After a breakout year for artificial intelligence (AI), which helped fuel the outperformance of the so-called 'Magnificent Seven' US technology names, what does the future hold for the sector?

Ben Rogoff and Nick Evans, co-heads of the Polar Capital Global Technology team, join Xuesong Zhao, lead manager of the Polar Capital Artificial Intelligence Fund, to discuss how they see the trajectory for the global economic backdrop emerging, offer their views on the case for the technology sector and explain why they believe a wave of AI enabled innovation and subsequent productivity gains are likely to reshape the investment landscape.

Q: What are your expectations for US interest rates and your subsequent view on any recessionary risk?

Ben Rogoff: In our view, the worst headwinds are behind us with the Federal Reserve (Fed) appearing to have engineered a soft landing for now. We believe the market is probably overstating the risk of recession; Goldman Sachs currently gives a 15% chance of recession next year1 and, while that is at the low end, the consensus position above 40%2 feels too high given the progress we seem to have made so far. US core personal consumption expenditure (PCE) is down from 5.2% last year to 3.7% in September and we expect further disinflation over the coming months as the labour market continues to rebalance. US growth has also been stronger than expected, which shows the Fed has managed to improve the inflation trend without tipping the economy into recession.

Q: What would that environment mean for technology stocks?

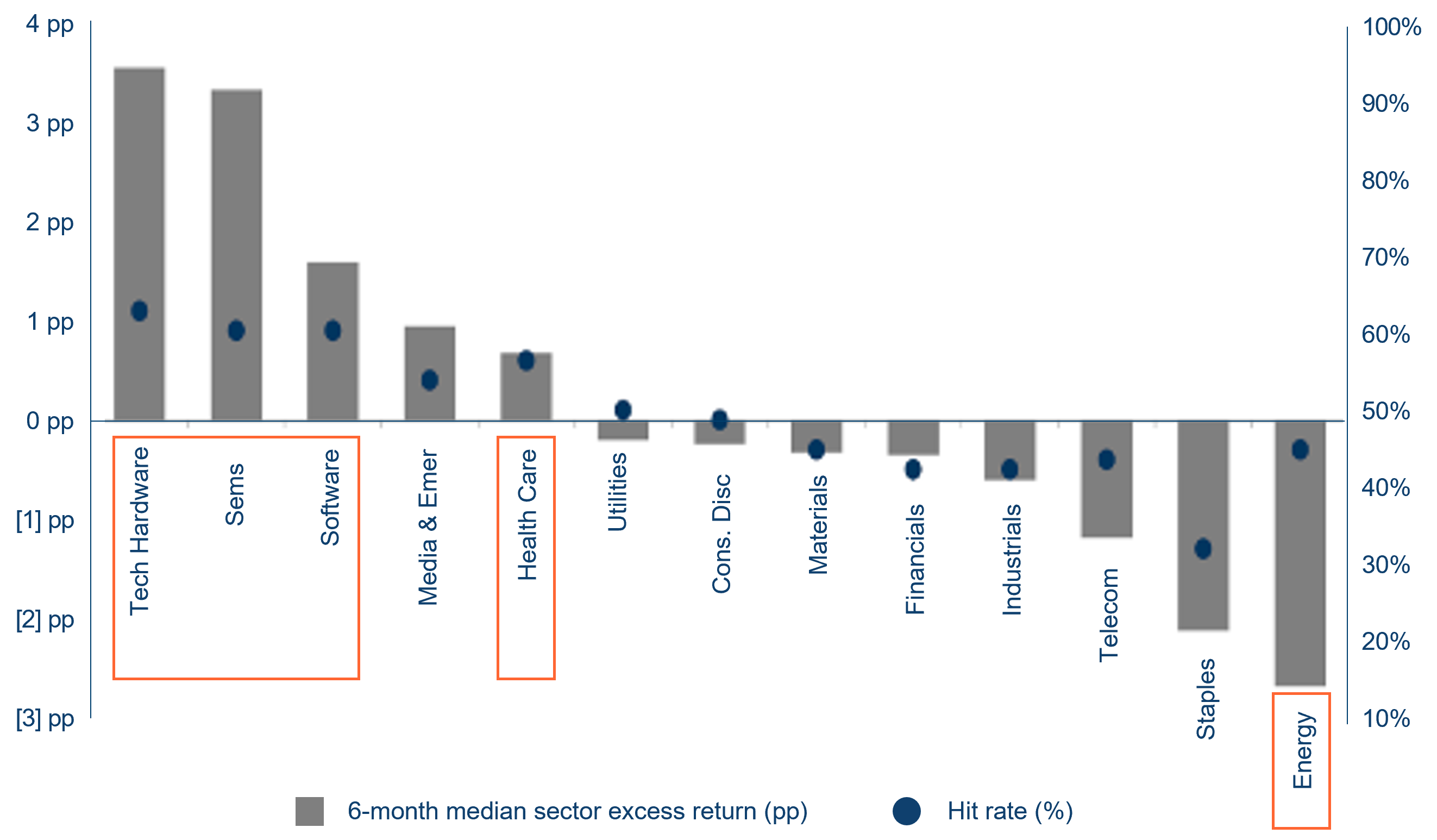

Nick Evans: Our base case is for moderate US growth, recession fears to subside, corporate IT budget growth to be solid and AI spending to remain robust. We don’t have a strong view as to when the Fed will cut rates, but with inflation trending down, we are hopeful that peak rates are behind us. This view is allowing investors to become more constructive on the medium-term outlook for growth stocks. However, what makes us particularly optimistic is that AI infrastructure demand and subsequent productivity gains remain in their infancy but that is likely to change dramatically in 2024. 70% of CIOs currently see generative AI as “game-changing technology”3, 55% are planning to deploy it and yet only 9% are actually deploying it today.

Sector performance; periods of stable rates and growth

Source: FactSet, Goldman Sachs Global Investment Research, November 2023.

Q: Is the breakthrough in AI fuelled by hype or longer-term assessments of added value?

Ben Rogoff: While there may have been a rush of excitement around AI this year, the Global Technology team here at Polar Capital has long recognised the potential of AI, launching a fund dedicated to the theme six years ago. The belief then was that AI would always become mainstream; the question was ‘When?’, and it would appear the answer is ‘Now’.

For us, generative AI represents one of the most exciting technological breakthroughs we’ve seen and could well be more important than the advent of the internet or cloud computing. However, we have not yet experienced the same overexuberance as seen in previous hype-driven cycles. Instead, valuations of key AI stocks have generally been backed up by robust earnings growth, while investors have been relatively selective rather than boosting the share prices of all firms riding on the sector’s popularity. We expect the market to broaden in 2024 which should play to our strengths with one of the largest and most experienced technology investment teams globally.

Moreover, there is a difference between so-called hype and genuinely backing a transformative technology. Just as the Bessemer process in the nineteenth century created an inexpensive way to mass produce steel, leading to the creation of myriad new industries, there is no telling what AI will facilitate from here. However, we are confident that the opportunity is vast given that AI is able to automate c25% of human tasks today with the potential to impact as many as 300m jobs globally.

Nick Evans: Once it became clear that AI capability had begun to inflect, we introduced what we call an “AI lens” to our investment process. This means we now consider how AI impacts every business in each portfolio and whether stocks are enablers or beneficiaries of AI. This raises the bar for investment ideas that do not fit into that framework, because of our conviction that AI is the next big trend in technology. However, not all AI was born equal; there is obviously older machine learning (ML) for instance, meanwhile many companies will claim to be evaluating or deploying generative AI, but understanding where it can be utilised most effectively will be important. It is our job to sift through all of that and identify the real opportunities. Based on our definition of AI, 80% of the Global Technology Fund is now invested in companies that we believe are beneficiaries from or enablers of AI. While our remaining positions have exposure to other exciting (non-AI) technology themes, we are hopeful that none are losers from AI, or we would have exited them.

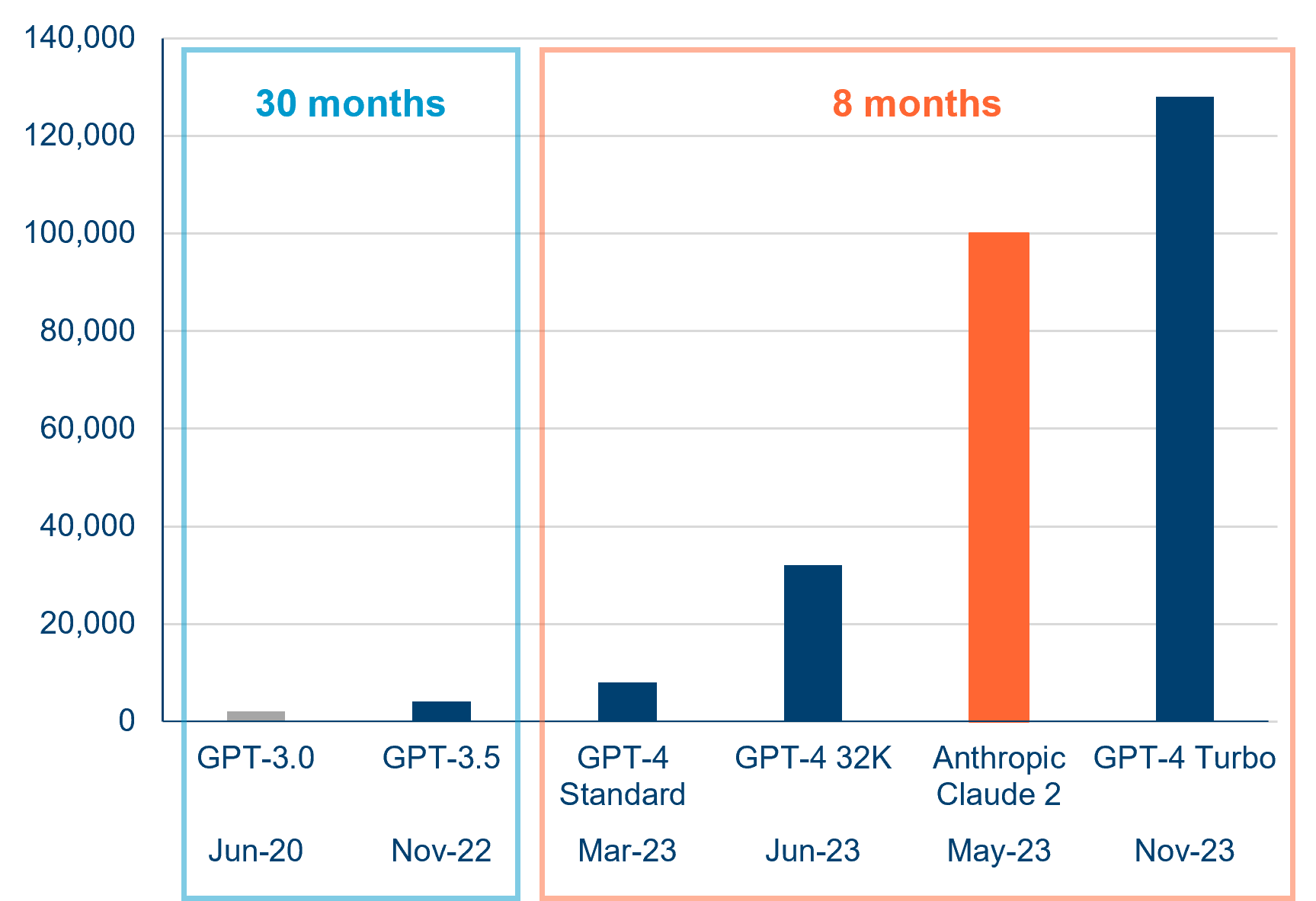

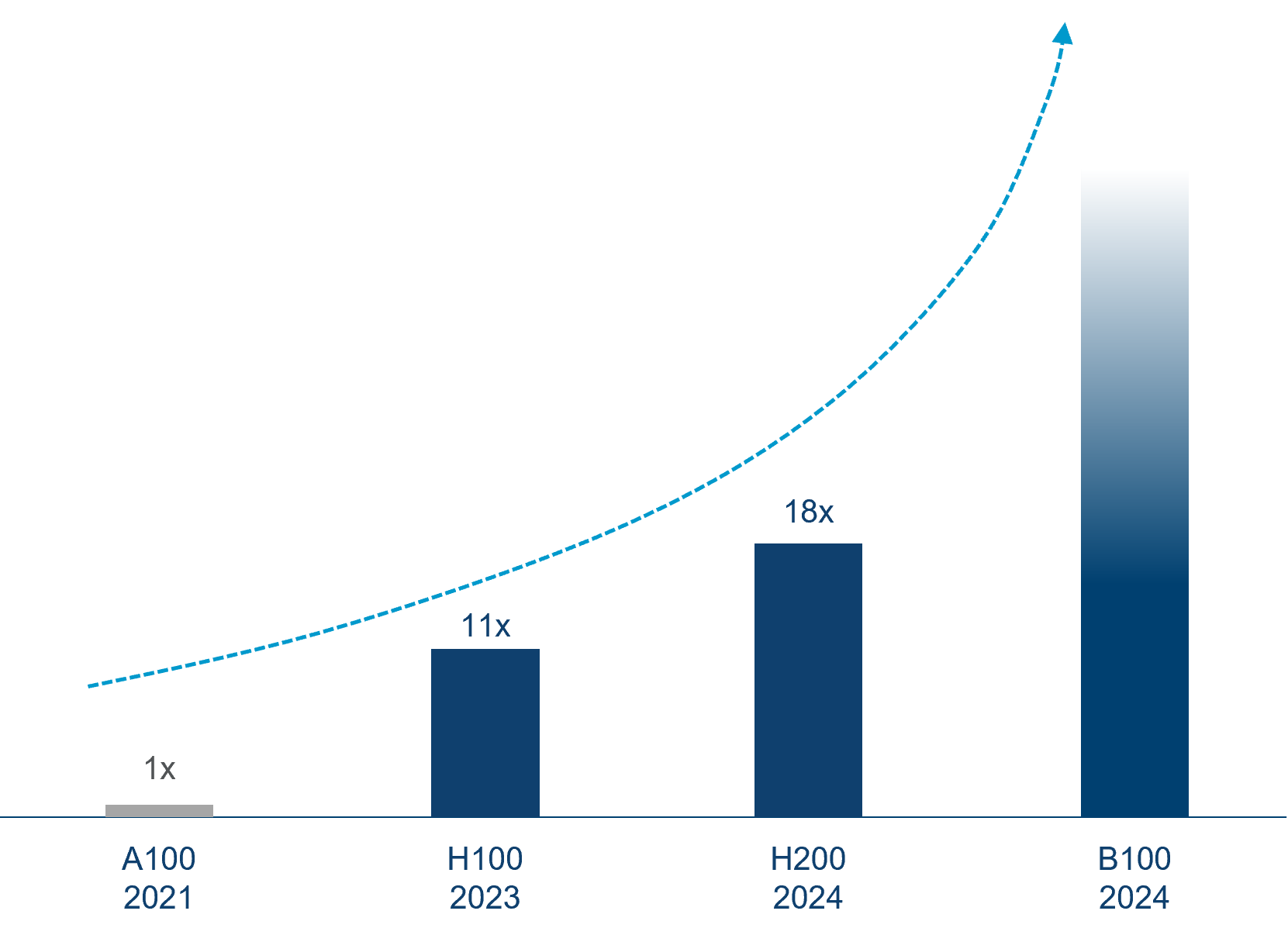

2022-2023: AI - Dramatic Pace of Improvement

| Generative AI models memory/token growth | Perpetual innovation, perpetual performance leaps |

|  |

| Source: openai.com4 | Source: NVIDIA, October 2023. |

Q: Have investors missed the boat on AI given the rise we have seen year to date?

Xuesong Zhao: I would paraphrase the old adage and say, “The best time to invest in AI was many years ago, the second best time may very well be today.” Very simply, we do not think investors have missed the AI boat. While there have been strong returns in some of the highest profile AI enablers this year, we think these moves have largely been supported by fundamentals, with many stocks still reasonably valued. In addition, we expect a broadening of the AI halo effect, as investors see robust demand benefitting a wide range of infrastructure stocks (the “enablers”). As we get further into 2024 and into 2025 we also expect to see a growing impact of AI led productivity gains and transformative change beyond the technology sector (the “beneficiaries”).

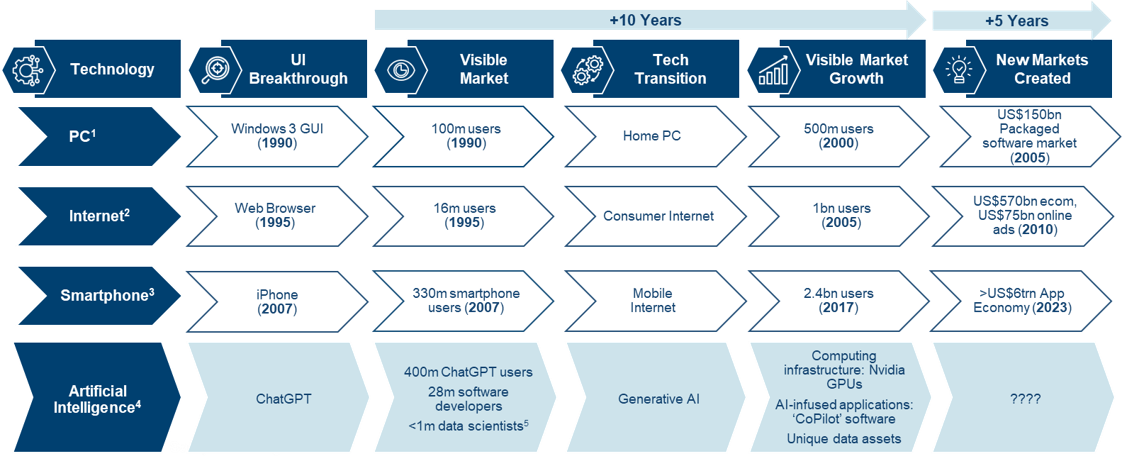

We are not saying the path is going to be smooth, there will of course be periods of volatility along the way, but the pace of innovation is such that we expect to see a bright future for AI as well as the opportunity for second-order themes in due course. One of the big benefits of AI is that it offers significant productivity gains, which could support a period of sustained non-inflationary growth leading to a stronger economic outlook than many believe is possible today. Importantly, we also expect to new commercial opportunities enabled by AI – just as the advent of the iPhone led to the huge global app economy today, something that few foresaw at the time.

AI: Technology transitions drive huge new markets

Source: 1. Datahub, https://datahub.itu.int/, 2023. 2. Internet World Stats, https://www.internetworldstats.com/emarketing.htm, August 2023. 3. 42 Matters, https://42matters.com/ blog/?p=the-state-of-the-app-economy-and-app-market, 30 September 2022. 4. Statista, https://www.statista.com/statistics/627312/worldwide-developer-population/, August 2023. 5. US Bureau of Labor Statistics, https://www.bls.gov/oes/current/oes152051.htm, May 2022.

Q: If the Polar Capital Global Technology Fund has a high exposure to AI, why is there a separate fund geared specifically towards the AI theme?

Nick Evans: From our perspective as a core technology fund, in time we expect many non-technology industries to come into our investible universe, in the same way Amazon is a retailer but is available to us as an investment given its online, streaming and cloud segments. However, there will still be many companies beyond our investable universe for whom AI will play a meaningful role. In this sense, leveraging the technology team’s knowledge and experience gives a unique perspective on working out which companies and industries have the potential to be disrupted, as opposed to having a focus purely on providers of technology. In essence, this gives the Polar Capital Global Technology Fund the opportunity to focus mainly on the technology enablers (and beneficiaries within technology, media and telecoms), with the Polar Capital Artificial Intelligence Fund able to focus on the beneficiaries of AI, often outside the technology sector entirely, as well as the enablers.

Xuesong Zhao: Ultimately, in the Polar Capital Artificial Intelligence Fund, we are building a portfolio of companies that will capture the opportunity as whole industries are rearchitected and reimagined around AI. We invest in not just the AI enabling companies, but the applications and beneficiaries of AI across all sectors. It is this approach that sets us apart from other AI funds that concentrate more on the technology companies and the AI functionality itself. We see the opportunity for great value creation beyond the technology sector, as AI is rapidly adopted across broad swathes of the economy. The ability to invest in the disruptive AI winners as well as avoiding the many companies that will be negatively impacted will be key.

Q: Can the US technology mega-cap companies continue their strong run?

Nick Evans: This has been a highly unusual multi year period where large cap stocks have dominated returns and growth investors have faced significant headwinds due to higher rates. Going forwards, we expect returns to be more evenly spread within the technology sector, supported by accelerating Al innovation and the benefits being more broadly felt.

It is certainly true that a significant difference has opened up between the so-called ‘Magnificent Seven’ large caps (Microsoft, Nvidia, Amazon, Google, Apple, Tesla and Meta) and equal-weighted technology or smaller-cap technology indices. Returns for this group have been very strong particularly year to date, but from a very depressed starting point given the poor performance of this group (down close to 40%) in 2022. Beyond that, much of their relative outperformance versus the market can be accounted for by their relative earnings strength (as per recent research from Goldman Sachs) and some multiple expansion explainable due to their superior growth. It is possible that we get a period of mean reversion but in our view, we are more likely to see some of the unloved stocks bounce back rather than material weakness emerge among the mega-caps.

Finally, many of these stocks, particularly Nvidia and Microsoft, are perceived enablers and/or beneficiaries of Generative AI which explains why we continue to own most of them in our top 10 holdings. We still expect solid absolute returns from this group in aggregate because of reasonable/achievable expectations for next year (with potential upside from stronger AI demand) superior growth potential and a supportive macro backdrop as discussed earlier. That said, we expect a broadening of stocks seen to be AI enablers or beneficiaries in 2024, a trend we would welcome because it should play to our strengths given our well-resourced team and growth-centric investment approach.

Q: What is your outlook on the technology sector as a whole?

Ben Rogoff: With the market and rates appearing more benign, we expect the pace of AI adoption to prove a key determinant of sector fortunes during 2024. While there could be setbacks or disappointments along the way, we are AI maximalists believing the technology could become the next general purpose technology (GPT). Nick and I have experienced a few of these instances during our careers – this one feels more important than the smartphone, and every bit as important as the Internet, a technology that saw myriad industries reimagined. Similarly, we expect AI to deliver significant productivity with recent improvement in this metric an auspicious indicator of potential gains in the years ahead.

1. Goldman Sachs cuts chances of US recession in next one year to 15% | Reuters

2. Bank Economists Soft Landing Odds Have Improved But Recession Risks Remain | American Bankers Association (aba.com)

3. Gartner Survey of Over 2,400 CIOs Reveals That 45% of CIOs are Driving a Shift to Co-Ownership of Digital Leadership

4. https://platform.openai.com/docs/models;+https://platform.openai.com/docs/+models;+https://help.openai.com/en/articles/7127966-what-is-the-difference-betweenthe-+gpt-4-models;+https://help.openai.com/en/articles/7127966-what-is-the-differencebetween-+the-gpt-4-models;+https://www.anthropic.com/index/100k-context-windows;+https://help.openai.com/en/articles/8555510-gpt-4-turbo.