead a range of macroeconomic and market inflection points for Japan, ultimately none come with a timeframe or expected impact quite like the corporate governance reforms already in flight. It is difficult to predict the full extent of their imposition but we still believe this programme is the most important catalyst for unlocking value in Japan. As company management is continually encouraged to become more transparent and accountable to return-oriented investors, efforts to create value and return cash to shareholders should only lift interest in the country’s stock market. Valuations should naturally respond to confidence in reform rollout, with re-ratings likely as domestic and foreign investor participation grows. As such, we continue to look for value among mid-cap and smaller names exhibiting the characteristics set to benefit from the TSE’s reforms and more robust domestic demand. The scope for long-term change here reaffirms to us that Japanese equities now represent some of the most attractive opportunities for some time.

1. Polar Capital, Bloomberg, 5 October 2023

2. Investing in Japan’s bright spots: Tourism and batteries | J.P. Morgan Private Bank (jpmorgan.com), FactSet

3. Bloomberg, MSCI, 29 September 2023

4. Which countries have the oldest populations? Japan and Italy | World Economic Forum (weforum.org)

6. Smith, Benthos – What would Buffett buy?, CLSA, April 2023

7. Yen falls past 148 per dollar after BOJ announcement - Nikkei Asia