“When that rope starts to pull tight, you can feel the devil bite your ass”. Tuco’s line to Blondie in The Good, the Bad and the Ugly could also accurately describe the challenges faced this year by investors attempting to navigate a volatile macro outlook. Over the past six months, financials have performed in line with broader equity markets, albeit bank valuations have suffered. Here, we have outlined some of the key themes across the sector in six charts.

The Good

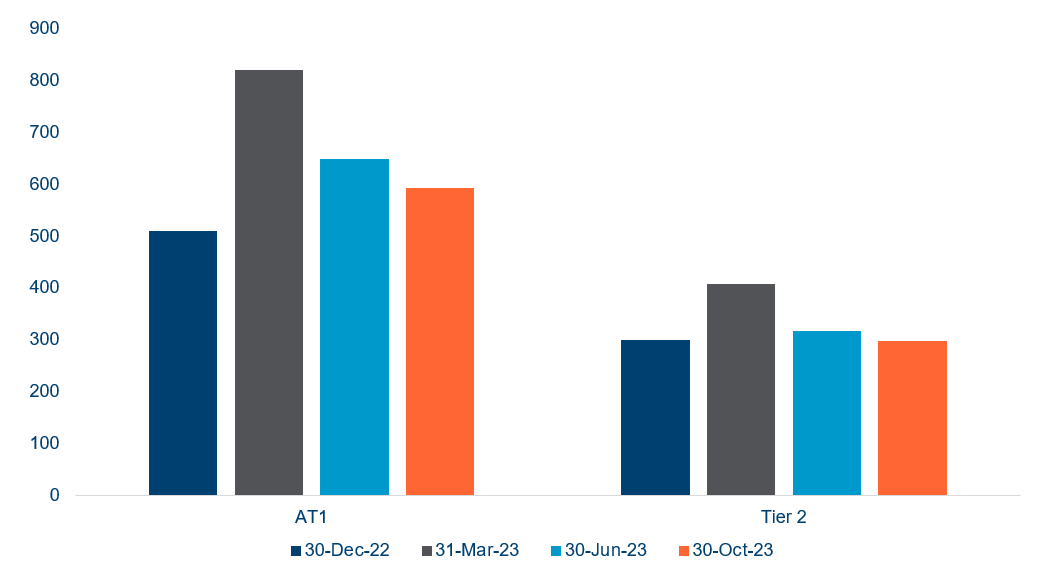

Subordinated bank bonds1 have performed well as spreads have normalised to the level seen before the US regional bank crisis and write-down of Credit Suisse AT1 bonds to zero in March, which has more than offset the rise in government bond yields.

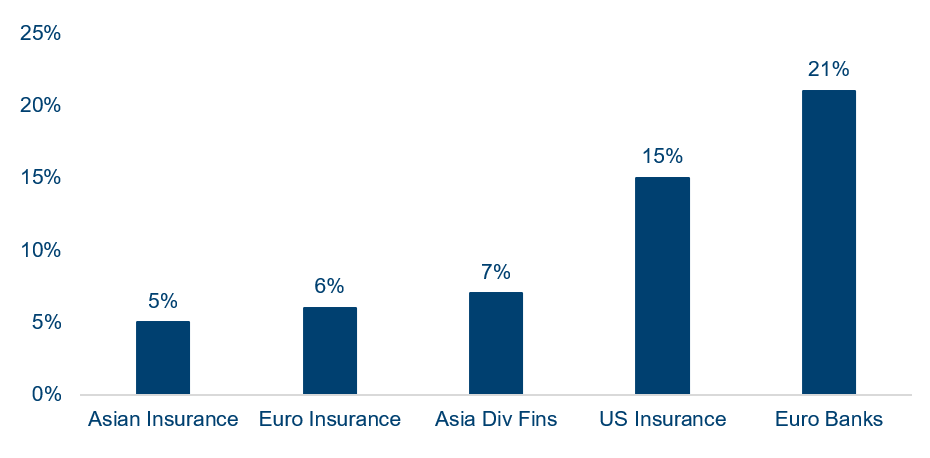

A number of financials subsectors have seen very strong earnings upgrades to their FY24 earnings per share (EPS). In particular, European banks’ earnings have benefited from the impact of rising interest rates on their net interest margins while insurers continue to enjoy a ‘hard market’, particularly reinsurers, and higher investment income.

The Bad

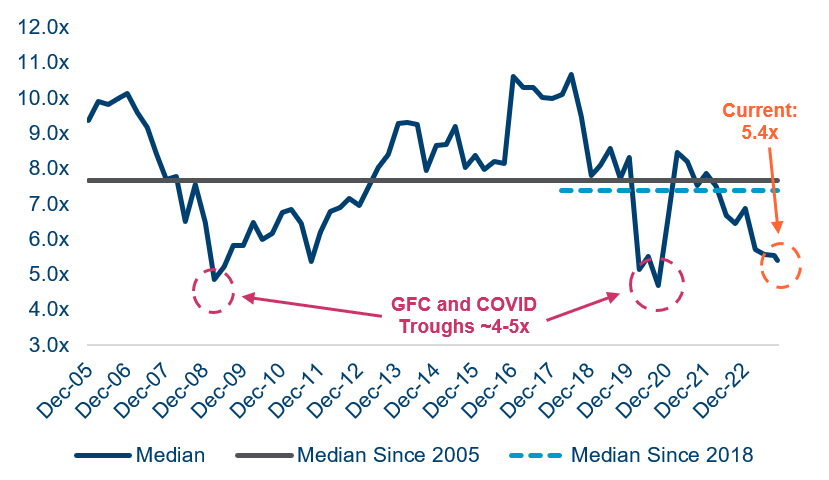

Improvements in underlying profitability have not been reflected in valuations, with banks trading at close to trough levels as investors anticipate a weaker macro environment and regulatory uncertainty for US banks on capital requirements due to so-called Basel Endgame.

History suggests that banks do not stay this cheap for long, with global banks having only traded at this level of price/earnings multiple (P/E; 7.5x) or below for 156 days since the global financial crisis (4.1% of the time). All things being equal, just reverting to their average over this period would lead to a rally of over 25% in their share prices.

The Ugly

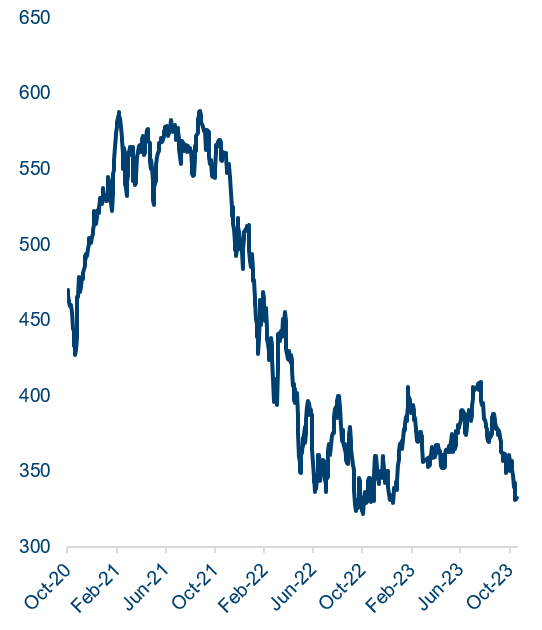

The selloff in global banks is now in line with historic recessions and crises, with US banks only falling more during the global financial crisis, Covid and the 1990 recession. Data from the early 1990s is limited but anecdotal stories suggest banks went into that downturn lending at much higher loan-to-value (LTV) multiples than in this cycle.

FinTech has materially derated on the back of a shift higher in interest rate expectations, weaker growth and intensified competition impacting margins (as seen in payments companies). UK banks continue to disappoint, latterly over concerns around deposit margins, and IFRS17 has created a headache for insurance analysts in Europe.

Outlook

The combination of stronger than expected economic growth, sticky inflation and the fastest and largest interest rate hike cycle in US history has created a challenging environment for investors assessing the probability of a soft economic landing. Each new data point is leading to a shift in perception. As Tuco said after he's thrown to the ground outside the bar: "One @#$*&"! goes in, another comes out!"

A number of financials subsectors have been derated in this environment and are increasingly pricing in a recessionary environment. While we recognise near-term uncertainty on the macro outlook, there is a disconnect between the support to medium-term profitability from the shift out of ultra-loose monetary policy and current valuations – as we have seen previously, the recovery that accompanies a turn in the economic cycle occurs rapidly. The funds run by the Polar Capital Global Financials team are positioned to capture this recovery through diversified, global exposure to the financials sector.

1. A subordinated bank bond ranks behind depositors and senior bank bonds but ahead of shareholders in terms of seniority.