The surprisingly strong UK inflation data has had huge implications. The Bank of England was forced to hike rates by 0.5% to 5%, with the market now pricing in that UK base rates may get above 6% in the year ahead. These are levels that will undoubtedly cause serious problems for many households – with some speculating that ultimately inflation will likely only be solved by a nasty recession.

Where do we go from here? Are there any signs of an improvement in inflation data? Can we avoid such a grim outcome?

Wage growth has been incredibly strong in the UK and, while certainly helping to hold up consumption levels, this has led to higher service-based inflation. The chart below shows regular pay levels for the whole economy rising to over 7% on the latest data, according to the Office for National Statistics.

Source: Office for National Statistics, April 2023.

The recent wage data has undoubtedly been affected by the c10% rise in the national living wage in April, given how many companies use this as a benchmark for starting levels of pay. Historically, a rise in the national living wage has led to companies raising pay for workers above the national living wage rate as they aim to maintain pay differentials in their organisation and ensure those being promoted still receive a pay rise. However, this jump will not repeat in the six months ahead. In fact, many companies are now reporting a much more benign environment for hiring as wage pressure is starting to abate.

Can goods inflation tell us anything?

The news on goods inflation is far better as, measured by UK PPI (producer price inflation), it has fallen dramatically to just 0.5%. Unsurprisingly, there is a very clear link between goods inflation and consumer price inflation (CPI) – although with a lag. All year many companies have been telling us how much they were starting to see input prices falling. However, we should have been more patient in its effects moving upwards with the core measure of CPI inflation. The graph below shows the clear relationship between UK goods inflation and the all-important measure of UK core CPI inflation.

Goods inflation and CPI

Source: Bloomberg, June 2023.

UK money supply

Milton Friedman famously said that inflation “is always and everywhere a monetary phenomenon”. The core tenet of his economic thesis was that periods of excessive growth in money supply always lead to inflation, as too much money chases too few goods and services. Covid saw a surge in UK money supply as policies were put in place to protect the economy through the lockdowns that were introduced. Again, after this more recent surge in UK money supply we can see that it is now much closer to 0%. This will help the inflationary outlook but, again, with a lag.

Source: Bloomberg, June 2023.

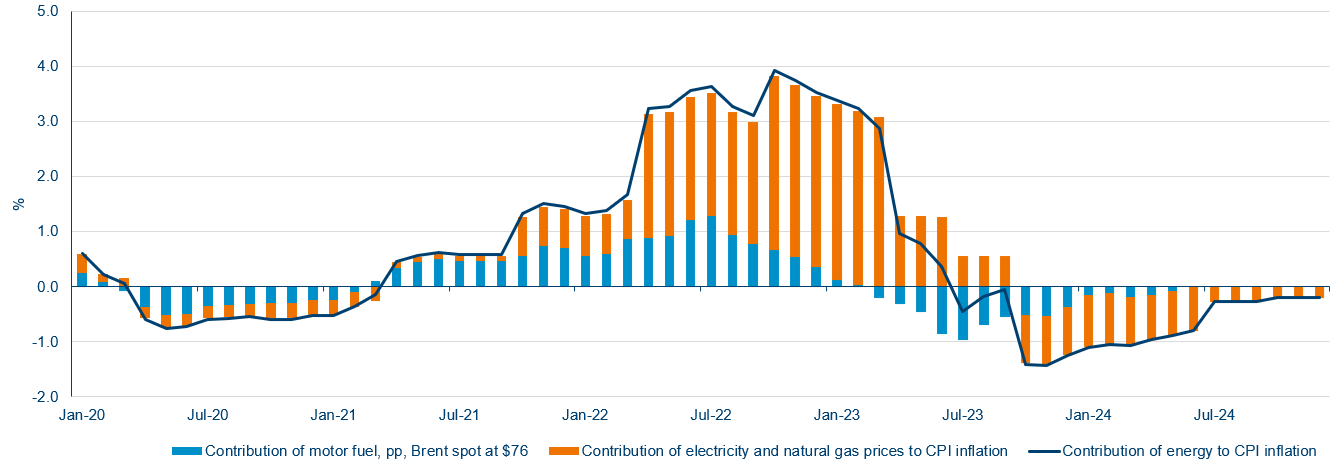

Energy costs

The aftermath of the Russian invasion of Ukraine had a dramatic impact on energy prices affecting companies and households alike as surging prices fed through to higher bills. Thankfully, from July onwards the energy price cap means we will start to prices come down (you may have already had a letter from your utility provider informing you of the fall you will see in July). This will start to have a significant deflationary impact on the UK inflation data from August onwards. The chart below shows this impact.

Energy prices will be making a large negative contribution soon

Source: Pantheon Economics, June 2023. PM Forecast, based on currect wholesale prices.

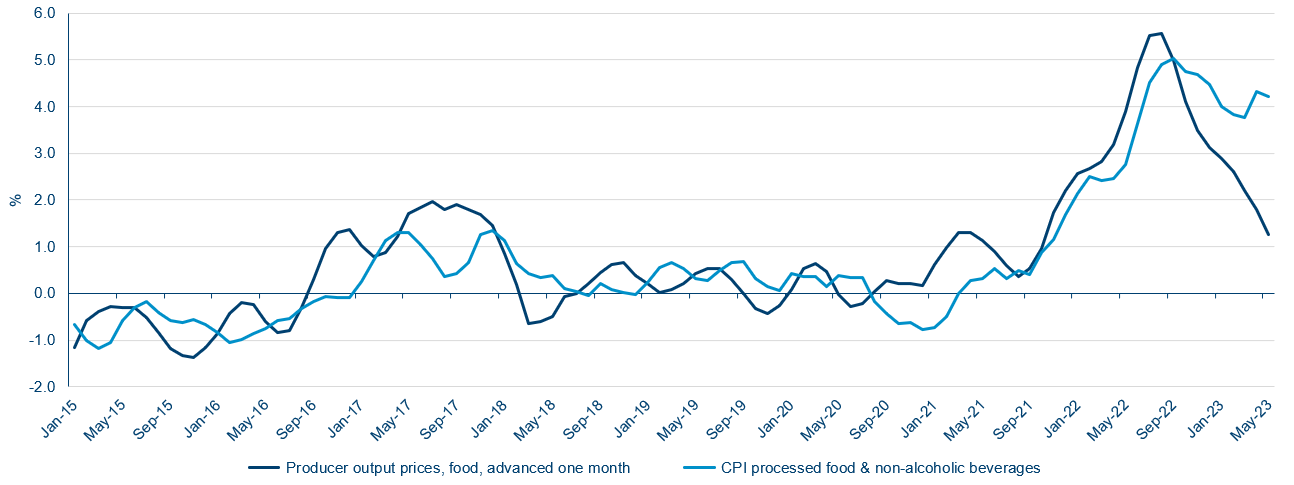

Food pricing

Food is a significant contributor, at nearly 12%, of the basket of goods used to calculate the inflation rate and, as all shoppers know, its costs have been very high. Here, more recent news is also encouraging as hospitality companies have been telling us they are seeing falling prices in food input costs and food producers have confirmed they currently do not need to put up prices again this year. The national supermarkets have been able to start cutting prices of essential items. The benefit of this should be felt in the months ahead.

Food producer output price inflation has slowed sharply

Source: Pantheon Economics, June 2023.

Conclusion

So far this year, we have been incorrect in assuming inflation would fall faster than expected. In part, we have overestimated the impact of companies talking to us about significant falling input inflation without appreciating the impact of wage rises on CPI inflation, meaning its fall would come later.

The market now assumes inflation is embedded within the UK and will require more and more tightening to come under control. However, if we look at the outlook for prices on goods, food, money supply, fuel and utility bills, then it is highly likely that we will see very sharp falls in inflation into the second half of the year. That is a difficult position to argue when so far all the inflation data has been worse than expected, however the evidence is strong that there will be a changing inflation picture from here. If this were to happen, it should prove positive for domestic equities and UK risk assets in general.

However, with the Bank of England slow to deal with the initial emergence of inflation and embarrassed by being caught out, will they now end up holding rates higher than is needed for longer and causing significant damage to the economy in the process? That is the conundrum for the rest of the year.